THT

Active member

- Messages

- 210

- Likes

- 58

Hi All

This thread is going to cover a lot of trading/Investing genres, its going to be a collective dump of various methods that I use to make money from the market - I've often thought over the years of producing a YouTube channel or selling a manual/book, but I just cannot be bothered with the hassle of dealing with the public and the time to produce, the very few idiots out there would just drive me crazy, so its a case of keep quiet or publish on here

Nothing I plan to post is unique, its out there, I learned it, tested it and traded it, but you may just find that I do it a slightly different way and I won't be posting that many potential trades, its not my aim to highlight possible trades, its my aim to show you methods that work, work well, are profitable and WIN - so there will be a lot of examples that have already happened

Some of the methods covered will be complicated, most however, will be pretty simple - I 100% believe that you can TIME the markets, I'm a massive WD Gann Fan, we will be venturing into his works at some point

I'm assuming a basic working knowledge of trading, such as risk, use of stops, money management, the emotional side etc, but I'll cover part of that as we go along

The 2 things with trading that are guaranteed are:

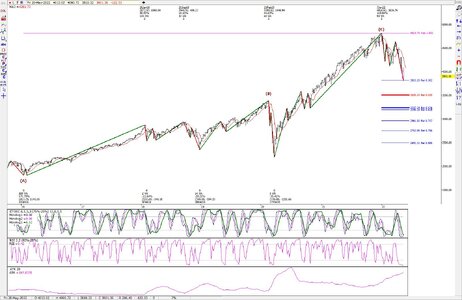

From the chart you can see how poor the FTSE100 has been, the FTSE250 is there on a par with the SP500 and Dow, but the runaway market has been the Nasdaq - for laziness and simplicity, I wanted a GBP based ETF that tracked the Nasdaq Index - This is an Investment and it has nothing to do with trading, but the thinking is linked - this Investment WILL BE SOLD in 2034

The reason it will be sold in 2034 is that is when I believe these major markets top out and turn down hard based on cycle analysis

I only have long term price data back to 1900 for the DJIA - There's no denying the UP/DOWN sequence in play (This sequence goes all the way back to when the DOW started in May 1792 - Its NOT a static cycle of 17 years, it varies between 16-19 years

From an economic pov - the DOWN sections will always be associated with bad economics, depression etc - take 2000 onwards - its the reason why Interest rates were slashed and unemployment rose, and now seen as we're in the UP cycle section, Interest rates have risen, its not rocket science - you can make some pretty accurate predictions on the economic factors (generic) of the country simply from knowing what cycle type you're in

Here's a prediction for 2034 - Day traders will be back in force en-masse, your plumber will all of a sudden be an "expert", just as the market tops, govts will be spending money on the tick thinking the good times will last forever and then bang!

So what happens apart from 1929*, in EVERY UP cycle section on the chart? The corrections are ALWAYS 100% guaranteed retraced fairly quickly, so the BIAS of your trading should be thinking LONG BUYS for stocks (other markets run differing time cycles) - This doesn't mean the corrections won't happen, but as a trader, we can be aware of their potential and of the opportunity they present when they end - I will show you how you could have timed the Oct 2022 SP500 correction bottom in a future post

I wanted to get you thinking of cycles, as they are Important and I'll show you how to use them and profit from them in trading

*1929 can be explained, but its a bit complicated, but you can see it followed the pattern of all the other UP cycle sections

THT

This thread is going to cover a lot of trading/Investing genres, its going to be a collective dump of various methods that I use to make money from the market - I've often thought over the years of producing a YouTube channel or selling a manual/book, but I just cannot be bothered with the hassle of dealing with the public and the time to produce, the very few idiots out there would just drive me crazy, so its a case of keep quiet or publish on here

Nothing I plan to post is unique, its out there, I learned it, tested it and traded it, but you may just find that I do it a slightly different way and I won't be posting that many potential trades, its not my aim to highlight possible trades, its my aim to show you methods that work, work well, are profitable and WIN - so there will be a lot of examples that have already happened

Some of the methods covered will be complicated, most however, will be pretty simple - I 100% believe that you can TIME the markets, I'm a massive WD Gann Fan, we will be venturing into his works at some point

I'm assuming a basic working knowledge of trading, such as risk, use of stops, money management, the emotional side etc, but I'll cover part of that as we go along

The 2 things with trading that are guaranteed are:

- You'll definitely have LOSSES / losing trades

- Its emotionally hard and stressful

From the chart you can see how poor the FTSE100 has been, the FTSE250 is there on a par with the SP500 and Dow, but the runaway market has been the Nasdaq - for laziness and simplicity, I wanted a GBP based ETF that tracked the Nasdaq Index - This is an Investment and it has nothing to do with trading, but the thinking is linked - this Investment WILL BE SOLD in 2034

The reason it will be sold in 2034 is that is when I believe these major markets top out and turn down hard based on cycle analysis

I only have long term price data back to 1900 for the DJIA - There's no denying the UP/DOWN sequence in play (This sequence goes all the way back to when the DOW started in May 1792 - Its NOT a static cycle of 17 years, it varies between 16-19 years

From an economic pov - the DOWN sections will always be associated with bad economics, depression etc - take 2000 onwards - its the reason why Interest rates were slashed and unemployment rose, and now seen as we're in the UP cycle section, Interest rates have risen, its not rocket science - you can make some pretty accurate predictions on the economic factors (generic) of the country simply from knowing what cycle type you're in

Here's a prediction for 2034 - Day traders will be back in force en-masse, your plumber will all of a sudden be an "expert", just as the market tops, govts will be spending money on the tick thinking the good times will last forever and then bang!

So what happens apart from 1929*, in EVERY UP cycle section on the chart? The corrections are ALWAYS 100% guaranteed retraced fairly quickly, so the BIAS of your trading should be thinking LONG BUYS for stocks (other markets run differing time cycles) - This doesn't mean the corrections won't happen, but as a trader, we can be aware of their potential and of the opportunity they present when they end - I will show you how you could have timed the Oct 2022 SP500 correction bottom in a future post

I wanted to get you thinking of cycles, as they are Important and I'll show you how to use them and profit from them in trading

*1929 can be explained, but its a bit complicated, but you can see it followed the pattern of all the other UP cycle sections

THT