When you start as an analyst in a retail FX shop and your background has largely been fundamental analysis you can quickly find yourself being ostracised, worse even ridiculed for your “old fashioned” view of the market.

Yep, you’ve guessed it, I’m writing from personal experience. But soon after moving into the retail world, I devoured tombs on technical analysis, progressing to inter-market analysis and then pretty fancy technical strategies. This ended up being the perfect complement to my fundamental background. While some traders are technical purists, I am not. I take the best bits from both to navigate the choppy waters of the markets.

With both my institutional and retail FX experience, I still come to the same conclusion: economic news and events are key drivers of the market, particularly the FX market. Thus, knowing how to react to news events is crucial if you want succeed at FX trading, even if you are a die-hard technician. Below is a practical guide for trading the news, with real-life examples.

1, Never be stumped for an idea again:

The great thing about trading the news is that there is so much of it. There are literally hundreds of currency pairs that you can trade and all are impacted by news events like economic data, central bank meetings and even political events. Added to that, currencies trade 24 hours a day and across all time frames. Likewise, data releases and news events occur across all time frames, so you can trade the news when it suits you. All you need is a good economic calendar to ensure you know when economic data is released and central bank meetings take place; and an alarm clock if you fancy trading an event that is outside of your time zone.

2, What events to trade?

The problem with trading the news is that there can sometimes be too much of it. Countries release hundreds, sometimes thousands of pieces of economic data. Thankfully on the whole it is only top-tier economic data that moves the markets and this is what you should be most concerned with. If you trade the majors including: dollar, euro, pound, yen, Swiss franc, Kiwi or the Aussie, then the most important data includes: quarterly releases like GDP, monthly releases like consumer prices, labour market data and PMI data, which measures sentiment in the manufacturing and non-manufacturing sectors and is a more timely indicator than GDP regarding the state of the economy. Weekly data is less frequent, but US initial jobless claims are always worth watching. Perhaps the most important release of them all is the US non-farm payrolls report, usually released the first Friday of every month. Payrolls measure the number of jobs created in the US economy each month and since the US is the world’s largest economy, the payrolls number can have a huge impact on the direction of markets and the US dollar in the hours and days following the release.

3, How to trade the news: part 1

The first thing you need to know is how to interpret the data before you can trade from it. The key thing to remember is that the bigger the surprise from the data release the more impact it has on the market. So how do you know if the data is a surprise? Don’t fear data providers like Bloomberg and Thompson Reuters poll economists before economic data releases and publish the median of their views, which is then considered the market “consensus”. Using payrolls as an example, a number above consensus can be positive for the US dollar as it suggests that the US economy is stronger than expected, whereas a number weaker than expected can weigh on the dollar for the opposite reason.

4, How to trade the news: part 2

Now is the time to figure out your trading strategy. Professional studies and years of analysing the markets suggest that news and economic data can impact the markets for hours, sometimes days, and sometimes for longer periods. Let’s take the Euro. When the Eurozone crisis first exploded in 2010, it caused EURUSD to decline pretty much consistently for 6-months, dropping from more than 1.50 to below 1.20. This is a fantastic trend that FX traders love, but unfortunately Eurozone crises do not explode that often. Economic data usually has a shorter-term impact on markets, but provides plenty of opportunity none the less.

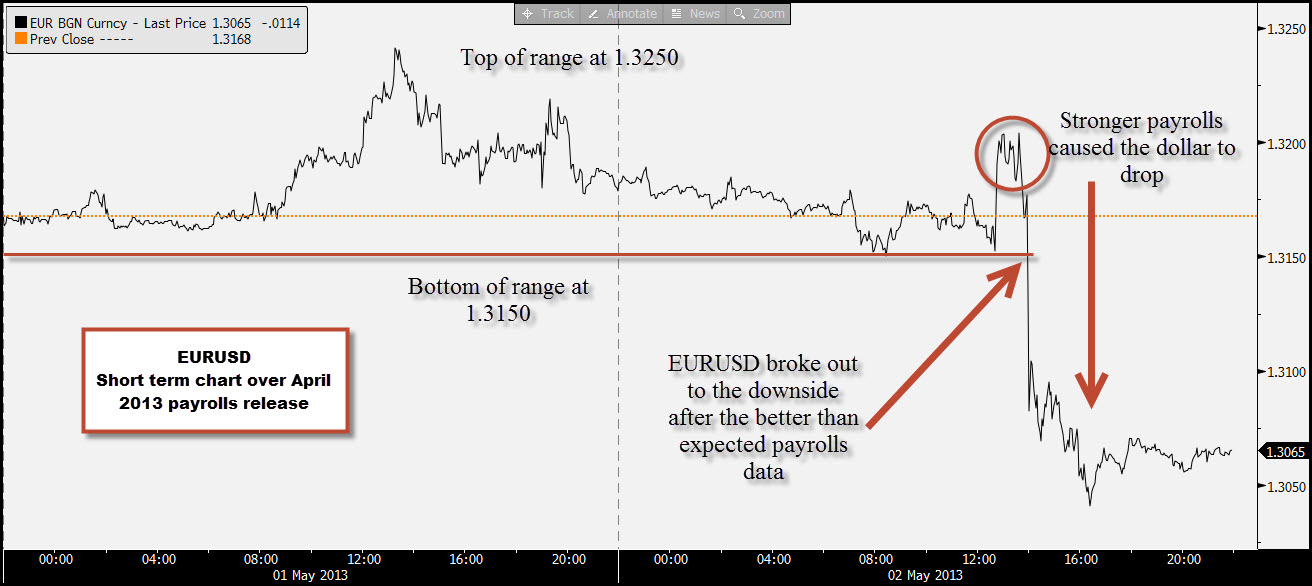

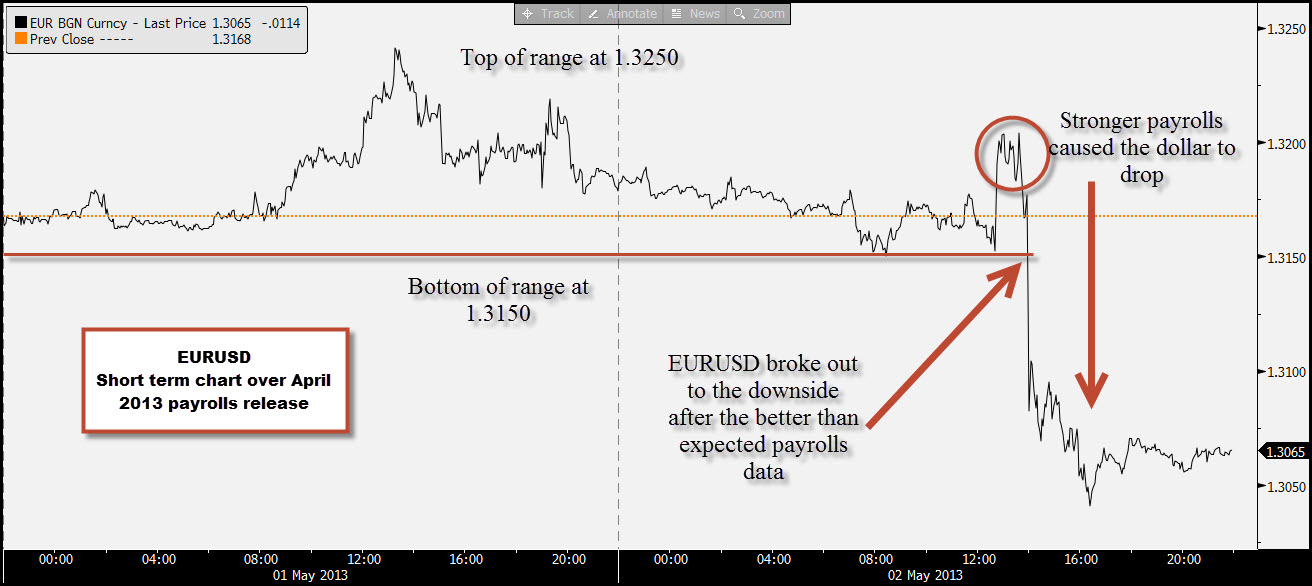

Economic data releases, especially data surprises, can have the most impact when the currency cross has been trading sideways in the lead up to it. Let’s use the 2013 April Non-Farm payrolls report as an example. It was released on 2nd May, and in the preceding few weeks EURUSD had been stuck in a tight range between 1.3010 on the downside and 1.3200 on the upside. In the few days before the release, this range had narrowed even more to 1.3150 – 1.3250, as you can see on the chart below. This meant that EURUSD would be very sensitive to a “surprise” from the non-farm payrolls report. At 1.30 pm on Friday 2nd May the payrolls report was released, and the number was 165k, stronger than the 140k expected. Added to this, there were upward revisions to the two previous months totalling 140k, so all-in-all this was a much stronger report, which suggested the US labour market was healthier than the market first thought.

There are two ways to trade this event:

1, Trading the release itself: assess the short term range, which for EURUSD was 1.3150 – 1.3250. Leave a sell order with your broker at the top end of the range in case of a strong number. To mitigate for a weak number, which may have caused the USD to fall, it would also be worth leaving a buy order at 1.3250 in case of an upside breakout in EURUSD.

2, Trading after the data is released: sometimes it’s more expedient to wait until the data release is over and done with and the dust is settled. In this instance, the number was stronger, so you may want to take a longer term outlook and trade a breakout in EURUSD to the downside. This could include leaving a sell order at the bottom of the range at 1.3150. Trading after the event requires a longer term strategy. Non-farm payrolls data causes the market to move very quickly, so you may miss the initial move, but if you think it weakens the basis for a stronger EURUSD over the coming days and weeks, it’s worth waiting for a better entry point to ensure the best chance of profit.

Hopefully, this quick guide will help you to trade the news more effectively.

Kathleen Brooks can be contacted at Forex.com/UK

Yep, you’ve guessed it, I’m writing from personal experience. But soon after moving into the retail world, I devoured tombs on technical analysis, progressing to inter-market analysis and then pretty fancy technical strategies. This ended up being the perfect complement to my fundamental background. While some traders are technical purists, I am not. I take the best bits from both to navigate the choppy waters of the markets.

With both my institutional and retail FX experience, I still come to the same conclusion: economic news and events are key drivers of the market, particularly the FX market. Thus, knowing how to react to news events is crucial if you want succeed at FX trading, even if you are a die-hard technician. Below is a practical guide for trading the news, with real-life examples.

1, Never be stumped for an idea again:

The great thing about trading the news is that there is so much of it. There are literally hundreds of currency pairs that you can trade and all are impacted by news events like economic data, central bank meetings and even political events. Added to that, currencies trade 24 hours a day and across all time frames. Likewise, data releases and news events occur across all time frames, so you can trade the news when it suits you. All you need is a good economic calendar to ensure you know when economic data is released and central bank meetings take place; and an alarm clock if you fancy trading an event that is outside of your time zone.

2, What events to trade?

The problem with trading the news is that there can sometimes be too much of it. Countries release hundreds, sometimes thousands of pieces of economic data. Thankfully on the whole it is only top-tier economic data that moves the markets and this is what you should be most concerned with. If you trade the majors including: dollar, euro, pound, yen, Swiss franc, Kiwi or the Aussie, then the most important data includes: quarterly releases like GDP, monthly releases like consumer prices, labour market data and PMI data, which measures sentiment in the manufacturing and non-manufacturing sectors and is a more timely indicator than GDP regarding the state of the economy. Weekly data is less frequent, but US initial jobless claims are always worth watching. Perhaps the most important release of them all is the US non-farm payrolls report, usually released the first Friday of every month. Payrolls measure the number of jobs created in the US economy each month and since the US is the world’s largest economy, the payrolls number can have a huge impact on the direction of markets and the US dollar in the hours and days following the release.

3, How to trade the news: part 1

The first thing you need to know is how to interpret the data before you can trade from it. The key thing to remember is that the bigger the surprise from the data release the more impact it has on the market. So how do you know if the data is a surprise? Don’t fear data providers like Bloomberg and Thompson Reuters poll economists before economic data releases and publish the median of their views, which is then considered the market “consensus”. Using payrolls as an example, a number above consensus can be positive for the US dollar as it suggests that the US economy is stronger than expected, whereas a number weaker than expected can weigh on the dollar for the opposite reason.

4, How to trade the news: part 2

Now is the time to figure out your trading strategy. Professional studies and years of analysing the markets suggest that news and economic data can impact the markets for hours, sometimes days, and sometimes for longer periods. Let’s take the Euro. When the Eurozone crisis first exploded in 2010, it caused EURUSD to decline pretty much consistently for 6-months, dropping from more than 1.50 to below 1.20. This is a fantastic trend that FX traders love, but unfortunately Eurozone crises do not explode that often. Economic data usually has a shorter-term impact on markets, but provides plenty of opportunity none the less.

Economic data releases, especially data surprises, can have the most impact when the currency cross has been trading sideways in the lead up to it. Let’s use the 2013 April Non-Farm payrolls report as an example. It was released on 2nd May, and in the preceding few weeks EURUSD had been stuck in a tight range between 1.3010 on the downside and 1.3200 on the upside. In the few days before the release, this range had narrowed even more to 1.3150 – 1.3250, as you can see on the chart below. This meant that EURUSD would be very sensitive to a “surprise” from the non-farm payrolls report. At 1.30 pm on Friday 2nd May the payrolls report was released, and the number was 165k, stronger than the 140k expected. Added to this, there were upward revisions to the two previous months totalling 140k, so all-in-all this was a much stronger report, which suggested the US labour market was healthier than the market first thought.

There are two ways to trade this event:

1, Trading the release itself: assess the short term range, which for EURUSD was 1.3150 – 1.3250. Leave a sell order with your broker at the top end of the range in case of a strong number. To mitigate for a weak number, which may have caused the USD to fall, it would also be worth leaving a buy order at 1.3250 in case of an upside breakout in EURUSD.

2, Trading after the data is released: sometimes it’s more expedient to wait until the data release is over and done with and the dust is settled. In this instance, the number was stronger, so you may want to take a longer term outlook and trade a breakout in EURUSD to the downside. This could include leaving a sell order at the bottom of the range at 1.3150. Trading after the event requires a longer term strategy. Non-farm payrolls data causes the market to move very quickly, so you may miss the initial move, but if you think it weakens the basis for a stronger EURUSD over the coming days and weeks, it’s worth waiting for a better entry point to ensure the best chance of profit.

Hopefully, this quick guide will help you to trade the news more effectively.

Kathleen Brooks can be contacted at Forex.com/UK

Last edited by a moderator: