Trend does not exist in the now and the phrase, "the trend" has no inherent meaning. -Ed Seykota

Among the various foundational concepts in technical analysis, trend occupies a unique space in its peculiarity. This article aims to explore the peculiar aspects of “trend” – a concept which may seem simple and familiar, yet is highly paradoxical when viewed from a critical perspective.

From a technical standpoint, the concept of trend is fairly straightforward and easy to grasp. Identifying a trend on a chart, or distinguishing trending from non-trending movement, is a fairly intuitive exercise. With regard to form, trends seem to possess a distinct clarity and singularity. With regard to progression, trends seem to exhibit a sense of logic and continuity. All of this can be seen in hindsight, as trends are determined from a static price landscape.

However, the notion of trend also concerns dynamic movement – the cutting-edge of a given now. This is the juncture at which the concept of trend becomes a bit peculiar. The terms commonly used to describe trend—general direction and prevailing tendency—effectively define the concept of trend. Yet both terms have conflicting implications, which come into play the moment a trader attempts to shift from analysis (trend identification) to action (trading). Identified trends are comprised of past (and therefore static) market movements, while the interpretation of trend is dynamic and perpetually variable. This article will explore the interplay between various conflicting implications within the concept of trend.

Irreconcilable Similarities

Let’s examine the common definitional language used to illustrate trend which is that of a “direction” and “tendency” in the movement of price. When thinking of trend, it is difficult to come up with better terms to convey its meaning. It is sensible that one can infer a price movement’s tendency from its measurable direction. In the realm of real time application, however, both terms tend to conflict rather then play supportive roles in upholding the concept.

A trend’s direction is measurable; one can map a trend on a chart using price alone or any indicators designed to assess trend action. Tendency, on the other hand, is a qualitative and temporal concept that concerns the discovery of prices as they unfold. One can only speculate but not foresee, as price progression has as its limit the elusive present. As this article’s introductory quote correctly points out, “trend does not exist in the now.” This statement suggests a rift between two temporal modes within the same concept: past vs. present.

For these reasons, we can view trend as an overarching concept that houses two radically opposed implications within the same word. The two distinct notions of direction and tendency do not differ in degree but in kind; and they tend to work against one another.

Trend as a Re-Constitution of Discontinuous and Indeterminate “Presents”

When a trader shifts from trend analysis to action, he is also making a leap from one temporal operation to another—from identifying static / re-constituted movement (past) to reacting within a dynamic / continuous environment (present).

Singularity, Continuity, and Agency

A trend appears as one singular movement containing a number of smaller fluctuations. It appears as if this singular trend reflects a prevailing market sentiment in a continuous and linear manner; a goal-oriented impulse that moves with a degree of agency expressing the correct course of action in a given market condition.

Let’s suppose we identify a trend leading up to the current price. At this point, the practical dilemma for every trader is whether or not the current price can be considered an extension of the identified trend. If any discrete point within the course of a trend could be considered a part belonging to a larger whole—a point within a high or low swing—then it would be easy to assume that the current price movement is an extension of the trend we had just identified and make a trading decision based on that information. Unfortunately, trading is not so simple: we cannot guarantee at any time that we are on the right side of the trend, or if there is a trend at all. Re-tracing a trend in hindsight is a completely different experience from trading that particular price movement in real-time.

When a trader is trading in real time, he must make his trading decisions based on the current price movements; looking at the price at a given moment, the trader cannot know if it will follow the trend that he has previously identified. It is only after the moment has passed and future prices are revealed that the trader will know whether that particular price was part of the trend. Although the image of a trend on a chart may appear to have a sense of directional certainty—as if prices were driven in a general and goal-oriented direction— in actuality, every distinct moment in an observable trend might have been as indeterminate as the present moment. The trend is simply a hindsight re-constitution of discrete movements that, once re-constituted, give the illusion of a singular over-arching extension. The appearance of a trend’s singularity and continuity is merely a construct of the criteria one uses to identify it.

Problem of Trend / Price Movement as “Smart Money”

Because trends exist on multiple levels, the price movements associated with trends are often contextualized within—or serve as a contextualizing framework to—numerous price patterns. Chart patterns are formed within larger trends, or are comprised of smaller trends. Thomas Bulkowski explains in his highly instructive book, Getting Started in Chart Patterns, “chart patterns are the footprints of smart money”. This maxim equates smart money with correct market action, as if the latter could have been foreseen by those whose means of analysis and actions were intelligently formed and executed.

