ChartSmart

Junior member

- Messages

- 11

- Likes

- 6

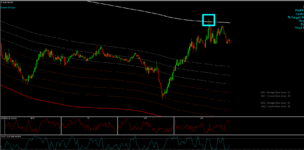

Price always returns to it's average.

Always.

If this is true and we can figure out when it is most likely to happen, we have a strong edge on market behavior that has always and will continue to always play out

So what needs to be considered?

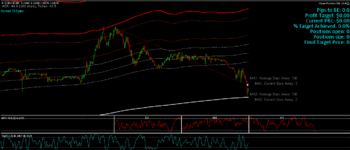

Well a lot of traders will tell you distance from the average is key. So if price is much further away from the average than normal, it will probably return to it fairly soon.

Of course this is nonsense. Complete and utter drivel.

On its own, distance from the average tells us nothing apart from the fact that we are in a strong trend or maybe experiencing a significant news event.

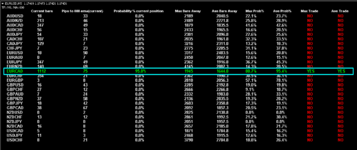

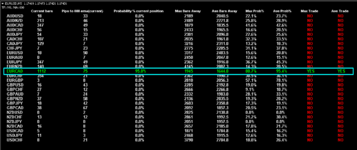

A better measure than distance travelled from the average is TIME spent away from the average compared to how long price normally spends away from the average.

Remember, if price always has to return to it's average, which it does, then the longer it has spent away from the average compared to normal, the higher the probability of it returning to the average sooner rather than later becomes.

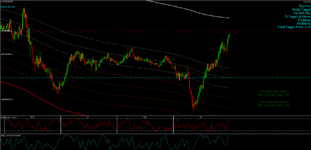

This combined with distance from the average now starts to give us a very powerful indication of whether price is likely to return to the average sooner rather than later.

The last element which I won't go into to much detail as it starts getting a bit mathsy is the Rate of Change of the average. We can discuss this later on, but it is critical to understand

So, if you are trading mean reversion back to the average of price remember - distance from the average is a start, but TIME spent away from the average is a far more useful concept to master.

Once we know price has spent to much time away from it's average we can start initiating positions to profit from it's return to the average.

Remember, price always returns to its average. Any average. Always.

All the best

Justin

Always.

If this is true and we can figure out when it is most likely to happen, we have a strong edge on market behavior that has always and will continue to always play out

So what needs to be considered?

Well a lot of traders will tell you distance from the average is key. So if price is much further away from the average than normal, it will probably return to it fairly soon.

Of course this is nonsense. Complete and utter drivel.

On its own, distance from the average tells us nothing apart from the fact that we are in a strong trend or maybe experiencing a significant news event.

A better measure than distance travelled from the average is TIME spent away from the average compared to how long price normally spends away from the average.

Remember, if price always has to return to it's average, which it does, then the longer it has spent away from the average compared to normal, the higher the probability of it returning to the average sooner rather than later becomes.

This combined with distance from the average now starts to give us a very powerful indication of whether price is likely to return to the average sooner rather than later.

The last element which I won't go into to much detail as it starts getting a bit mathsy is the Rate of Change of the average. We can discuss this later on, but it is critical to understand

So, if you are trading mean reversion back to the average of price remember - distance from the average is a start, but TIME spent away from the average is a far more useful concept to master.

Once we know price has spent to much time away from it's average we can start initiating positions to profit from it's return to the average.

Remember, price always returns to its average. Any average. Always.

All the best

Justin