You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

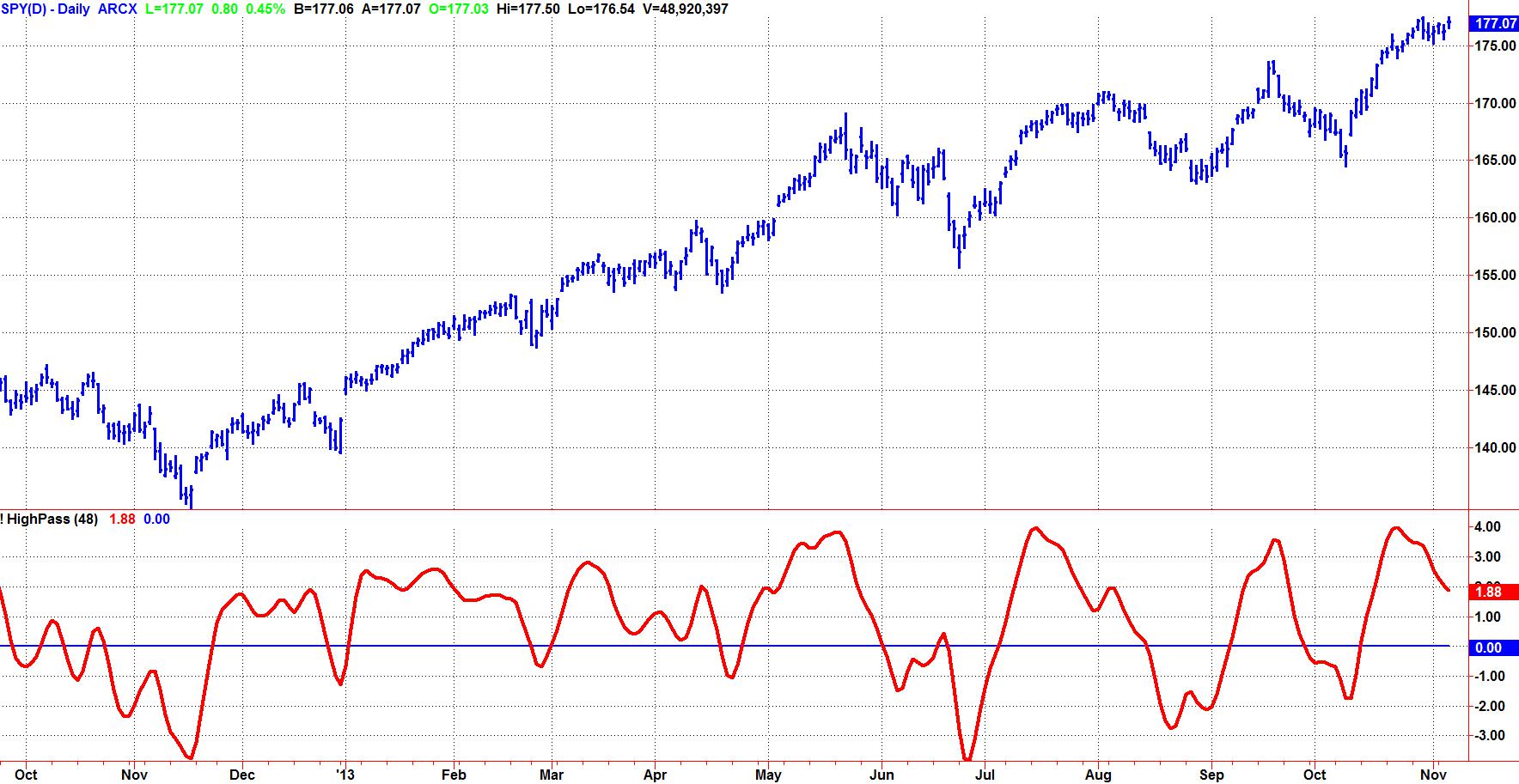

Buy and sell cycles reveal hidden intentions of the market's biggest players, as they engage in macro strategies that affect price direction. Investors and traders can identify these cycles through technical tools that measure the persistence of the push behind these cycles and can use these measurements to predict when such cycles will flip over from buy to sell and vice versa. These natural rhythms show their greatest power in major indexes and futures contracts that guide thousands of underlying equities, bonds and forex crosses.

The S&P-500, Nasdaq-100 and Russell-2000 serve this purpose for a broad basket of equities, grinding through easily observed cycles that tell participants how aggressive or defensive they need to be as they...

Although prices may appear to be random, they actually create repeating patterns and trends. One of the most basic repeating patterns is a fractal. Fractals are simple five-bar reversal patterns. This article will explain fractals and how you might apply them to your trading strategy.