Given the multiplicity of participants in any market and the variable actions that take place during the course of a trade—disproportionate capital resources among buyers and sellers, pre-emptive or reactionary moves, over- and under-estimations of market conditions, converging and conflicting forecasts within both technical and fundamental analyses, diverse market intentions (speculation, hedging, spreading, etc.), fluid changes in fundamental/technical conditions, unexpected market moving events (economic, political, natural), and competing market strategies with incomplete and/or unique market views and intentions—it’s hard to imagine a fine line that separates, on one side, “smart” actions from lucky actions, and on the other side, ”dumb” actions from well-informed but unlucky actions.

Mass participation also entails both convergent and divergent market actions that are distributed across multiple time frames, comprised of diverse strategies (with different goals and price/time targets), and with a wide variance of capital resources. The notion of chart patterns reflecting smart money is too simplistic, as it doesn’t take into account the true complexity of real-time market participation. Price movements reflect the end result of a complex interplay of highly diverse market actions; it hardly reflects a collective “we” or a singular prevailing market sentiment from start to finish.

Trend and Structural Free-Play

In identifying a trend, we impose an interpretive structure. Trend, as structure, frames the price movements within it while establishing a set of “borders” beyond which certain price movements are excluded. This structure is the foundation of an identified trend. However, the same market movements, evaluated within a narrower or broader time frame, may be a fragment of a completely different trend or may prove to be insignificant movements that are not part of any trend. Let’s look back at the introductory quote of this article: Trend does not exist in the now, and the phrase "the trend" has no inherent meaning. In his quote, Ed Seykota is saying, with more than a little truth, that trends are merely projections of our own definitions.

When observing a trend, we often refer to the general fluctuations as “swings” or (in Elliott Wave theory) “waves.” For simplicity’s sake we will refer to these fluctuations as swings. Within a trend context, these swings are designated as primary (main impulse) or secondary (corrective). Primary swings follow the general direction of a trend while the corrective swing is a temporary reaction (not counting smaller fluctuations in between).

Trends are considered to be “up-trends” or “down-trends.” Let’s discuss the movement of an up-trend. In most cases, an up-trend will include a number of both upward and downward swings. For an up-trend, the downward swing-lows (lowest point of a swing) will not violate the prior swing-lows, and the swing-highs (highest point of a swing) will break above the prior swing-highs. That’s what constitutes an uptrend—higher highs and higher lows. For a “down-trend,” the criteria explained above are in reverse, yielding lower lows and lower highs.

