UKtradergirl

Established member

- Messages

- 825

- Likes

- 148

Just wanted to post a trade setup i am looking at that looks as though it may be a good one. I don't trade currencies that often but this one looks good.

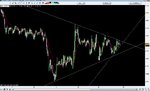

A nice triangle formation going on here, at a guess i'd say the price will break downwards. When it does it has some way to go before it hits major support. See attached graph. Saying that, it could break upwards too (less likely). Either way i'm ready to jump on board.

I wanted to post this as an example of how simple trade setups can be. I have also posted this before the event so you can see i don't have the benefit of seeing the outcome first 😉

A nice triangle formation going on here, at a guess i'd say the price will break downwards. When it does it has some way to go before it hits major support. See attached graph. Saying that, it could break upwards too (less likely). Either way i'm ready to jump on board.

I wanted to post this as an example of how simple trade setups can be. I have also posted this before the event so you can see i don't have the benefit of seeing the outcome first 😉