NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

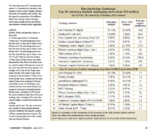

heres Currency Trader magazines list of top 2013 Traders .........

Pretty minimal on detail and clearly the % return tells you nothing about the risks they took to achieve it ......

may be worth looking up some of those dudes - like IronFortress

ALTAVRA | Iron Fortress FX USA (Managed Forex)

anyone know more about of some of these guys ?

N:smart:

Pretty minimal on detail and clearly the % return tells you nothing about the risks they took to achieve it ......

may be worth looking up some of those dudes - like IronFortress

ALTAVRA | Iron Fortress FX USA (Managed Forex)

anyone know more about of some of these guys ?

N:smart: