Many regular readers of this column know that I sometimes use cross-market analysis to find Forex trades. If you think that sounds complicated, keep reading and you'll see that it's easier than it sounds. You might recall last October's article, "Using Stocks to Trade Forex," where the S&P was used as an indicator to trade the GBP/JPY currency pair. Recently, a trade setup presented itself where I was able to use a major support level on the S&P 500 as an indicator to place a trade on another currency pair that is known to follow that index.

Let's begin with a very long-term look at the S&P 500; we can do this by checking the continuous monthly chart of the E-Mini futures contract. From this chart, it's very clear that the 800 area acted as support and helped form the bottom during the bear market of 2001-2002, and was re-tested early in 2003. That same level and the area just below it has been tested repeatedly during our current bear market, during both 2008 and 2009 (see figure 1).

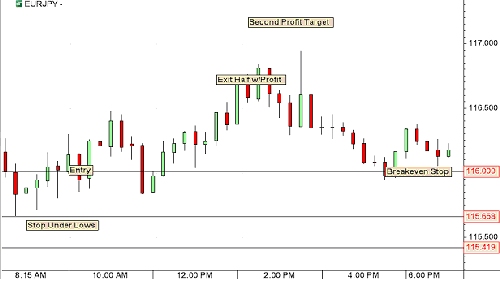

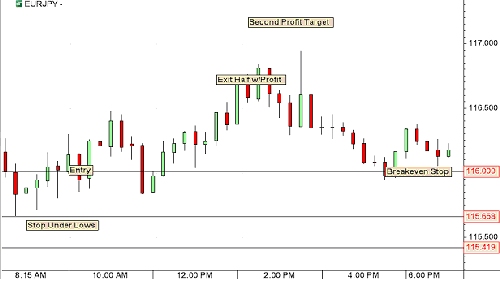

There are certain currency pairs that have a strong correlation to the equity markets; in other words, when the stock market goes down, these currency pairs go down with it, and when the market rises, it pulls these currency pairs up in its wake. This relationship exists across many currency pairs that include the Japanese Yen, such as GBP/JPY and EUR/JPY, and after considering a variety of alternatives, a plan began to form. The general idea was this; if the S&P 500 bounces off of that support level, then the JPY pairs should bounce as well. We would wait for the S&P 500 to drop below 800, and then if it rebounded above that level, we would go long EUR/JPY. That is exactly what occurred on the morning of February 17, 2009. This occurred just before 10 am New York time, about one half hour into trading. That time of day is infamous for reversals in U.S. stocks, and since we were trading a currency pair that mirrored the action in the equity markets, we were counting on a similar reversal in EUR/JPY.

After entering the trade, the EUR/JPY floated back and forth, just drifting sideways. What happened? The S&P 500 failed to hold above 800, but it wouldn't fall back either, treading water above 790. Finally, after lunch, stocks mounted enough of a rally to pull EUR/JPY up to our first target, and after all that time we were happy to ring the register with half of the trade. Following our plan, we raised the stop on the remainder of our trade to our entry point - the breakeven point - and let the rest of the trade run. This would guarantee a worst case scenario of a profit on the first half of the trade, and a break even trade on the second half.

We had locked in a winner, but a bigger bounce never materialized, and the S&P sank into the close. This pulled EUR/JPY back down to our entry point, where the second half of the trade was closed for a breakeven trade. While the result wasn't everything we had hoped for, we did well - the trade was not a home run, but not a strikeout either. The important thing was that we were able to lock in a profit and at the same time give our winner a chance to run. Experience teaches us that if traders keep doing the right things, like eliminating risk, locking in profits and letting winners run, then good things can happen.

On a side issue, I was recently asked the following question regarding trading on Fridays

My reply was: It's good that you're paying attention to important patterns in your trading. There is nothing wrong with trading on Fridays per se, but we need to pay attention to the time of day - not just where we are located, but everywhere. I'll give you an example; let's assume you are trading in New York. When it's 10 am in New York on a Friday, it might not be a bad time to trade because London traders are still active. London is five hours ahead of New York, so when it is 10 am in New York, it is 3 pm in London - still a few hours of good trading remain from the world's capital of Forex trading (London is responsible for about one third of all Forex volume).

But what if the time is 2 pm on a Friday in New York? Well, that would mean that the time is 7pm in London, and those traders have closed up shop for the week. Also, when it is 2 pm on Friday in New York, it is already Saturday morning in Asia, so we can't expect any volume from that part of the world. You might notice that as Friday wears on, intraday candles have a tendency to get smaller and smaller. When I worked as an equity trader, we would close our positions and take off every Friday afternoon between Memorial Day and Labor Day, due to low volume and a lack of interest on the part of many market participants. The idea was that you could either keep trading a market that won't move and bang your head against the wall, or you could preserve your capital and find a more useful way to spend your time. A low volatility market can be frustrating, so if you sense that the keg is kicked and the party is over, there is nothing wrong with closing out your short-term positions and walking away.

Let's begin with a very long-term look at the S&P 500; we can do this by checking the continuous monthly chart of the E-Mini futures contract. From this chart, it's very clear that the 800 area acted as support and helped form the bottom during the bear market of 2001-2002, and was re-tested early in 2003. That same level and the area just below it has been tested repeatedly during our current bear market, during both 2008 and 2009 (see figure 1).

There are certain currency pairs that have a strong correlation to the equity markets; in other words, when the stock market goes down, these currency pairs go down with it, and when the market rises, it pulls these currency pairs up in its wake. This relationship exists across many currency pairs that include the Japanese Yen, such as GBP/JPY and EUR/JPY, and after considering a variety of alternatives, a plan began to form. The general idea was this; if the S&P 500 bounces off of that support level, then the JPY pairs should bounce as well. We would wait for the S&P 500 to drop below 800, and then if it rebounded above that level, we would go long EUR/JPY. That is exactly what occurred on the morning of February 17, 2009. This occurred just before 10 am New York time, about one half hour into trading. That time of day is infamous for reversals in U.S. stocks, and since we were trading a currency pair that mirrored the action in the equity markets, we were counting on a similar reversal in EUR/JPY.

After entering the trade, the EUR/JPY floated back and forth, just drifting sideways. What happened? The S&P 500 failed to hold above 800, but it wouldn't fall back either, treading water above 790. Finally, after lunch, stocks mounted enough of a rally to pull EUR/JPY up to our first target, and after all that time we were happy to ring the register with half of the trade. Following our plan, we raised the stop on the remainder of our trade to our entry point - the breakeven point - and let the rest of the trade run. This would guarantee a worst case scenario of a profit on the first half of the trade, and a break even trade on the second half.

We had locked in a winner, but a bigger bounce never materialized, and the S&P sank into the close. This pulled EUR/JPY back down to our entry point, where the second half of the trade was closed for a breakeven trade. While the result wasn't everything we had hoped for, we did well - the trade was not a home run, but not a strikeout either. The important thing was that we were able to lock in a profit and at the same time give our winner a chance to run. Experience teaches us that if traders keep doing the right things, like eliminating risk, locking in profits and letting winners run, then good things can happen.

On a side issue, I was recently asked the following question regarding trading on Fridays

"I have recently decided against trading on Fridays, because the strategies that are so effective during the week seem to fail me miserably on Fridays and I end up losing money. Is there any advice you can give on successful Friday trading?"

My reply was: It's good that you're paying attention to important patterns in your trading. There is nothing wrong with trading on Fridays per se, but we need to pay attention to the time of day - not just where we are located, but everywhere. I'll give you an example; let's assume you are trading in New York. When it's 10 am in New York on a Friday, it might not be a bad time to trade because London traders are still active. London is five hours ahead of New York, so when it is 10 am in New York, it is 3 pm in London - still a few hours of good trading remain from the world's capital of Forex trading (London is responsible for about one third of all Forex volume).

But what if the time is 2 pm on a Friday in New York? Well, that would mean that the time is 7pm in London, and those traders have closed up shop for the week. Also, when it is 2 pm on Friday in New York, it is already Saturday morning in Asia, so we can't expect any volume from that part of the world. You might notice that as Friday wears on, intraday candles have a tendency to get smaller and smaller. When I worked as an equity trader, we would close our positions and take off every Friday afternoon between Memorial Day and Labor Day, due to low volume and a lack of interest on the part of many market participants. The idea was that you could either keep trading a market that won't move and bang your head against the wall, or you could preserve your capital and find a more useful way to spend your time. A low volatility market can be frustrating, so if you sense that the keg is kicked and the party is over, there is nothing wrong with closing out your short-term positions and walking away.

Last edited by a moderator: