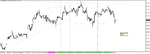

Done the above, now I am going close to the price, because I am trading the NOW, not what has been and not what I like i to be.....

Before the the last drop what happened?

Prices broke down strongly the lower channel line (prices are always in some kind of channel), indicating strong bear, made a double bottom on a major up trend line (bears taking profits and sideline bulls going long).

Bulls got to the magnet line (support turned resistance), what happened there? Went into a flag (indecision), the flag broke and failed( fail final flag) just at the magnet level.

What else is there? A low 2 bear flag or a double top bear flag or an abc pattern, but do not get lost in nomenclatures, in a bear if bulls try twice and fails normally the opposite happens.

What else is there? There is small trend reversal with a test of the extreme which is also the high of the previous day .

took 35 pips out of it, 2.2%, sell order was placed before I went to class, news coming in 25 minutes. it can go either way....only one trade today.

Done.