Another Day, another dollar

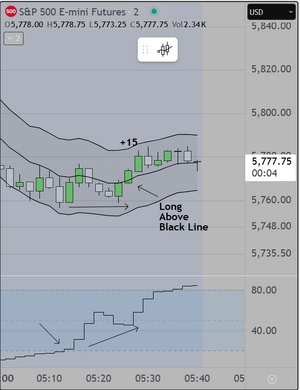

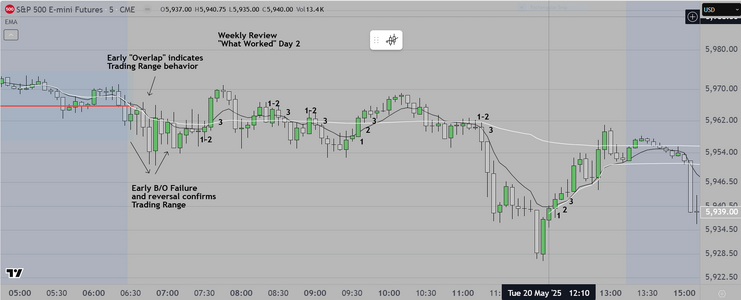

The attached chart shows the simplified version that I teach

The focus is on teaching struggling traders to identify where

they are going wrong and correct that.

What I found in my previous classes, was as follows

1) Lack of preparation

2) Inability to "align their thinking with institutional intent"

3) No system edge

4) Poor choice of, and undisciplined use of the tools of the trade

5) Unskilled decision making on both ends (Entry & Exit)

The result is inevitable

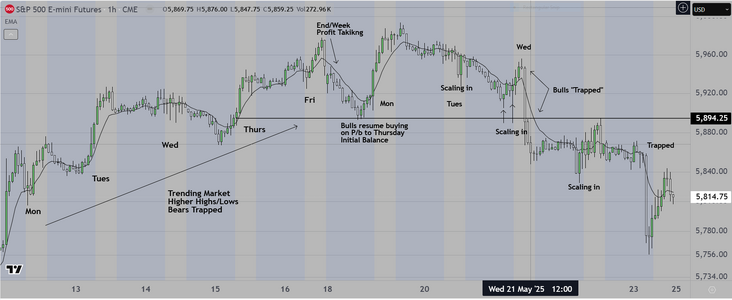

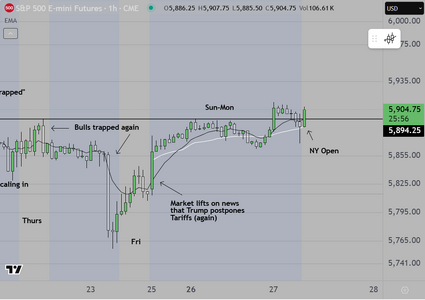

The Chart cannot show the pre-planning that goes into this process

We assume readers know of our preparation over a weekend to analyze

previous price action and economic news. The chart below shows what

comes next. The skill is to identify the price action on the open, and react

appropriately. We monitor for a specific period of time in order to determine

whether the market is trending or in a trading range. Once we make THAT

decision we enter, at the appropriate time, and designate a profit target and

stop loss. The tools have already been specified. How to use them is part of

the class. Once a student has a feel for this, we look at the decision making

process in detail, especially how to reduce stress, by relying on the system

rules. As with professional sports, success depends on 1) talent first, then on

2) preparation, and finally on 3) "reps" (practice) and by that we mean good

practice, that insures that the student trader is learning the right skills, rather

than developing bad habits.

Readers may remember that we suggest trading within a specific timing window

then getting out with a profit. As with any similar situation (casino gambling comes

to mind) the longer you stay, the more the odds favor that you "give back" what

you have won. Once you've earned it, take your money and go live your life.

Good luck