I am done for the session and wanted once again to

post this for Trader333

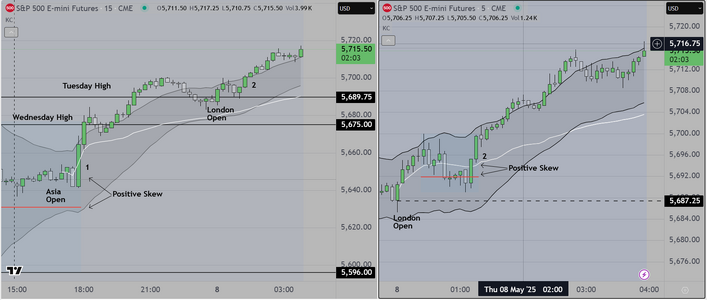

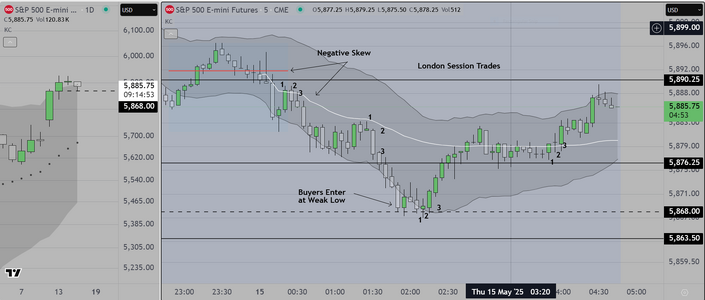

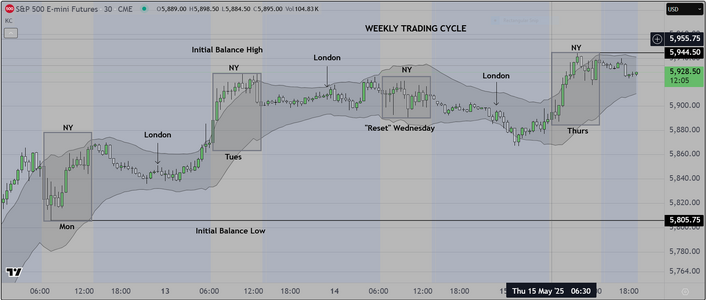

The attached chart shows two (2) views, on the left

using 15 min candles, we show the Asia session as traders

"Lift the offer". For those who may not have the skills, this means

that institutions and professionals alike are buying the asking price

because they are aggressive (they really want to get long). WHY?

Because President Trump promised "Big" deal announcement and

the markets are "buying into" the possibility that he actually HAS

made deals that will reduce the need for tariffs. I am not a big fan

of this person, but what matters is not my politics, but what the big

Asian and Euro banks think, and it was easy to anticipate that this

is what would happen. My strategy was to get long WITH those

institutions and get paid during Asia and London, then to wait to

see what (exactly) the "big" deal is. I won't be trading the NY session.

So far I am up +40

On the right is the 5 min chart showing the London session. Same tools

Same approach, Same result.

Trader333, in terms of success, what really matters is accurate evaluation

of context (news), THEN, can you predict how markets will respond? Any

amateur who wanted to know in advance what might happen, only had

to check out the comments offered by Google's AI engine. It supplied

the information about the probable response to this event yesterday.

Plenty of time to figure out a trading strategy. Used to be that I had to

call "friends" to ask what they thought. No longer necessary.

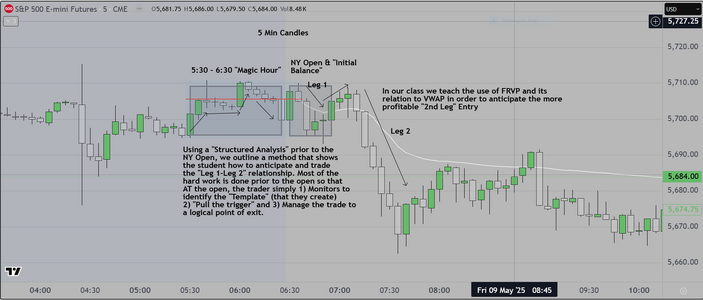

The display is simple to figure out, the only technically demanding issue

is to learn where to anchor the tools. Once you have that in place, you can

see where the entries are, you get long, you hold to +10 and +20, then as

I have said previously "you get paid and you get out". That is the job.

By the way, this approach works like a charm for any index including FTSE

and DAX.

Good luck

post this for Trader333

The attached chart shows two (2) views, on the left

using 15 min candles, we show the Asia session as traders

"Lift the offer". For those who may not have the skills, this means

that institutions and professionals alike are buying the asking price

because they are aggressive (they really want to get long). WHY?

Because President Trump promised "Big" deal announcement and

the markets are "buying into" the possibility that he actually HAS

made deals that will reduce the need for tariffs. I am not a big fan

of this person, but what matters is not my politics, but what the big

Asian and Euro banks think, and it was easy to anticipate that this

is what would happen. My strategy was to get long WITH those

institutions and get paid during Asia and London, then to wait to

see what (exactly) the "big" deal is. I won't be trading the NY session.

So far I am up +40

On the right is the 5 min chart showing the London session. Same tools

Same approach, Same result.

Trader333, in terms of success, what really matters is accurate evaluation

of context (news), THEN, can you predict how markets will respond? Any

amateur who wanted to know in advance what might happen, only had

to check out the comments offered by Google's AI engine. It supplied

the information about the probable response to this event yesterday.

Plenty of time to figure out a trading strategy. Used to be that I had to

call "friends" to ask what they thought. No longer necessary.

The display is simple to figure out, the only technically demanding issue

is to learn where to anchor the tools. Once you have that in place, you can

see where the entries are, you get long, you hold to +10 and +20, then as

I have said previously "you get paid and you get out". That is the job.

By the way, this approach works like a charm for any index including FTSE

and DAX.

Good luck