It was once one of the darlings of the FTSE, but over the past year the telecommunications sector has had a rough ride. So is it out of woods yet, or is there worse to come?

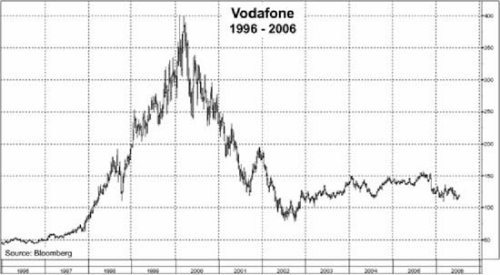

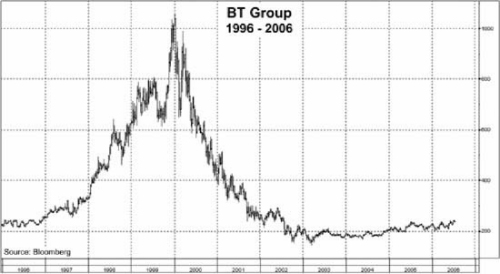

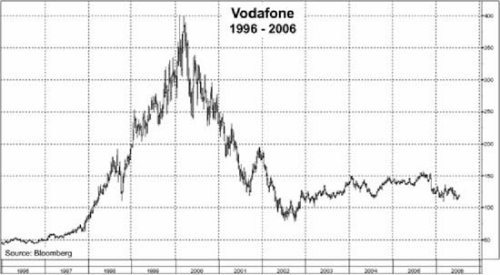

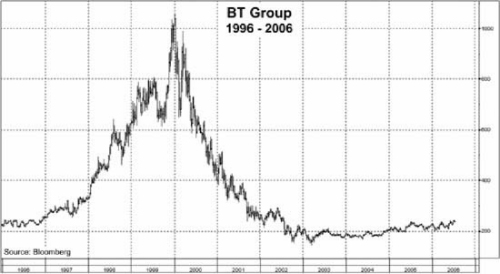

Changes in the telecom sector since the turn of the century have made the telcos a markedly different investment proposition since the high flying days of the tech boom. At the height of the bubble incredibly optimistic industry growth projections propelled the share prices to record heights. Inevitably the bubble burst, and in the aftermath investors shunned the sector.

However, today company balance sheets are stronger, prospective earnings multiples are generally in the low to mid teens, and surplus cash is flowing back to shareholders via increased dividends and share buybacks. Established participants are also executing strategies to combat the threats to growth caused by market saturation, increasing competition, and new technologies.

With over 185 million customers, Vodafone (VOD) is the global heavyweight, and a prime example of how the industry landscape has changed. The days of mega-acquisitions look to be over, with management adopting a more measured approach to growth.

Indeed the company is even shedding underperforming and non-core businesses. Vodafone Japan, a source of angst in recent years, was sold to Softbank for £9.8 billion in April. The disposal was welcome, coming as it did hot on the heels of the company's £28 billion impairment write-down. The potential disposal of the company's stake in Verizon Wireless in America would also provide a significant cash injection and shore up investor sentiment even further.

Growth in developed markets is a hot issue for mobile phone companies operating in saturated regions such as the US, UK and continental Europe. The challenge is to find replacement growth in emerging markets and through unsaturated technologies. With respect to the former, Vodafone is targeting places like South Africa, Turkey, and India. Whilst from a technology perspective, Vodafone is betting on 3G.

Considering the practical implications of restoring former growth path glories, it is somewhat surprising how impatient investors have become. For instance, Arun Sarin, CEO of Vodafone, returned from this week's annual general meeting after facing down calls from some shareholders for new leadership. No doubt the next 12 months will see a renewed sense of urgency on his part. While we do not expect a transformation over night, we do believe that in Vodafone's case the building blocks for growth are in place.

BT Group (BT.A), the world's sixth largest telco by market cap, is also in the Fat Prophets Portfolio. BT underwent a radical restructuring following the end of the technology bull market as well. After ringing these changes BT became a much leaner operator, and has been able to effectively address the significant threats posed by increased fixed line competition, mobiles, and voice over internet protocol. Today the company announced that first quarter 'New wave' sales rose 18 percent to £1.6 billion - these now account for more than a third of turnover.

Increasing competition is in BT's case proving to be a double-edged sword. In the past the company's monopolistic position, particularly in the UK, has been a millstone around its neck, with regulatory intervention a fact of life. However respite has arrived - the British regulator scrapped 22 years of price controls last week.

Despite the threat of increasing competition, and new technologies, the large telecom companies remain massive cash generators. Vodafone generated free cash flow of £6.4 billion last year while BT delivered £1.6 billion. Both as a result are engaging in capital enhancing initiatives such as share repurchases and increased dividends.

From a balance sheet perspective both telcos in the Fat Prophets Portfolio are solid. Vodafone's gearing is under 20 percent while at BT net debt is now £7.7 billion, and some way from the £29 billion amassed during the dotcom boom.

The fundamental story of robust cash flows, increasing dividend payouts, and improving balance sheet strength is prevalent amongst other telcos. Indeed these attributes at O2 contributed to a takeover by Spain's Telefonica last year.

Corporate activity has been particularly rife amongst the mid-tier telecom operators. Cable & Wireless took over Energis last year while Virgin Mobile was recently bought by US cable company NTL. Increasing competitive pressures combined with attractive valuations suggest that further industry rationalisation should not be discounted.

Sensing value, outsiders are also getting in on the act. Bid vehicle Holmar has tabled an offer for Telent, formerly Marconi. Irish telcoms company Eircom, meanwhile is being stalked by Australian based, Babcock and Brown.

Corporate activity in the UK has to some extent taken the lead from that across the Atlantic. In March AT&T, the largest telco in the US, announced the takeover of BellSouth. It was only last year that AT&T itself was bought by SBC Communications for $16 billion. That deal pre-empted competitor Verizon's acquisition of long distance carrier MCI Communications. The latest move could now force Verizon to make a play for Qwest Communications, the fourth surviving 'Baby Bell'.

Rapid consolidation amongst the phone carriers is also spilling over to the companies supplying their infrastructure. Last month Nokia and Siemens agreed to create the world's third-largest network equipment supplier through a joint venture. As a result Alcatel-Lucent, Ericsson-Marconi and Nokia Siemens Networks will all have more than double the revenues of their nearest competitors. Nortel, Motorola and Huawei may now come under pressure to seek deals themselves.

We believe that increasing competitive pressures combined with attractive valuations will ensure that industry rationalisation in the UK, and globally gathers pace. The benefits to participants therein lie in efficiencies of scale, increased pricing power, and wider product offerings. However merged companies will also have the financial muscle to respond to ongoing advances on the technological front.

Overall the telecommunications sector has undergone something of a transformation over the past decade. The trend over the next decade is likely to involve many companies broadening their horizons. Indeed some have already outlined the desire to present a converged offering of mobile and fixed-line telephony, broadband internet access and pay-TV.

In any case, in the here and now we find a sector where growth projections are more realistic and valuation fundamentals more conservative than they were six years ago. While a return to the heady levels reached during the dot com boom is unlikely, the sector offers much merit as an investment destination.

Changes in the telecom sector since the turn of the century have made the telcos a markedly different investment proposition since the high flying days of the tech boom. At the height of the bubble incredibly optimistic industry growth projections propelled the share prices to record heights. Inevitably the bubble burst, and in the aftermath investors shunned the sector.

"..the telecommunications sector has undergone something of a transformation over the past decade. "

However, today company balance sheets are stronger, prospective earnings multiples are generally in the low to mid teens, and surplus cash is flowing back to shareholders via increased dividends and share buybacks. Established participants are also executing strategies to combat the threats to growth caused by market saturation, increasing competition, and new technologies.

With over 185 million customers, Vodafone (VOD) is the global heavyweight, and a prime example of how the industry landscape has changed. The days of mega-acquisitions look to be over, with management adopting a more measured approach to growth.

Indeed the company is even shedding underperforming and non-core businesses. Vodafone Japan, a source of angst in recent years, was sold to Softbank for £9.8 billion in April. The disposal was welcome, coming as it did hot on the heels of the company's £28 billion impairment write-down. The potential disposal of the company's stake in Verizon Wireless in America would also provide a significant cash injection and shore up investor sentiment even further.

Growth in developed markets is a hot issue for mobile phone companies operating in saturated regions such as the US, UK and continental Europe. The challenge is to find replacement growth in emerging markets and through unsaturated technologies. With respect to the former, Vodafone is targeting places like South Africa, Turkey, and India. Whilst from a technology perspective, Vodafone is betting on 3G.

Considering the practical implications of restoring former growth path glories, it is somewhat surprising how impatient investors have become. For instance, Arun Sarin, CEO of Vodafone, returned from this week's annual general meeting after facing down calls from some shareholders for new leadership. No doubt the next 12 months will see a renewed sense of urgency on his part. While we do not expect a transformation over night, we do believe that in Vodafone's case the building blocks for growth are in place.

BT Group (BT.A), the world's sixth largest telco by market cap, is also in the Fat Prophets Portfolio. BT underwent a radical restructuring following the end of the technology bull market as well. After ringing these changes BT became a much leaner operator, and has been able to effectively address the significant threats posed by increased fixed line competition, mobiles, and voice over internet protocol. Today the company announced that first quarter 'New wave' sales rose 18 percent to £1.6 billion - these now account for more than a third of turnover.

Increasing competition is in BT's case proving to be a double-edged sword. In the past the company's monopolistic position, particularly in the UK, has been a millstone around its neck, with regulatory intervention a fact of life. However respite has arrived - the British regulator scrapped 22 years of price controls last week.

Despite the threat of increasing competition, and new technologies, the large telecom companies remain massive cash generators. Vodafone generated free cash flow of £6.4 billion last year while BT delivered £1.6 billion. Both as a result are engaging in capital enhancing initiatives such as share repurchases and increased dividends.

From a balance sheet perspective both telcos in the Fat Prophets Portfolio are solid. Vodafone's gearing is under 20 percent while at BT net debt is now £7.7 billion, and some way from the £29 billion amassed during the dotcom boom.

The fundamental story of robust cash flows, increasing dividend payouts, and improving balance sheet strength is prevalent amongst other telcos. Indeed these attributes at O2 contributed to a takeover by Spain's Telefonica last year.

Corporate activity has been particularly rife amongst the mid-tier telecom operators. Cable & Wireless took over Energis last year while Virgin Mobile was recently bought by US cable company NTL. Increasing competitive pressures combined with attractive valuations suggest that further industry rationalisation should not be discounted.

Sensing value, outsiders are also getting in on the act. Bid vehicle Holmar has tabled an offer for Telent, formerly Marconi. Irish telcoms company Eircom, meanwhile is being stalked by Australian based, Babcock and Brown.

Corporate activity in the UK has to some extent taken the lead from that across the Atlantic. In March AT&T, the largest telco in the US, announced the takeover of BellSouth. It was only last year that AT&T itself was bought by SBC Communications for $16 billion. That deal pre-empted competitor Verizon's acquisition of long distance carrier MCI Communications. The latest move could now force Verizon to make a play for Qwest Communications, the fourth surviving 'Baby Bell'.

Rapid consolidation amongst the phone carriers is also spilling over to the companies supplying their infrastructure. Last month Nokia and Siemens agreed to create the world's third-largest network equipment supplier through a joint venture. As a result Alcatel-Lucent, Ericsson-Marconi and Nokia Siemens Networks will all have more than double the revenues of their nearest competitors. Nortel, Motorola and Huawei may now come under pressure to seek deals themselves.

We believe that increasing competitive pressures combined with attractive valuations will ensure that industry rationalisation in the UK, and globally gathers pace. The benefits to participants therein lie in efficiencies of scale, increased pricing power, and wider product offerings. However merged companies will also have the financial muscle to respond to ongoing advances on the technological front.

Overall the telecommunications sector has undergone something of a transformation over the past decade. The trend over the next decade is likely to involve many companies broadening their horizons. Indeed some have already outlined the desire to present a converged offering of mobile and fixed-line telephony, broadband internet access and pay-TV.

In any case, in the here and now we find a sector where growth projections are more realistic and valuation fundamentals more conservative than they were six years ago. While a return to the heady levels reached during the dot com boom is unlikely, the sector offers much merit as an investment destination.

Last edited by a moderator: