wallstreet1928

Legendary member

- Messages

- 6,609

- Likes

- 89

analysis of market leading stocks

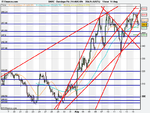

Barclays - bearish ....failed double top @ 366 .....support @ 354, 350 , 337

Anglo American - bullish ....uptrend still intact...higher highs,higher lows..fall below 1900 and I will become bearish

BP -neutral posture.... range bound between 500 - 520.......just keep playing that range as a day trader

Marks and sparks - bearish...bear flag scenario ...I will look to short this stock on any rise ...target 326

Barclays - bearish ....failed double top @ 366 .....support @ 354, 350 , 337

Anglo American - bullish ....uptrend still intact...higher highs,higher lows..fall below 1900 and I will become bearish

BP -neutral posture.... range bound between 500 - 520.......just keep playing that range as a day trader

Marks and sparks - bearish...bear flag scenario ...I will look to short this stock on any rise ...target 326

Attachments

Last edited: