Level_Trader

Active member

- Messages

- 171

- Likes

- 2

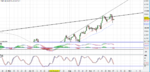

Dow Jones exhausted?

The daily chart shows the Dow retracing following the record highs that it hit a few days ago. It is likely to test the 20 daily moving average around 26,260 and my view is that it could go as low as 26,000 before buyers come in. The inverse hammer formation from today's trading action suggests we get some follow through on the sell side tomorrow but how big that sell off will be will be dependent on how hawkish Powell is in his press conference on the future path of monetary policy.

The daily chart shows the Dow retracing following the record highs that it hit a few days ago. It is likely to test the 20 daily moving average around 26,260 and my view is that it could go as low as 26,000 before buyers come in. The inverse hammer formation from today's trading action suggests we get some follow through on the sell side tomorrow but how big that sell off will be will be dependent on how hawkish Powell is in his press conference on the future path of monetary policy.