Salvadorveiga,

PositionSizer works with a series of price capture clicks. You chose your entry price, stop price, then 0,1,2 profit targets and it gives you your position size based on the % Risk model and your RR ratios at which time you click the TRADE POSITION button. Then your order is sent to the broker and upon order fill the stops and target orders are place automatically as well You need to have reason to buy/sell or some kind of system I should say. PositionSizer is an order entry add-on and not a program that tells you when to buy or sell.

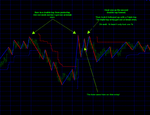

As for the 3rd waves. Sometimes they can be huge. You are right on that. But this is when trading gets the hardest psychologically. This is where I make all my mistakes. Getting out to early and not following the ATR all the way down.

Funny as it may be the PositionSizer now has an Auto ATR so I am able to let it manage my stop automatically.

The Pip Thief