I'm constantly amazed by the number of new members joining T2W who don't ever consider other markets and instruments and think that forex is the only market worth trading. I don't doubt that if other brokers offered the same charts as yours for equities, commodities and indices etc., that the general picture would be very similar and the same conclusions could be drawn. Nonetheless, it does illustrate that forex isn't the easy fast track to unlimited wealth that so many newbies appear to think it is.

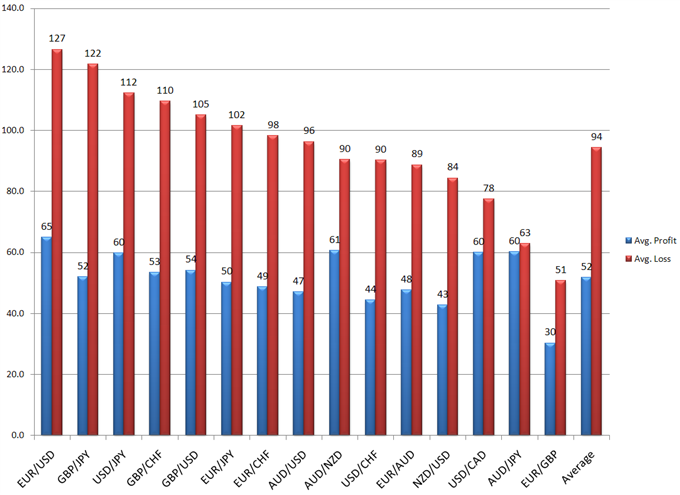

What I can't answer - is why the profit to loss ratio on EUR/USD is roughly 2:1, but on AUD/JPY it's nearer 1:1? I don't trade forex, so perhaps there's something about the individual characteristics of those two pairs that cause FXCM clients to trade them differently and apply different risk management criteria to each? Be that as it may, based on those charts, the 'best' pair to trade (as in not losing too much too quickly, lol!) looks like being USD/CAD.

Tim.

Agree, and you are right, in many ways FX is actually worse.

Stocks = more chance of finding something trending.

Indices = not as restricted in terms of range.

FX = largely rangebound due to CB tactics, pegging and cross border trade hedging etc.

Notable exceptions are AUD and JPY pairs - due to rates (Daily).

Not being aware of that certainly doesn't help...

If you are aware, you can turn it to your advantage.

For me the primary attraction was greater timespan for intraday time decay (only when applicable).

As close to an overnight hold as you will get, but still flat each day, simple as that.

If its big trends, then obviously ES, YM and NQ have been better,

plus you have volume / tape etc.

For me the PITA is PDT, wire transfer hassle (have to do wires on phone with my bank...),

connection lag to U.S. servers etc.