mrtorrence

Newbie

- Messages

- 6

- Likes

- 0

Imagine you were in this situation, what would you do?

You have warrants to buy 9.5 million shares at 2 cents of a micro cap OTC company currently trading at about 4.5 cents. You also have a cashless exercise option with the following equation for determining what % of the 9.5 million shares you get:

y= 9,500,000[(x-.02)/x]; where x is the average closing price from the previous 5 days

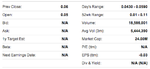

Attached are pictures of the stock's chart from the last 6 months, and a brief summary.

What would you do?

You have warrants to buy 9.5 million shares at 2 cents of a micro cap OTC company currently trading at about 4.5 cents. You also have a cashless exercise option with the following equation for determining what % of the 9.5 million shares you get:

y= 9,500,000[(x-.02)/x]; where x is the average closing price from the previous 5 days

Attached are pictures of the stock's chart from the last 6 months, and a brief summary.

What would you do?