Introduction to Fractals

When people hear the word "fractal," they often think about complex mathematics. That is not what we are talking about here. Fractals also refer to a recurring pattern that occurs amid larger more chaotic price movements.

Fractals are composed of five or more bars. The rules for identifying fractals are as follows:

A bearish turning point occurs when there is a pattern with the highest high in the middle and two lower highs on...

Many people participate in the stock markets, some as investors; others as traders. Investing is done with a long term view in mind, years or even decades. Trading, meanwhile, is done to pocket gains on a regular basis.

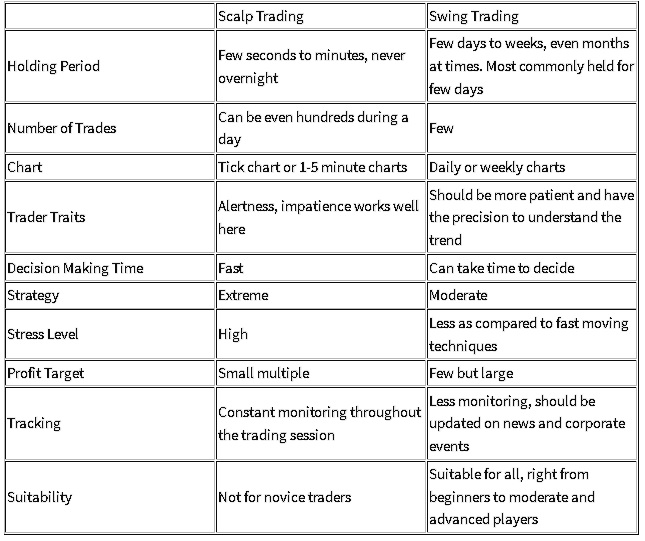

There are many sub categories of traders. One of the common ways to distinguish them is the “time period” for which traders hold a stock, which can vary from a few seconds to months or even years. Some of the popular trading strategies are day trading, swing trading, scalping and position trading. Choosing a style that suits your own trading temperament is essential for the success in the long term. This article lays out the differences between the scalping strategy and a swing trading strategy.

Scalping

The strategy...

Trading systems are usually thought of as complex computer programs requiring massive amounts of data to calculate the best entry and exit parameters. But in trading, often the best solution is the simplest. In fact, one of the best known trading systems doesn't even require a computer. Read on as we take a look at the weekly rule system and show you how this simple system can help you profit from a trade.

Trend following is a well-known concept underlying many successful trading systems. Probably the first such system was the weekly rule devised by Richard Donchian. Test results for this system were published as early as 1970, and it was found to be the most profitable system then known.

Donchian was called the "father of modern...

Traders and investors who seek to limit potential losses can use several types of orders to get them into and out of the market at times when they may not be able to place an order manually. Stop-loss orders and stop-limit orders are two tools that can accomplish this, but it is critical to understand the difference between the two similar sounding orders.

Stop-Loss Orders

There are two types of stop-loss orders.

1) Sell-stop orders protect long positions by triggering a market sell order if the price falls below a certain level. The underlying assumption behind this strategy is that if the price falls this far, it may continue to fall much further, so the loss is capped by selling at this price.

For example, let's say a trader owns...

Millions of traders test their skill in the financial markets each year, but most are destined to lose their stakes and walk away with their tails between their legs. A select few defy the odds, churning out profit after profit over long periods, building the wealth, security and wellbeing that others just dream about. So what separates these elite traders from the mediocre pack and how can you gain membership to this exclusive club?

First, let’s consider what isn’t required to become an elite trader. You don’t need to take special courses or move to Manhattan and work on Wall Street for a decade or two, although many elite traders follow that path. Nor do you need a huge stake to start your journey, because you already possess the...

The furore over high-frequency trading (HFT) was once just a preoccupation of those directly connected with Wall Street. Now the topic has gone mainstream and may soon go all the way up to the White House.

In October 2015, US Presidential hopeful Hilary Clinton's campaign proposed a tax on HFTs, a move that surprised many, since previously this was considered some quixotic notion of her rival Bernie Sanders. At a press conference in May 2015, Sanders' "Robin Hood Tax" campaign detailed the Vermont senator's proposal for a tax on trades at $0.50 per $100 for stocks and a smaller amount for certain other financial instruments. The quixotic purpose: to use the tax revenue to make US public universities free, and eradicate student debt...

As investors, we must take some risk to make any money in the markets. While it is true that cash in the bank doesn’t seem to have any risk, since it doesn’t rise and fall, changing interest rates cause its return to vary. And because the interest on cash is so low, the risk is that it won’t keep up with inflation.

