User

Experienced member

- Messages

- 1,170

- Likes

- 23

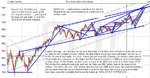

Weekly Close Above 12000......

Is that because we going higher and higher and higher......?

Nope

Its just to get more suckers in before the plug is pulled......

😈

Those of you that don't believe it......

Well not many believed it in 2000......

Nor did they believe that the market was tired of downside in Oct 02 and Mar 03

Oh Well

Have a look at the Weekly chart interpretation I have attached.

Good Luck

Is that because we going higher and higher and higher......?

Nope

Its just to get more suckers in before the plug is pulled......

😈

Those of you that don't believe it......

Well not many believed it in 2000......

Nor did they believe that the market was tired of downside in Oct 02 and Mar 03

Oh Well

Have a look at the Weekly chart interpretation I have attached.

Good Luck