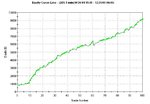

As my first post here, I'd like to donate a trading system for TradeStation that I have been using since November last year. I use this for trading index futures intraday. It worked well for me on the Nikkei, but I now use it on another index (which I dont really want to name.)

Its basic, very basic: Sell a contract at the current high of the day minus X points.

I.E, when an index is down X points from its high, it will have high chance of going down X number of points further. Obviously a market is more prone, especially in these times, to undergo a wave of panic selling, than a wave of panic buying. This takes advantage of this.

This system works well in a downtrending market - heh. It includes a break-even stop, and the sell level should be optimized for the market. I now watch the direction of the Asian markets before I take this trade, I.E. if both Nikkei and Hang are up, a lot, I wont do the trade. Anyway...I'll leave it up to you....

(Sorry for those who dont have TS)

File is all of 4 bytes.

Its basic, very basic: Sell a contract at the current high of the day minus X points.

I.E, when an index is down X points from its high, it will have high chance of going down X number of points further. Obviously a market is more prone, especially in these times, to undergo a wave of panic selling, than a wave of panic buying. This takes advantage of this.

This system works well in a downtrending market - heh. It includes a break-even stop, and the sell level should be optimized for the market. I now watch the direction of the Asian markets before I take this trade, I.E. if both Nikkei and Hang are up, a lot, I wont do the trade. Anyway...I'll leave it up to you....

(Sorry for those who dont have TS)

File is all of 4 bytes.