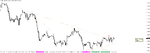

so a quick update. I am really gutted on the GBP/CAD I should have left it as it traded further 70 pips 🙁... however I just locked in 80 pips on the GBP/JPY trade and moved my take profit down to the daily up trendline to 129.50 which is going to give me roughly 6:1 ratio on this trade. I think that will be it for this week of trading, I will be updating this thread regularly so If anyone would like to join in and exchange some ideas, please go ahead. On the side note, as soon as you get the trend lines right and you follow the set of rules the return is really good on it. Just to be honest with you my account it's not huge we are looking at £2200 as of now. But taking all the trades from this week into account with a risk of 2% per each trade, you'd be looking at the below profit:

EUR/NZD = 2:1 ratio = £88 profit

GBP/CAD = 1.56:1 = £68 profit

GBP/JPY (if it will hit my target) = 6:1 = £264 profit

In total = £420 profit, it wouldn't be too bad for a week worth of trading.

EUR/NZD = 2:1 ratio = £88 profit

GBP/CAD = 1.56:1 = £68 profit

GBP/JPY (if it will hit my target) = 6:1 = £264 profit

In total = £420 profit, it wouldn't be too bad for a week worth of trading.