Consistent profitability. What does that mean? Every trade? Every day? Week, month, year? What? Trading is about probabilities not certainty. Just like any business. You can have all the right things in the right place at the right time with all the right people and you can still get shafted. It happens. Aiming for consistent profitability is probably the last thing anyone should be concentrating on when they're trying to make money. That comes about as a byproduct of the process.

You want 'methods' to support the probability of on-going success and 'overall eventual profitability'? Fundamentals, Research, Knowledge, Experience, Discipline, Effort, Energy, Stamina, Confidence, Self-Belief, Resilience, Quietness of Mind, Passion, Capital, Network, Information, Luck.

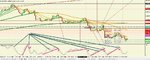

Alternatively, as many reading First Steps will have their account fully funded with £1000 and a chart full of indicators. Remove all your indicators. Then just stick three moving averages on it: a short one, one 4 times the length of the short one and one 10 times the length of the short one. When the shortest crosses the longest, trade. Exit when the shortest crosses the middle size one. Do not trade in the middle of a run, wait for a cross; there's always another one. Take every cross. Laugh at the losers. Ignore the winners. At the end of the week, not before, check your bottom line. You will not believe just how close you are to how the pros do it. Sorry, almost forgot - take long lunches and play golf in the afternoons.