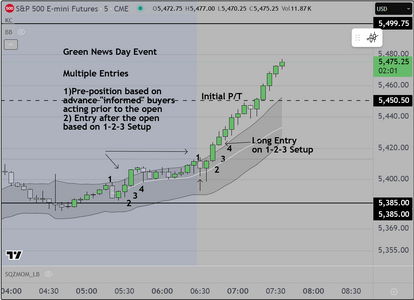

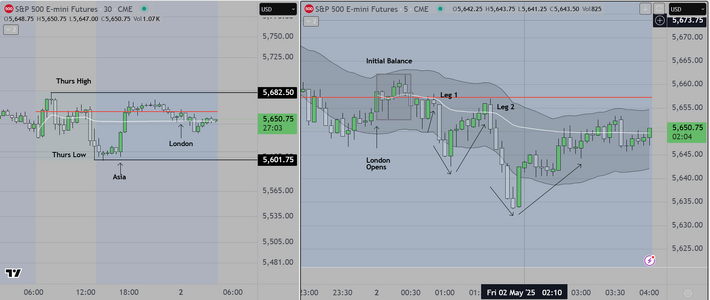

Today was a "Green News" day, meaning that we had

several "high impact" economic news events happening

and (in our opinion), "other" time frame participants had

advance knowledge of the outcome and had pre-positioned

themselves in the market, to take advantage of the move up

We teach this. It's straightforward, and only requires that students

pay attention to the obvious human behavior. We show traders

how to find the "tells" which are based on price action and volume

(or momentum). Then they learn to create scenarios based on

what we call "confidence levels".

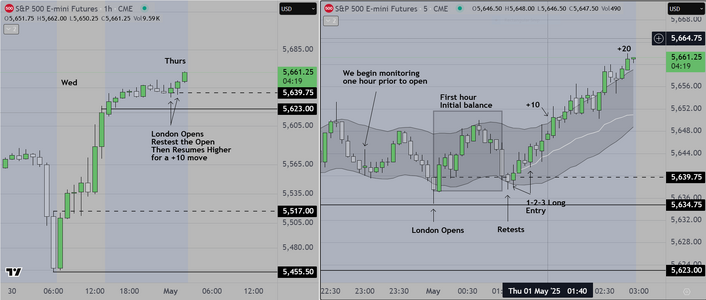

In this case, the scenario provides two options. The trader can if they

wish, pre-position along with the institutions, then if the trade is working

they take partial profit early (called "buying a stop") and they hold a

"runner". This requires that they trade at least two (2) contracts. OR

They can simply wait for the formal open and take the 1-2-3 setup with

long entry on "4".

The attached markup shows the entries. We did not take the early entry

(we were sleeping) but it is often the case that when we do the preparation

for this day, we get up early to participate in what we were taught to call

a "Green News Day Event". Obviously an overhead profit target was hit.

Postscript

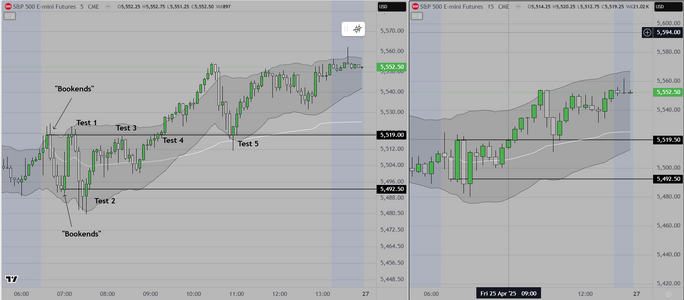

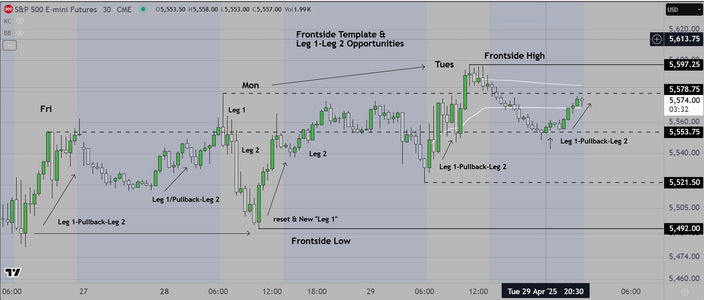

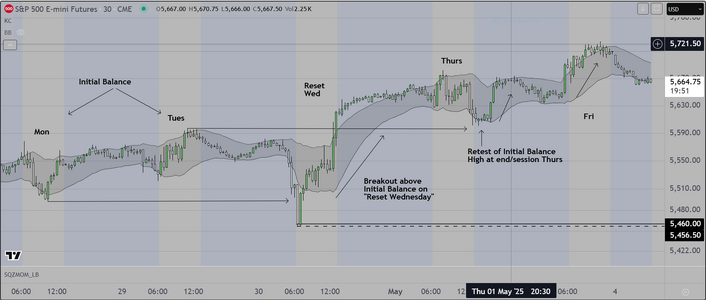

We had to clean up our chart, to better show the opportunities

We have said this previously, "nothing works all the time" however

this type of logic based trading does work quite well if one commits

to and maintains the discipline. The results certainly speak for themselves.

Good luck

several "high impact" economic news events happening

and (in our opinion), "other" time frame participants had

advance knowledge of the outcome and had pre-positioned

themselves in the market, to take advantage of the move up

We teach this. It's straightforward, and only requires that students

pay attention to the obvious human behavior. We show traders

how to find the "tells" which are based on price action and volume

(or momentum). Then they learn to create scenarios based on

what we call "confidence levels".

In this case, the scenario provides two options. The trader can if they

wish, pre-position along with the institutions, then if the trade is working

they take partial profit early (called "buying a stop") and they hold a

"runner". This requires that they trade at least two (2) contracts. OR

They can simply wait for the formal open and take the 1-2-3 setup with

long entry on "4".

The attached markup shows the entries. We did not take the early entry

(we were sleeping) but it is often the case that when we do the preparation

for this day, we get up early to participate in what we were taught to call

a "Green News Day Event". Obviously an overhead profit target was hit.

Postscript

We had to clean up our chart, to better show the opportunities

We have said this previously, "nothing works all the time" however

this type of logic based trading does work quite well if one commits

to and maintains the discipline. The results certainly speak for themselves.

Good luck

Attachments

Last edited: