When you open your first option trading account (or add option capability to an existing equities brokerage account), your broker assigns you an options approval level. Usually the levels run from Level One to Level Five. Your approval level determines which option strategies you are allowed to use in that account.

The idea behind the approval level structure is that the riskier an options strategy is, the more options experience and/or capital should be required. Here is a typical list of approval levels and the types of trades allowed:

Level 1 – Covered Calls, Protective Puts (i.e. option positions that also include a position in the underlying stock)

Level 2 – Level 1 items plus speculative call and put buying (i.e. buying calls alone as a bullish speculation, or buying puts alone as a bearish speculation)

Level 3 – Level 2 items plus debit spreads (i.e. positions involving more than one option, where the maximum loss is the original net debit paid. For example, bull call spreads, bear put spreads, long butterflies, long calendar spreads, long diagonal spreads)

Level 4 – Level 3 items plus naked short puts and credit spreads (i.e. positions involving more than one option, where the position is entered for a net credit, and the maximum loss may be greater than the original net credit received. For example, bull put spreads and bear call spreads, iron condors, iron butterflies, put ratio spreads).

Level 5 – Level 4 items plus positions involving naked short calls, including short straddles, short strangle, and call ratio spreads.

Having a low option approval level is a challenge since it shuts out many good option trading opportunities. As educated option traders, we would like to be able to use any option strategy that meets our own risk parameters.

The first thing to do along this line is to get the highest option approval level that you legitimately can get. In your options account application, you will be asked what types of option trades you would like to do. I suggest you check all the boxes. You will also be asked what the purpose of the account is. Check all the boxes here too, including speculation. If you only check the box labeled long-term investing, you will receive a low option approval level.

You’ll also be asked about your experience in trading different instruments. Make sure to speak with a live representative and have that person clarify what they mean by experience. Find out if trading in option classes or simulated trading can be counted. Let that person know what options education you have, as this might make a difference in marginal cases.

Let’s say that after all that, the highest level you can get as an absolute beginner is level two. Your broker may require several more months of trading experience before approving you for level three. This is not uncommon. Or, it may be that in the type of account you have, level two is the highest level ever given. This is true in Registered accounts in Canada and in some IRAs in the U.S., for example. Then what?

Well, the fact is that level two, or even level one, is not quite as restrictive as it appears if we use a little ingenuity. Using a fascinating property of options called Put-Call Parity and working entirely within the rules, with a level one or two account we can create positions equivalent of many Level 3 and even Level 4 strategies.

Very briefly, one of the key aspects of put-call parity is this: The amount of time value in a Put at strike x and a Call at strike x, of the same underlying and expiration, is equal (after making adjustments for interest and dividends, if applicable).

That leads to a set of equivalencies between options positions which we can exploit to construct many of the positions we want from the lower-level positions we are allowed to use.

In the following explanation, the notation P(x) means a Put at strike X. For example, on a $100 stock, if we write P(x) and we mean a put at the 95 strike, then x is 95. That in turn means that if we write C(x) we mean a call at the 95 strike.

These are the notations we will be using:

• +S = Long 100 shares of the underlying Stock

• -S = Short 100 shares of the underlying Stock

• +C(x) = One long call option at strike X

• -C(x) = One short call option at strike X

• +P(x) = One long put option at strike X

• -P(x) = One short put option at strike X

Here is a basic equation: +S + P(x) = C(x)

This translates to: 100 shares of stock plus one put at strike x equals one call at strike x.

In the above translation, equals means yields the same profit or loss in all conditions. The amount of capital required for the two equivalent trades may be different, but the profit or loss is the same.

Here’s a real-world example: Today we could buy GLD stock at $164.50 per share. A put at the $160 strike is worth $1.43 per share today (all of that value is time value since that put is out of the money). Meanwhile, a Call at the $160 strike is worth $5.98, including $1.48 of time value and $4.50 of intrinsic value.

Note that the time value in the call ($1.48) is five cents greater than the time value in the put ($1.43). Without going into too much detail about this, the five-cent difference is the adjustment to time value needed to compensate for interest. It is the amount it would cost to borrow an amount of money equal to the strike price ($160) for the period until expiration (14 days) at the current risk-free interest rate (1.5% annually). $160 times 1.5% times 14 / 365 = $.05.