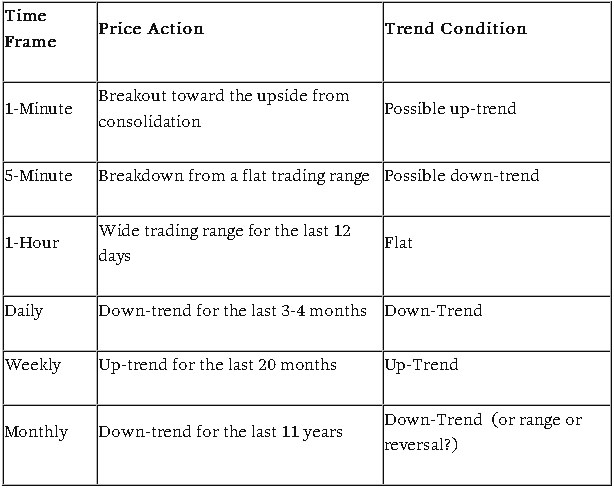

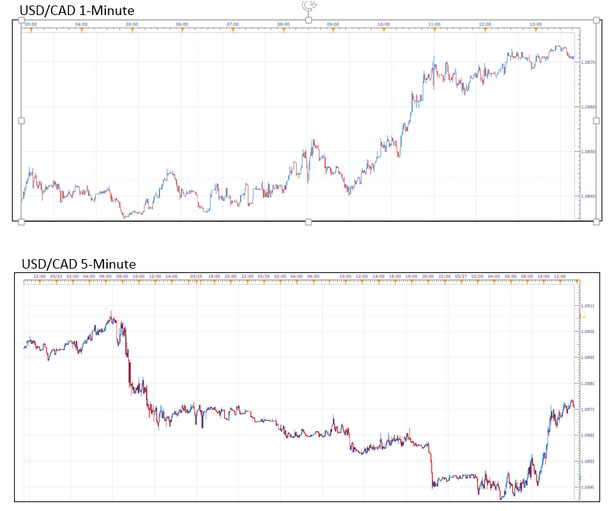

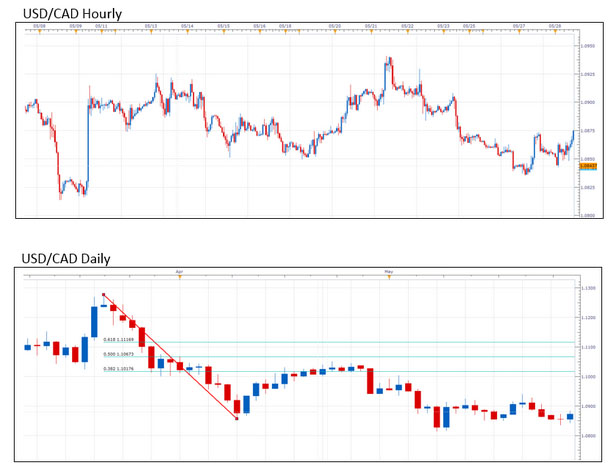

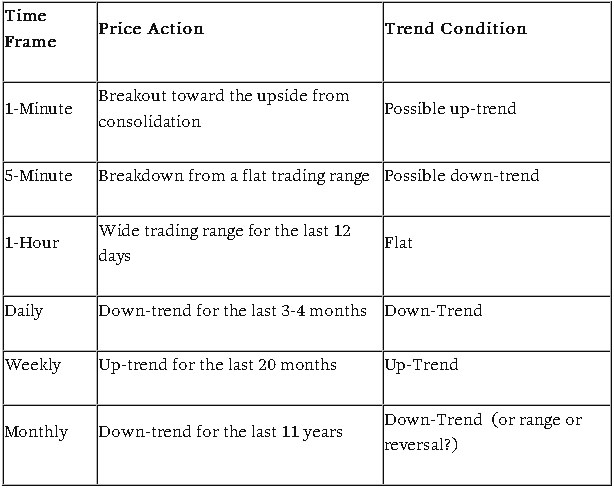

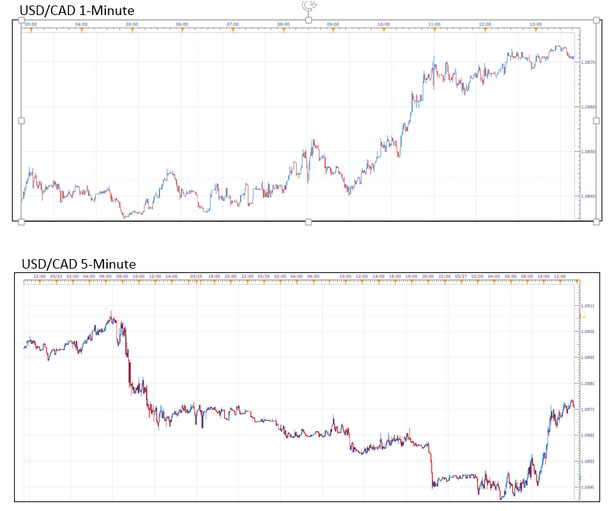

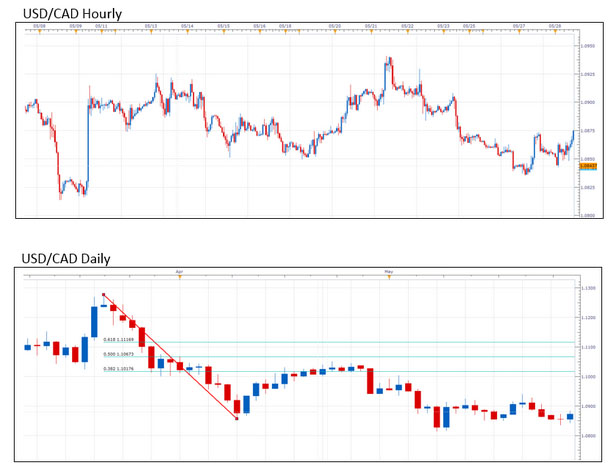

Below is an example using the USD/CAD market during a given time period, which highlights how the same market movements when assessed through a broader or narrower time-frame can yield variable and in some cases contradictory trend conditions:

As you can see from the above charts and corresponding analysis, time frame plays an important role in trend identification.

In addition to time frame, trend criteria play an obvious role. For instance, a trader identifies a short-term downtrend on the daily charts that has retraced and is now moving back down from the 0.50 Fibonacci level. Another trader, looking at the same chart but with a longer-term view, sees that down trend as a mere correction at the 0.318 Fibonacci level from a larger up trend. Traders using different moving averages to help identify trend direction will have differing opinions on trend direction.

What is Noise

Justin Kuepper, in his article “Trading without Noise,” defines noise as the “price data that distorts the picture of the underlying trend.” Following his logic, noise gives false signals that distract from a trend’s true direction. This explanation establishes a polarity: on one side trend, and on the other, noise. The terms trend and noise are held in contradistinction to one another and for good reason.

Noise (in the data context) is a loaded term that has several implications beyond that of irrelevant, meaningless, or diversionary data. Noise implies elements that cannot be reconciled with those elements that constitute the function, order, or identity of a given structure. Noise has the potential to rupture a signal’s cohesiveness, consistency, or communicative function.

Trend as Noise

If we can agree on this illustration of noise, what concept “performs” the implications of noise, albeit in a concealed manner, better than trend? Though trend is viewed in opposition to noise, it ironically exhibits the same qualities and characteristics of noise. This can be seen more clearly when viewing trend as a variable construct rather than as a fixed structure. In essence, trend exhibits the same characteristics and performs the same processes of that which it tries to exclude or control.

From Trend to Noise

Trend structure, in contrast to noise, establishes a sense of order and control by establishing limits that manage the interpretation of price movement. However, noise—a transformative force—does not necessarily exist on the same plane as that of the imposed structure.

Price movement is driven by multiple factors. Regardless of what motivations and actions drive price, its end result is ultimately subject to a multiplicity of interpretations, many of which are not mutually compatible. The open-ended use or application of price data within an analytical or theoretical framework therefore gives it a kind of neutrality. It is a mere trace of historical market activity. What its history tells us ultimately depends on the kind of interpretive structure one uses to analyze it.

If we took the concept of noise and limited its definition to a mere instance of irrelevant price data within a given interpretive structure (such as trend), then that particular market noise is to a considerable extent brought into existence by the very structure that defines it. In such a case, there is no concept of noise until there is a concept of structure. This paints a very different picture from our practical understanding of the trend/noise relationship in which the latter, as a separate entity, exists beyond the limits of the former.

From Noise to Trend

Price movements, later to be identified as trends, have at their onset the current instance of price discovery (the cutting-edge of price movement at any given “now”). Prices are in a constant state of change or becoming. They are perpetually shaped by a countless number of discrete actions and events that uniquely and singularly converge at a given moment. Structures, on the other hand, have a way of fixing the perception of things (how things are or should be), and this conflicts with the actuality of price movement, which at every moment is always what it is becoming. This perpetual process of change can never be structurally determined. It is, to a certain extent, noise. As price discovery unfolds through this process, which exists before its interpretive construct, the indeterminate moments of the process mark the origination of phenomena that are eventually seized and distributed within a structural framework.

A Badly Formed Question

A question that traders come across every so often is “does trend following work?” as if such a general “philosophy” of trading can be put to a conclusive test. As most traders know, there is no conclusive yes or no answer to this question. Which trends and trading systems are we talking about? Is it possible to calculate and assess them all? Even if it were possible, how can such an assessment be reliable if different interpretations of trends overlap, contradict, or shift identities between trending, non-trending, counter-trending?

One thing that is clear is that if someone is on the right side of the market—long or short—for a prolonged amount of time, and with adequate money management parameters, then one potentially profits from that prolonged move. But this gets complicated when one imposes trend structures as a basis for a trading strategy. It’s possible that two traders who are following the same trend might have different outcomes – one earning profits and the other losses; this is possible because the two traders might be using completely different strategies or money management principles. Trend is a relative, heterogeneous, and elusive concept.

