You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

trendie

Legendary member

- Messages

- 6,875

- Likes

- 1,433

as you said in your other thread, strictly speaking, this shouldnt be about prediction, ie, wot actually happened next.

more, it should be about where price needs to go for it to become interesting.

what line in the sand does price need to cross for you to consider a change in trend and to assess ones reaction to it.

not quite sure what those horiz-bars are. I suppose they are Market Profile type stuff?

I am treating them as areas of heavy action. if so, price should shoot through the light-vol gap.

more, it should be about where price needs to go for it to become interesting.

what line in the sand does price need to cross for you to consider a change in trend and to assess ones reaction to it.

not quite sure what those horiz-bars are. I suppose they are Market Profile type stuff?

I am treating them as areas of heavy action. if so, price should shoot through the light-vol gap.

Attachments

dick_dastardly

Established member

- Messages

- 843

- Likes

- 152

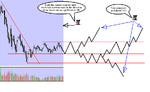

Assuming the sideways bars are something to do with volume @ price, them the last low co-incided with a "value area support" type level. Either way, it reversed but didn't set a new high. We made a Double top in a period of consolidation during a downtrend, ad have just broken through a "soft" trendline.

Looking to re-test the low shown in either of the ways shown here.

Perspective changes if we break the highs of the double top, then all my levels shown in blue, and I would probably ad a Fib in there too.

Looking to re-test the low shown in either of the ways shown here.

Perspective changes if we break the highs of the double top, then all my levels shown in blue, and I would probably ad a Fib in there too.

Attachments

everyonerich

Experienced member

- Messages

- 1,109

- Likes

- 43

megamuel

Experienced member

- Messages

- 1,098

- Likes

- 164

Hmm, I'll probably get laughed at for this but oh well, its only a bit of fun!

Looks bearish on long term. There seems to be a small double top there showing resistance, I'd say initially price rises towards this resistance but finds it below the double top - at where I have drawn my trend line. It bounces off this towards the downside, finds support at the major low, and starts a new trend towards the upside, breaking through all previous support and resistance. It then finds a new level of resitance whish it will test twice and then break on the third attemp.

Now anyone wanting to get this right - draw exactly the opposite of what I just have!!!

Sam.

Looks bearish on long term. There seems to be a small double top there showing resistance, I'd say initially price rises towards this resistance but finds it below the double top - at where I have drawn my trend line. It bounces off this towards the downside, finds support at the major low, and starts a new trend towards the upside, breaking through all previous support and resistance. It then finds a new level of resitance whish it will test twice and then break on the third attemp.

Now anyone wanting to get this right - draw exactly the opposite of what I just have!!!

Sam.

Attachments

hwsteele

Experienced member

- Messages

- 1,227

- Likes

- 182

Well, with no cat ears to speak of I'm 100% in the dark!

SO I closed my eyes and drew some lines. The lady on the psychic hot line told me it would turn out ok, and that I would meet that special someone!:clap:😍😱

Any way, I'm going to say a double bottom and then a brighter future.

You know wasp this would be so much easier if you at least left the symbol of what's being charted!

:edit

Um, I'm not complaining, as I do enjoy these games, BUT when you leave the volume at the bottom it becomes obvious that the market does not move past that point. Not that I think I would do any better. If I had to do it I would just leave one candle on the chart and cover the rest with some risque photos:cheesy: (um, not of me)

SO I closed my eyes and drew some lines. The lady on the psychic hot line told me it would turn out ok, and that I would meet that special someone!:clap:😍😱

Any way, I'm going to say a double bottom and then a brighter future.

You know wasp this would be so much easier if you at least left the symbol of what's being charted!

:edit

Um, I'm not complaining, as I do enjoy these games, BUT when you leave the volume at the bottom it becomes obvious that the market does not move past that point. Not that I think I would do any better. If I had to do it I would just leave one candle on the chart and cover the rest with some risque photos:cheesy: (um, not of me)

Attachments

Last edited:

firewalker99

Legendary member

- Messages

- 6,655

- Likes

- 613

seems obvious, no?...a touch of db...a dash of wasp...and do the opposite of whatever fw posts...:cheesy:

is that the best you can come up with? surely the experience "on the road" has taught you better? :cheesy:

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

firewalker99

Legendary member

- Messages

- 6,655

- Likes

- 613

Future forecasting by firewalker

Since everything can be foretold, here's one thing I predict:

There won't be an equally accurate forecast for this chart, as was the case for the first WOT thread by wasp. :smart:

Since everything can be foretold, here's one thing I predict:

There won't be an equally accurate forecast for this chart, as was the case for the first WOT thread by wasp. :smart:

wasp

Legendary member

- Messages

- 5,107

- Likes

- 880

seems obvious, no?...a touch of db...a dash of wasp...and do the opposite of whatever fw posts...:cheesy:

rainman2 (and kenobi), if you can't do it, there's no reason to be embarrassed or bitter, just keep watching the threads and practising... you'll get there...

Last edited:

The Philosopher

Junior member

- Messages

- 28

- Likes

- 12

rags2riches

Well-known member

- Messages

- 399

- Likes

- 135

mr.marcus

Active member

- Messages

- 245

- Likes

- 176

Since everything can be foretold, here's one thing I predict:

There won't be an equally accurate forecast for this chart, as was the case for the first WOT thread by wasp. :smart:

.....dont be shy mate....just ask if i do a "calls" service...😆...in the meantime may your trendlines bring you all the prosperity and happiness you wish for....with love as always ...mark j.

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

ok, it's nice to be on the other side of the wot table thanks to young waspy, so I'll give this one a go.

It's totally beyond me to predict where it's going, but I'm going to prepare to go long since I'm making the assumption that the action over the last few weeks (red-lined) is a process of accumulation by the big-guns preparatory to taking the price back up when overall market conditions are favourable. Should it break south I won't be taking a short since my assumption would require it to be seen as a shake out to pick up the last chunk of stock from nervous holders. If it kept on going south, then so what - I'll just be noting that my assumption was not valid.

So why my assumption:

1. The fall in price seems to be sufficient for it to be worthwhile to take the price back to the upper range.

2. As the big-guns build their positions by buying what becomes available, then selling some to keep the price within their buying range and so on I would expect volume to be relatively low, down bars generally closing well off their lows and decent rises counter-acted pretty rapidly. All featured here to my eye.

So that's it - but then I thought Skill's 747 would remain motionless on the runway, too 😆

good trading

jon

It's totally beyond me to predict where it's going, but I'm going to prepare to go long since I'm making the assumption that the action over the last few weeks (red-lined) is a process of accumulation by the big-guns preparatory to taking the price back up when overall market conditions are favourable. Should it break south I won't be taking a short since my assumption would require it to be seen as a shake out to pick up the last chunk of stock from nervous holders. If it kept on going south, then so what - I'll just be noting that my assumption was not valid.

So why my assumption:

1. The fall in price seems to be sufficient for it to be worthwhile to take the price back to the upper range.

2. As the big-guns build their positions by buying what becomes available, then selling some to keep the price within their buying range and so on I would expect volume to be relatively low, down bars generally closing well off their lows and decent rises counter-acted pretty rapidly. All featured here to my eye.

So that's it - but then I thought Skill's 747 would remain motionless on the runway, too 😆

good trading

jon

Attachments

Similar threads

- Replies

- 35

- Views

- 9K