Stock prices cycle up and down and they all move more or less together. In a bull market most stocks rise and in a bear market most fall, the only difference being one of degree. Precious metal prices also change in cycles, but usually not in synch with stocks and likewise for bond prices. All of these assets have risks which must be managed.

A concentrated portfolio would be one that invested in only one asset class, say...

MACD divergence is discussed in most trading books and frequently cited as the reason for trend reversals, or as to why a trend could reverse. In hindsight divergence looks great; many examples can be found where a reversal was preceded by MACD divergence. Look closely though, and you'll find that many reverses aren't preceded by divergence, and often divergence doesn't result in a reversal at all. So before assuming divergence is a reliable tool to use in your trading, let's dig deeper into what MACD divergence is, what causes it, and how to improve the use of divergence.

What is Indicator Divergence?

Indicator divergence is when an oscillator or momentum indicator, such as the Moving Average Convergence Divergence (MACD) indicator...

A "trading rut" is invariably endured by almost all traders at some point in their trading experience. A trading rut is a point in time where profits are elusive, or losses may even be mounting. These losing or unprofitable streaks can happen to anyone at any time. It may occur because the market has shifted in some way. At other times, it may be because the trader has altered a strategy or is no longer adhering to a trading plan. No matter what the reason for the slump is, there are five questions a trader can ask to help isolate the problem so changes can be initiated and hopefully a return to profitability will ensue.

The Questions

The following questions should be answered as honestly and as fully possible. Each will probe current...

Financial markets are enormously complex, but most trading strategies tend to fall into one of two categories: trend following or swing trading. Each strategy has advantages and disadvantages, as well as specific requirements that investors must follow consistently in order to avoid errors. However, many investors randomly apply these contrary strategies without understanding how that can undermine profitability. Identify whether you are a trend trader or a swing trader in order to hone your strategy correctly.

In theory, the trend trader takes risk in an uptrend or downtrend, staying positioned until the trend changes. In contrast, the swing trader works within the boundaries of range bound markets, buying at support and selling at...

Active traders often group themselves into two camps: the day traders and the swing traders. Both seek to profit from short-term stock movements (versus long-term investments), but which trading strategy is the better one? Below, we explore the pros and cons of day trading versus swing trading.

Day trading, as the name suggests, involves making dozens of trades in a single day, based on technical analysis and sophisticated charting systems. The day trader's objective is to make a living from trading stocks, commodities or currencies, by making small profits on numerous trades and capping losses on unprofitable trades. Day traders typically do not keep any positions or own any securities overnight.

Swing trading is based on identifying...

Most brokerage firms today offer free or premium trading software applications to individual clients when they open a brokerage account. The bundled software applications, offering a wide variety of trade, research, and analysis functions, are used as a prominent sales-pitch to the trader client. They also boast features like in-built technical indicators, fundamental analysis numbers, integrated applications for trade automations, news, and alert features. We will examine some of the most widely used, based on features (not price point):

MetaStock Trader: One of the most popular stock trading software applications, MetaStock Trader offers more than 300 technical indicators, built-in drawing tools like Fibonacci retracement to...

Some 10 years ago any attempt to mention financial markets in a non-professional milieu inevitably hit the wall of skepticism: «Forex again?! Oh, spare us this rubbish, please!»

I would like to draw reader’s attention to a particular issue: this common reaction is based on the misconception known as fallacy of composition where the negative attitude towards Forex is inferred upon financial markets in general. Like it or not, that kind of attitude distorts the reality dramatically and we must figure out how to avoid detrimental generalizations.

It is obvious that this reality switch is rooted in the heavy advertising run by Forex brokers all over the world. The negative attitude is just an epilogue to the personal experience...

Does China matter? That’s a popular question throughout the investment community right now. The answer, however, is relatively simple: yes. Simple numbers can prove this point.

Earnings Performance

According to FactSet, U.S. companies that generate more than 50% of their revenue from overseas have seen a collective earnings decline of 11.2% for the fourth quarter. U.S. companies that generate at least 50% of their revenue domestically, meanwhile, have seen their collective earnings increase 2.7% in the fourth quarter. Overseas revenue doesn’t mean China only, but as the second-largest economy in the world with a massive population China, has the biggest impact. Unfortunately, the following words and phrases are currently associated...

Insider buying and selling data can be extremely valuable for the individual investor. That is, if one knows how to use that data and interpret it so that a meaningful investment decision can be made.

Insiders (executives and beneficial owners) must file what is called a Form 4 with the Securities and Exchange Commission (SEC). The form essentially outlines the date and price at which a given executive has completed a large transaction in a stock. This data is then used by the investment community as a gauge of insider sentiment.

But what specifically should an investor look for in this information and what should be ignored? Here we'll provide some guidelines for interpreting insider data.

Clusters

There are many reasons why an...

Single-market analysis is the study of one asset class or market in a single country. Intermarket analysis, on the other hand, is the study of multiple asset classes in a variety of markets in nations around the globe. Do investors and traders using the second technique have a significant advantage over those using the first when it comes to returns?

We have all heard financial experts sing the praises of the diversified portfolio. "It is never a good idea to put all your eggs in one basket," they say. What they mean is that limiting your investments to just a few companies greatly increases your risk, especially if one or two of your major holdings experiences a meltdown.

Investors who heed this conventional wisdom own a number of...

Swing traders specialize in using technical analysis to take advantage of short-term price moves. Successfully trading these swings requires the ability to accurately determine both trend direction and trend strength. This can be done through the use of chart patterns, oscillators, fractals, volume analysis and a variety of other methods. This article will focus on using oscillators and candlestick patterns as a quick and easy way to characterize a trend and successfully identify swing trades

Finding Potential

The first step is to find the right conditions for a reversal, which can be done with either candlesticks or oscillators. Candlestick reversal indicators are characterized by indecision candles, while oscillator reversal...

You’re a trader, right, not a shopkeeper and there can’t possibly be any common ground between the two can there? Just a minute, though, both are trying to make a profit from the transactions they undertake and both are concerned about their bottom line and their overall and continued profitability. In short, both are in business.

As a trader it is quite likely that your Trading Plan will concentrate its focus on how you will approach individual trades. It will probably have quite a lot about how and when you will enter a trade, rather less about how you will guard against excessive loss and less again about how and when you will take your gains. Your bottom line probably won’t rate much of a mention at all. A Business Plan, however...

Swing trading has been described as a kind of fundamental trading in which positions are held for longer than a single day. This is because most fundamentalists are actually swing traders since changes in corporate fundamentals generally require several days or even a week to cause sufficient price movement that renders a reasonable profit.

But this description of swing trading is a simplification. In reality, swing trading sits in the middle of the continuum between day trading to trend trading. A day trader will hold a stock anywhere from a few seconds to a few hours but never more than a day; a trend trader examines the long-term fundamental trends of a stock or index, and may hold the stock for a few weeks or months. Swing traders...

Everyone knows the market data are fractal. You can look at a chart of daily data, look at a chart of weekly data, and the charts basically look the same if the scales are removed. In other words, the amplitude of the cyclic swings scale in direct proportion to the cycle period. I call this effect Spectral Dilation because longer cycle periods have larger swings. The Hurst Coefficient is directly related to the degree of dilation. Fibonccians use the Golden Spiral to show the dilation factor is 1.618. The exact degree of dilation is not important. The fact that dilation exists is beyond question. So, in round numbers, the spectrum amplitude increases 6 dB per octave of cycle period. This “1/F” phenomena seems to be almost...

Firstly back-testing should be done as accurately as possible. This means that all the best practices of back-testing should be implemented. Some examples are:

Including reasonable spreads

Avoiding look forward bias

Including any possible forms of commissions if applicable

Using historical data which is as accurate and complete as possible

Ensuring trade logic tested is reasonable and practicable in actual trading

Reducing slippage (although this is normally not a problem with Forex due to its immense liquidity)

With accurate back-testing, characteristics of the trading strategy can be observed and analysed reliably. What this means is the risk and returns profile of the strategy is statistically reliable, and any performance...

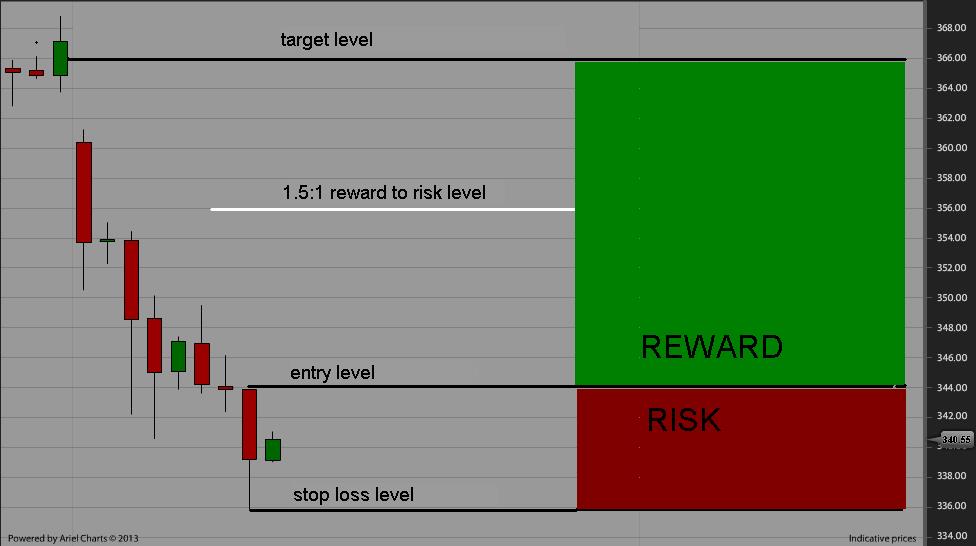

Ah, the ever present question as to where a trader should place stops. We all encounter this as we are trading. Let’s face it, there is a fine balance in placing a stop that allows you to minimize damage from a bad trade and a stop that is too close to the market which will get shaken out with normal volatility. So what is a trader to do? In past lessons, I have suggested some volatility stops and even using average prices.

Successful traders follow rule-based strategies to minimize emotions. That is exactly what we teach in our courses. This week, I will discuss a rule-based stop method that is based on using the definition of trends to determine when to exit.

An uptrend is a series of higher lows usually accompanied by higher highs...

I have found that traders usually fail for five primary reasons:-

1. Lack of trading skill

2. Lack of risk capital

3. Improper trading psychology

4. Lack of support

5. Lack of experience

1. Lack of Trading Skill

Usually new traders are so eager to make a killing in the market that they are just too impatient to learn how to trade before trying to trade. Basically, they either wing it, or think they know what they are doing without objectively determining their skill level.

If new traders can get the dollar signs out of their eyes and focus on developing their trading skills in a stress free, fun environment, they will be off to a good start. I encourage new traders to ‘paper trade’ first, so that they can practice their trading...

Trading is hard work. Becoming a profitable trader is even harder. So how can traders move from average to successful? I’ve found the best way to help those completely new to trading is to explain the amount of time and dedication required to become a profitable trader with sports analogies. For instance, in baseball if it’s the first time you experience a 100mph fast ball, you’re going to swing and miss. But if you’re dedicated, work hard and practice, you’ll be able to anticipate the 100mph pitch and knock it out of the park. The most successful athletes work hard and constantly seek out ways to improve their performance, and those same principles apply to successful traders.

As a trader with more than 10 years of experience on the...

Why Point & Figure Charts?

Point & Figure (P&F) charts are one of the simplest and clearest ways to determining the best time to buy and sell shares. The P&F system represents one of the oldest approaches to share market trading. This method takes the technical analysts approach while monitoring supply and demand for each share and the charts are designed for long-term trading so that the time and cost of trading shares is minimal.

How are Point & Figure Charts Constructed?

In P&F charts both axis are dependent on price rather than one being based on price and the other on date. The key unit in a P&F chart is the point, or unit of price. The point size may change in value along the y-axis to provide consistent and relative price...

There are two prices that are critical for any investor to know: the current price of the investment he or she owns, or plans to own, and its future selling price. Despite this, investors are constantly reviewing past pricing history and using it to influence their future investment decisions. Some investors won't buy a stock or index that has risen too sharply, because they assume that it's due for a correction, while other investors avoid a falling stock, because they fear that it will continue to deteriorate.

Does academic evidence support these types of predictions, based on recent pricing? In this article, we'll look at four different views of the market and learn more about the associated academic research that supports each...

Not long ago, I was spending time with a friend of mine who I have been close with since we were children. For years, anytime my career comes up in conversation, he insists that trading is nothing more than gambling. I actually get this question from others at trading events as well. It is a very hard question for me to answer because I think the whole question is wrong.

Whether you are a trader, gambler in a casino, Pepsi buying advertising space on a network, retail store owner, casino, car dealer, franchise owner, street vender, someone who buys and sells things on eBay, and so on, YOU ARE A SPECULATOR at some level. The trader takes on risk in a market for a potential reward. The gambler risks a $5.00 chip on the black jack table...

The decision to trade online or through a full service broker will undoubtedly make a large impact on your bottom line. However, the impact may or may not be what you had in mind. If you aren't ready to begin placing your orders online on your own, despite saving money on commission it may be the most costly mistake that you ever make.

While commission is baggage, a slightly higher rate it may be worth every penny assuming that your broker is truly giving you what you are paying for - reliable and efficient execution along with quality guidance in strategy and analysis.

Hopefully this article will open your eyes to the realities of transaction costs. While experienced traders should look for low rates with quality service, novice...