In Summary

The point of this article was to critically explore the concept of trend and to take it off the “how-to” treadmill. We often hear or read about yet another way to identify and trade trends. There are always new statistical studies to support or debunk trend following systems. After a certain point the concept of trend becomes all too familiar, and our ability to reflect on it gets blunted. How often have we stopped to ask, how do we understand the concept “trend”?

Perhaps the development of one’s thinking toward a given matter occurs not in the habitual search for answers, but in the slower and more painstaking approach of creating questions. By creating questions in a critical fashion, we position ourselves in a less restricted space where we can re-contextualize not only an object of thought but also the modes by which we identify that object. At times, such a process can end up transforming the object—its content and form--into something unrecognizable. But through taking a position of doubt one can either affirm one’s understanding of a concept, or re-invent a different way of looking at it.

Karl Montevirgen can be contacted on this link: Karl Montevirgin

Among the various foundational concepts in technical analysis, trend occupies a unique space in its peculiarity. This article aims to explore the peculiar aspects of “trend” – a concept which may seem simple and familiar, yet is highly paradoxical when viewed from a critical perspective.

From a technical standpoint, the concept of trend is fairly straightforward and easy to grasp. Identifying a trend on a chart, or distinguishing trending from non-trending movement, is a fairly intuitive exercise. With regard to form, trends seem to possess a distinct clarity and singularity. With regard to progression, trends seem to exhibit a sense of logic and continuity. All of this can be seen in hindsight, as trends are determined from a static price landscape.

However, the notion of trend also concerns dynamic movement – the cutting-edge of a given now. This is the juncture at which the concept of trend becomes a bit peculiar. The terms commonly used to describe trend—general direction and prevailing tendency—effectively define the concept of trend. Yet both terms have conflicting implications, which come into play the moment a trader attempts to shift from analysis (trend identification) to action (trading). Identified trends are comprised of past (and therefore static) market movements, while the interpretation of trend is dynamic and perpetually variable. This article will explore the interplay between various conflicting implications within the concept of trend.

Irreconcilable Similarities

Let’s examine the common definitional language used to illustrate trend which is that of a “direction” and “tendency” in the movement of price. When thinking of trend, it is difficult to come up with better terms to convey its meaning. It is sensible that one can infer a price movement’s tendency from its measurable direction. In the realm of real time application, however, both terms tend to conflict rather then play supportive roles in upholding the concept.

A trend’s direction is measurable; one can map a trend on a chart using price alone or any indicators designed to assess trend action. Tendency, on the other hand, is a qualitative and temporal concept that concerns the discovery of prices as they unfold. One can only speculate but not foresee, as price progression has as its limit the elusive present. As this article’s introductory quote correctly points out, “trend does not exist in the now.” This statement suggests a rift between two temporal modes within the same concept: past vs. present.

For these reasons, we can view trend as an overarching concept that houses two radically opposed implications within the same word. The two distinct notions of direction and tendency do not differ in degree but in kind; and they tend to work against one another.

Trend as a Re-Constitution of Discontinuous and Indeterminate “Presents”

When a trader shifts from trend analysis to action, he is also making a leap from one temporal operation to another—from identifying static / re-constituted movement (past) to reacting within a dynamic / continuous environment (present).

Singularity, Continuity, and Agency

A trend appears as one singular movement containing a number of smaller fluctuations. It appears as if this singular trend reflects a prevailing market sentiment in a continuous and linear manner; a goal-oriented impulse that moves with a degree of agency expressing the correct course of action in a given market condition.

Let’s suppose we identify a trend leading up to the current price. At this point, the practical dilemma for every trader is whether or not the current price can be considered an extension of the identified trend. If any discrete point within the course of a trend could be considered a part belonging to a larger whole—a point within a high or low swing—then it would be easy to assume that the current price movement is an extension of the trend we had just identified and make a trading decision based on that information. Unfortunately, trading is not so simple: we cannot guarantee at any time that we are on the right side of the trend, or if there is a trend at all. Re-tracing a trend in hindsight is a completely different experience from trading that particular price movement in real-time.

When a trader is trading in real time, he must make his trading decisions based on the current price movements; looking at the price at a given moment, the trader cannot know if it will follow the trend that he has previously identified. It is only after the moment has passed and future prices are revealed that the trader will know whether that particular price was part of the trend. Although the image of a trend on a chart may appear to have a sense of directional certainty—as if prices were driven in a general and goal-oriented direction— in actuality, every distinct moment in an observable trend might have been as indeterminate as the present moment. The trend is simply a hindsight re-constitution of discrete movements that, once re-constituted, give the illusion of a singular over-arching extension. The appearance of a trend’s singularity and continuity is merely a construct of the criteria one uses to identify it.

Problem of Trend / Price Movement as “Smart Money”

Because trends exist on multiple levels, the price movements associated with trends are often contextualized within—or serve as a contextualizing framework to—numerous price patterns. Chart patterns are formed within larger trends, or are comprised of smaller trends. Thomas Bulkowski explains in his highly instructive book, Getting Started in Chart Patterns, “chart patterns are the footprints of smart money”. This maxim equates smart money with correct market action, as if the latter could have been foreseen by those whose means of analysis and actions were intelligently formed and executed.

Given the multiplicity of participants in any market and the variable actions that take place during the course of a trade—disproportionate capital resources among buyers and sellers, pre-emptive or reactionary moves, over- and under-estimations of market conditions, converging and conflicting forecasts within both technical and fundamental analyses, diverse market intentions (speculation, hedging, spreading, etc.), fluid changes in fundamental/technical conditions, unexpected market moving events (economic, political, natural), and competing market strategies with incomplete and/or unique market views and intentions—it’s hard to imagine a fine line that separates, on one side, “smart” actions from lucky actions, and on the other side, ”dumb” actions from well-informed but unlucky actions.

Mass participation also entails both convergent and divergent market actions that are distributed across multiple time frames, comprised of diverse strategies (with different goals and price/time targets), and with a wide variance of capital resources. The notion of chart patterns reflecting smart money is too simplistic, as it doesn’t take into account the true complexity of real-time market participation. Price movements reflect the end result of a complex interplay of highly diverse market actions; it hardly reflects a collective “we” or a singular prevailing market sentiment from start to finish.

Trend and Structural Free-Play

In identifying a trend, we impose an interpretive structure. Trend, as structure, frames the price movements within it while establishing a set of “borders” beyond which certain price movements are excluded. This structure is the foundation of an identified trend. However, the same market movements, evaluated within a narrower or broader time frame, may be a fragment of a completely different trend or may prove to be insignificant movements that are not part of any trend. Let’s look back at the introductory quote of this article: Trend does not exist in the now, and the phrase "the trend" has no inherent meaning. In his quote, Ed Seykota is saying, with more than a little truth, that trends are merely projections of our own definitions.

When observing a trend, we often refer to the general fluctuations as “swings” or (in Elliott Wave theory) “waves.” For simplicity’s sake we will refer to these fluctuations as swings. Within a trend context, these swings are designated as primary (main impulse) or secondary (corrective). Primary swings follow the general direction of a trend while the corrective swing is a temporary reaction (not counting smaller fluctuations in between).

Trends are considered to be “up-trends” or “down-trends.” Let’s discuss the movement of an up-trend. In most cases, an up-trend will include a number of both upward and downward swings. For an up-trend, the downward swing-lows (lowest point of a swing) will not violate the prior swing-lows, and the swing-highs (highest point of a swing) will break above the prior swing-highs. That’s what constitutes an uptrend—higher highs and higher lows. For a “down-trend,” the criteria explained above are in reverse, yielding lower lows and lower highs.

Below is an example using the USD/CAD market during a given time period, which highlights how the same market movements when assessed through a broader or narrower time-frame can yield variable and in some cases contradictory trend conditions:

As you can see from the above charts and corresponding analysis, time frame plays an important role in trend identification.

In addition to time frame, trend criteria play an obvious role. For instance, a trader identifies a short-term downtrend on the daily charts that has retraced and is now moving back down from the 0.50 Fibonacci level. Another trader, looking at the same chart but with a longer-term view, sees that down trend as a mere correction at the 0.318 Fibonacci level from a larger up trend. Traders using different moving averages to help identify trend direction will have differing opinions on trend direction.

What is Noise

Justin Kuepper, in his article “Trading without Noise,” defines noise as the “price data that distorts the picture of the underlying trend.” Following his logic, noise gives false signals that distract from a trend’s true direction. This explanation establishes a polarity: on one side trend, and on the other, noise. The terms trend and noise are held in contradistinction to one another and for good reason.

Noise (in the data context) is a loaded term that has several implications beyond that of irrelevant, meaningless, or diversionary data. Noise implies elements that cannot be reconciled with those elements that constitute the function, order, or identity of a given structure. Noise has the potential to rupture a signal’s cohesiveness, consistency, or communicative function.

Trend as Noise

If we can agree on this illustration of noise, what concept “performs” the implications of noise, albeit in a concealed manner, better than trend? Though trend is viewed in opposition to noise, it ironically exhibits the same qualities and characteristics of noise. This can be seen more clearly when viewing trend as a variable construct rather than as a fixed structure. In essence, trend exhibits the same characteristics and performs the same processes of that which it tries to exclude or control.

From Trend to Noise

Trend structure, in contrast to noise, establishes a sense of order and control by establishing limits that manage the interpretation of price movement. However, noise—a transformative force—does not necessarily exist on the same plane as that of the imposed structure.

Price movement is driven by multiple factors. Regardless of what motivations and actions drive price, its end result is ultimately subject to a multiplicity of interpretations, many of which are not mutually compatible. The open-ended use or application of price data within an analytical or theoretical framework therefore gives it a kind of neutrality. It is a mere trace of historical market activity. What its history tells us ultimately depends on the kind of interpretive structure one uses to analyze it.

If we took the concept of noise and limited its definition to a mere instance of irrelevant price data within a given interpretive structure (such as trend), then that particular market noise is to a considerable extent brought into existence by the very structure that defines it. In such a case, there is no concept of noise until there is a concept of structure. This paints a very different picture from our practical understanding of the trend/noise relationship in which the latter, as a separate entity, exists beyond the limits of the former.

From Noise to Trend

Price movements, later to be identified as trends, have at their onset the current instance of price discovery (the cutting-edge of price movement at any given “now”). Prices are in a constant state of change or becoming. They are perpetually shaped by a countless number of discrete actions and events that uniquely and singularly converge at a given moment. Structures, on the other hand, have a way of fixing the perception of things (how things are or should be), and this conflicts with the actuality of price movement, which at every moment is always what it is becoming. This perpetual process of change can never be structurally determined. It is, to a certain extent, noise. As price discovery unfolds through this process, which exists before its interpretive construct, the indeterminate moments of the process mark the origination of phenomena that are eventually seized and distributed within a structural framework.

A Badly Formed Question

A question that traders come across every so often is “does trend following work?” as if such a general “philosophy” of trading can be put to a conclusive test. As most traders know, there is no conclusive yes or no answer to this question. Which trends and trading systems are we talking about? Is it possible to calculate and assess them all? Even if it were possible, how can such an assessment be reliable if different interpretations of trends overlap, contradict, or shift identities between trending, non-trending, counter-trending?

One thing that is clear is that if someone is on the right side of the market—long or short—for a prolonged amount of time, and with adequate money management parameters, then one potentially profits from that prolonged move. But this gets complicated when one imposes trend structures as a basis for a trading strategy. It’s possible that two traders who are following the same trend might have different outcomes – one earning profits and the other losses; this is possible because the two traders might be using completely different strategies or money management principles. Trend is a relative, heterogeneous, and elusive concept.

In Summary

The point of this article was to critically explore the concept of trend and to take it off the “how-to” treadmill. We often hear or read about yet another way to identify and trade trends. There are always new statistical studies to support or debunk trend following systems. After a certain point the concept of trend becomes all too familiar, and our ability to reflect on it gets blunted. How often have we stopped to ask, how do we understand the concept “trend”?

Perhaps the development of one’s thinking toward a given matter occurs not in the habitual search for answers, but in the slower and more painstaking approach of creating questions. By creating questions in a critical fashion, we position ourselves in a less restricted space where we can re-contextualize not only an object of thought but also the modes by which we identify that object. At times, such a process can end up transforming the object—its content and form--into something unrecognizable. But through taking a position of doubt one can either affirm one’s understanding of a concept, or re-invent a different way of looking at it.

Karl Montevirgen can be contacted on this link: Karl Montevirgin

Last edited by a moderator: