Very hard to justify selling the DAX here at 8600/10 resistance band, the price action is dictating that this is a trending day with a gap fill at 8630 looking a possibility, there is also resistance up at 8645. (8630 is an old unfilled gap).

Take the lead MrDAXTrader - Anticipate the breakout and have big enough hairy ones to take action on my opinion.

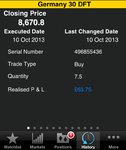

Bought @ 8600.8

Reasons why I'm now SHORT -

- We are approaching lunchtime and just ahead of the U.S open, volume will die down for a little while, therefore I don't expect buying to continue at this moment of time.

- Price has filled the old unfilled gap at 8630, longs are looking to take profit or partial profit, the 8645 resistance level is the likely level for this to happen ahead of the lunch hour and U.S open.

- Price has pushed/extended/diverged away from the 15 minute 200sma this morning, often price pulls-back to this MA or at least retraces some of the move when this happens in such a short time.

- 2 minute RSI divergence - lower highs while price prints higher highs at the 8645 resistance.

This is only a short term counter trend play for me during a quiet period of the day after a morning rally, so I'm only in this trade at half stakes looking for a quick dip and tight stop of 10pts, I will then stand aside and wait for U.S.

Well if I have no reason to sell it, then I must have a reason to buy it.

Similar to this morning - just trying to play the breakout during a trending day - though taking the lead from the DJIA, I posted yesterday on another thread on this forum that the DJIA target for an extension of a chart pattern was 14957, DJIA has came close to that out of hours but has not moved into the 14950's yet.

So I think towards the open or just after the open we could see more upside movement as DJIA attempts to hit the upside target, this should push DAX past the 8645 resistance and onto the 8685???

Well thats the plan anyway, so may as well attempt to trade the bloody thing since its not selling off from this 8645 resistance level yet

😉

Worst case scenario, price pops up and triggers me in and then reverses and stops me out for -15pts.

Best case scenario, I'm right and I make enough money to have fish'n'chips tonight.

Other scenario, price sells off and doesn't trigger my buy order, and makes a mockery of me as I was short earlier with a counter trend trade that I cut for +3pts.

My plan-

BUY STOP @ 8650

MY STOP LOSS @ 8635

MY INITIAL TARGET @ 8685 (Subject to change)

My follow through plan - Be prepared to act on my feet and take partial or all profits early or cut the trade should price action look weak after entry.

SELLING into the European close at the 8690/700 resistance, pure and simple after a lovely trending day. Profit takers likely to come in ahead of the close.

Just took my first losing trade of the week on the DJIA

http://www.trade2win.com/boards/indices/120172-anyone-scalping-ftse-futures-3628.html#post2201878

£200 gone....just like that.

Today's total: £238

Weeks total: £2,845

Looking back at today's trades, I'm not to disappointed in my performance overall, even though I made a howler on the DJIA.

I felt I nailed

trade 1 perfectly, I have no beef with my decision on that trade, as I called today a trending day early, I therefore took action with the trend.

This trade worked perfectly for a total profit of £318.

The next trade

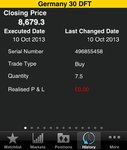

(trade 2) wasn't a bad trade in the fact that I did have technical reasons and timing reasons to go short, however, I quickly realised that the DAX was not going to sell-off from this level as the trend was still intact. I cut that trade for only +3pts or £32 profit.

Even though the trade didn't work as planned, I'm still happy with my decision making both with entry and exit.

Trade 3, I also feel this was perfectly analysed

😉 hey- have to float my own boat here! Seriously though, I have no issue with my decision on this trade as it followed the plan of action perfectly. The lead indicator on this trade was that I was expecting the DJIA to move into the 14950's, therefore dragging the DAX up again with the days trend. However, I experienced slippage of 8pts on this position and it caused me to exit early with only £25 profit.

This was more of a spit the dummy out reaction rather than a technical one, so I missed out on the profit when target was hit. Still my analysis was correct, but my decision to exit was wrong.

Trade 4, Again, technical reasons and timing for the decision to enter I feel was correct. The only problem here was it was against a strong intraday trend, I may have been a little over egar to fade this, however the trade did produce a small profit on one half of my position while the other half stopped at entry. Not to disappointed on this trade.

Trade 5, A complete ****! I traded the DJIA at a level which was not part of my plan. So no technically strong reasons to enter short at 15000 , and no particular reason why I should have went toe to toe with the trend either. I feel I was just caught up in the moment in a market that I do not normally trade, but do track. I paid the price for my poor decision making on this trade.

Took a £200 loss.