Let’s compare two different equivalent positions.

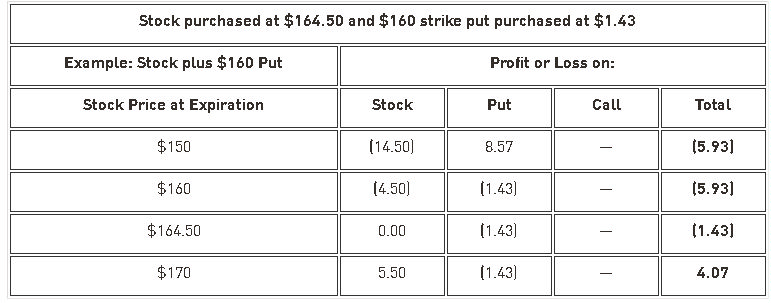

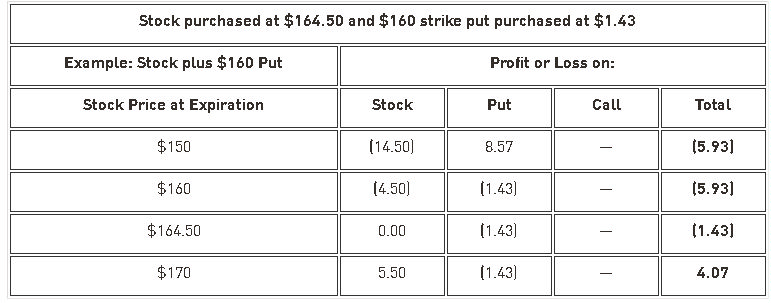

Position 1 involves buying 100 shares of GLD at $164.50, and also buying one protective put at the $160 strike. Here are the P/L results for a position held until expiration, given a few selected prices of the underlying GLD shares at that time:

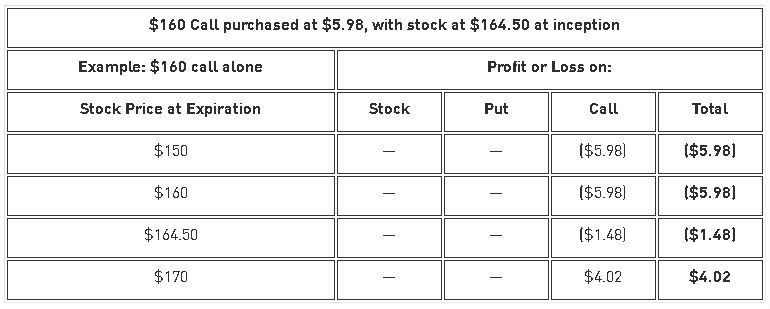

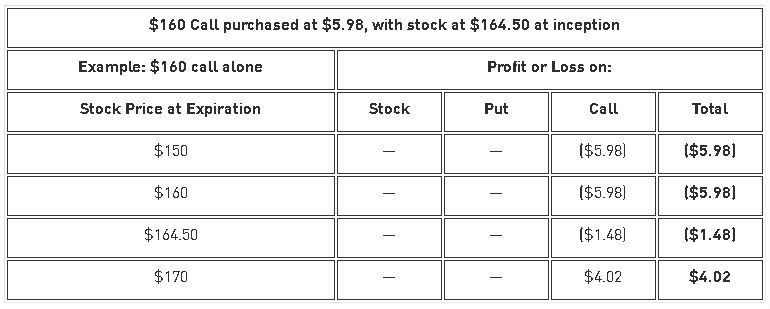

Position 2 consists of no stock and no puts; instead it is the purchase of a Call at the $160 strike alone:

Notice that no matter the eventual price of GLD, Position 1 always yields a result that appears better than Position 2 by exactly five cents. When we consider that Position 1 would require $160 more in capital than position 2 (because we have to buy the stock in position 1 but not position 2), and factor in the extra interest cost of 5 cents on that capital for Position 1, the positions are precisely equivalent, to the penny.

So, the above example is proof of the equation S + P(x) = C(x). Clearly, we can get the same result by buying 100 shares of GLD at the market price and also buying a protective put at the $160 strike, as we could get by just buying a GLD call at the $160 strike. The Stock-plus-put combination is a synthetic long call.

In this particular case, that gives us an alternative way to construct a position that we might want to do (a long call) in an account where we might not be allowed to do it (an account with Level One approval. That account can buy protective puts, but it cannot just buy single calls).

Taking that example one step further, consider that the synthetic call from Position 1 can be combined with a short call at, say the 165 strike. This short call would be a covered call because Position 1 includes 100 shares of stock, so it is allowed in a Level 1 account. The entire position now is exactly like a position containing a long call at the 160 strike and a short call at the 165 strike – in other words, a bull call spread. This is a debit spread normally requiring Level 3 approval, synthesized in a Level 1 account. It will perform in all respects just like a 160-165 bull call spread.

Going yet another step, the covered 165 short call that we added to the synthetic long call above could have been at any strike, including a lower strike (an in-the-money strike). If we selected, say the 155 strike for the short call instead of the 165, then the combined position would be the equivalent of a 155-160 bull call spread. This, by the way, through the magic of put-call parity, is in turn the exact equivalent of a 155-160 bull put spread – a credit spread normally requiring Level 4 approval. We have synthesized a level 4 credit spread in a level one account.

The same principal can be used to construct equivalents for, or in other words to synthesize, other types of positions as well. We’ll go into more detail on that next time, but in the meantime here’s a hint: the equation S + P(x) = C(x) can be rearranged into any of its forms to synthesize any long or short stock or option position from the other two components. This means that in a Level Two account, we can use the positions that we are allowed to use to synthesize most types of positions that normally require approval levels up to Level Four.

Russ Allen can be contacted on this link: Russ Allen

The idea behind the approval level structure is that the riskier an options strategy is, the more options experience and/or capital should be required. Here is a typical list of approval levels and the types of trades allowed:

Level 1 – Covered Calls, Protective Puts (i.e. option positions that also include a position in the underlying stock)

Level 2 – Level 1 items plus speculative call and put buying (i.e. buying calls alone as a bullish speculation, or buying puts alone as a bearish speculation)

Level 3 – Level 2 items plus debit spreads (i.e. positions involving more than one option, where the maximum loss is the original net debit paid. For example, bull call spreads, bear put spreads, long butterflies, long calendar spreads, long diagonal spreads)

Level 4 – Level 3 items plus naked short puts and credit spreads (i.e. positions involving more than one option, where the position is entered for a net credit, and the maximum loss may be greater than the original net credit received. For example, bull put spreads and bear call spreads, iron condors, iron butterflies, put ratio spreads).

Level 5 – Level 4 items plus positions involving naked short calls, including short straddles, short strangle, and call ratio spreads.

Having a low option approval level is a challenge since it shuts out many good option trading opportunities. As educated option traders, we would like to be able to use any option strategy that meets our own risk parameters.

The first thing to do along this line is to get the highest option approval level that you legitimately can get. In your options account application, you will be asked what types of option trades you would like to do. I suggest you check all the boxes. You will also be asked what the purpose of the account is. Check all the boxes here too, including speculation. If you only check the box labeled long-term investing, you will receive a low option approval level.

You’ll also be asked about your experience in trading different instruments. Make sure to speak with a live representative and have that person clarify what they mean by experience. Find out if trading in option classes or simulated trading can be counted. Let that person know what options education you have, as this might make a difference in marginal cases.

Let’s say that after all that, the highest level you can get as an absolute beginner is level two. Your broker may require several more months of trading experience before approving you for level three. This is not uncommon. Or, it may be that in the type of account you have, level two is the highest level ever given. This is true in Registered accounts in Canada and in some IRAs in the U.S., for example. Then what?

Well, the fact is that level two, or even level one, is not quite as restrictive as it appears if we use a little ingenuity. Using a fascinating property of options called Put-Call Parity and working entirely within the rules, with a level one or two account we can create positions equivalent of many Level 3 and even Level 4 strategies.

Very briefly, one of the key aspects of put-call parity is this: The amount of time value in a Put at strike x and a Call at strike x, of the same underlying and expiration, is equal (after making adjustments for interest and dividends, if applicable).

That leads to a set of equivalencies between options positions which we can exploit to construct many of the positions we want from the lower-level positions we are allowed to use.

In the following explanation, the notation P(x) means a Put at strike X. For example, on a $100 stock, if we write P(x) and we mean a put at the 95 strike, then x is 95. That in turn means that if we write C(x) we mean a call at the 95 strike.

These are the notations we will be using:

• +S = Long 100 shares of the underlying Stock

• -S = Short 100 shares of the underlying Stock

• +C(x) = One long call option at strike X

• -C(x) = One short call option at strike X

• +P(x) = One long put option at strike X

• -P(x) = One short put option at strike X

Here is a basic equation: +S + P(x) = C(x)

This translates to: 100 shares of stock plus one put at strike x equals one call at strike x.

In the above translation, equals means yields the same profit or loss in all conditions. The amount of capital required for the two equivalent trades may be different, but the profit or loss is the same.

Here’s a real-world example: Today we could buy GLD stock at $164.50 per share. A put at the $160 strike is worth $1.43 per share today (all of that value is time value since that put is out of the money). Meanwhile, a Call at the $160 strike is worth $5.98, including $1.48 of time value and $4.50 of intrinsic value.

Note that the time value in the call ($1.48) is five cents greater than the time value in the put ($1.43). Without going into too much detail about this, the five-cent difference is the adjustment to time value needed to compensate for interest. It is the amount it would cost to borrow an amount of money equal to the strike price ($160) for the period until expiration (14 days) at the current risk-free interest rate (1.5% annually). $160 times 1.5% times 14 / 365 = $.05.

Let’s compare two different equivalent positions.

Position 1 involves buying 100 shares of GLD at $164.50, and also buying one protective put at the $160 strike. Here are the P/L results for a position held until expiration, given a few selected prices of the underlying GLD shares at that time:

Position 2 consists of no stock and no puts; instead it is the purchase of a Call at the $160 strike alone:

Notice that no matter the eventual price of GLD, Position 1 always yields a result that appears better than Position 2 by exactly five cents. When we consider that Position 1 would require $160 more in capital than position 2 (because we have to buy the stock in position 1 but not position 2), and factor in the extra interest cost of 5 cents on that capital for Position 1, the positions are precisely equivalent, to the penny.

So, the above example is proof of the equation S + P(x) = C(x). Clearly, we can get the same result by buying 100 shares of GLD at the market price and also buying a protective put at the $160 strike, as we could get by just buying a GLD call at the $160 strike. The Stock-plus-put combination is a synthetic long call.

In this particular case, that gives us an alternative way to construct a position that we might want to do (a long call) in an account where we might not be allowed to do it (an account with Level One approval. That account can buy protective puts, but it cannot just buy single calls).

Taking that example one step further, consider that the synthetic call from Position 1 can be combined with a short call at, say the 165 strike. This short call would be a covered call because Position 1 includes 100 shares of stock, so it is allowed in a Level 1 account. The entire position now is exactly like a position containing a long call at the 160 strike and a short call at the 165 strike – in other words, a bull call spread. This is a debit spread normally requiring Level 3 approval, synthesized in a Level 1 account. It will perform in all respects just like a 160-165 bull call spread.

Going yet another step, the covered 165 short call that we added to the synthetic long call above could have been at any strike, including a lower strike (an in-the-money strike). If we selected, say the 155 strike for the short call instead of the 165, then the combined position would be the equivalent of a 155-160 bull call spread. This, by the way, through the magic of put-call parity, is in turn the exact equivalent of a 155-160 bull put spread – a credit spread normally requiring Level 4 approval. We have synthesized a level 4 credit spread in a level one account.

The same principal can be used to construct equivalents for, or in other words to synthesize, other types of positions as well. We’ll go into more detail on that next time, but in the meantime here’s a hint: the equation S + P(x) = C(x) can be rearranged into any of its forms to synthesize any long or short stock or option position from the other two components. This means that in a Level Two account, we can use the positions that we are allowed to use to synthesize most types of positions that normally require approval levels up to Level Four.

Russ Allen can be contacted on this link: Russ Allen

Last edited by a moderator: