You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Please can you describe what you would prepare for next and how you would do it?

Thanks

Thanks

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

If price breaks through the SL, the short is done. If the breakout fails, then another short is on the table (a long won't be taken until the first retracement). But given that the first short op was in August, a short here would by any definition be late. Therefore the trader who is past the primer level must decide how much room to give the trade, the first hurdle being the last swing high in September. If he prefers to exit, that's his prerogative.

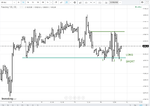

The hourly:

The hourly:

Attachments

If price breaks through the SL, the short is done. If the breakout fails, then another short is on the table (a long won't be taken until the first retracement). But given that the first short op was in August, a short here would by any definition be late. Therefore the trader who is past the primer level must decide how much room to give the trade, the first hurdle being the last swing high in September. If he prefers to exit, that's his prerogative.

The hourly:

Db, here you say wait for a retracement to go long but in your SLAB pdf under Wyckoff and Auction Market Theory on page 63 in Crib Notes it says, When price breaks out of the range, either trade the breakout or wait for and trade the retracement. why do you say a long will not be taken until the retracement above? I understand a BO could always turn out to be a fake out and a retracement would be a safer entry. Am I misunderstanding something?

Gring0

Well-known member

- Messages

- 264

- Likes

- 128

Db, here you say wait for a retracement to go long but in your SLAB pdf under Wyckoff and Auction Market Theory on page 63 in Crib Notes it says, When price breaks out of the range, either trade the breakout or wait for and trade the retracement. why do you say a long will not be taken until the retracement above? I understand a BO could always turn out to be a fake out and a retracement would be a safer entry. Am I misunderstanding something?

Some talk of daily bar intervals and hourly is getting mixed up. The SL I believe is from the daily and the range breakout is from the hourly.

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Db, here you say wait for a retracement to go long but in your SLAB pdf under Wyckoff and Auction Market Theory on page 63 in Crib Notes it says, When price breaks out of the range, either trade the breakout or wait for and trade the retracement. why do you say a long will not be taken until the retracement above? I understand a BO could always turn out to be a fake out and a retracement would be a safer entry. Am I misunderstanding something?

You're referring to the Crib Notes for trading via AMT, but the daily chart posted above is plain ol' SLA (p.9), the short op presenting itself in August (the op being there whether one took it or not). If one is trading the daily, the short is still in effect, and even if one wanted to go long for some reason, he would not be able to do so as one can't be long and short in the same instrument at the same time. He'd have to exit the short first, then find some rationale for going long, and, so far, there isn't one.

The "retracement" referred to is a retracement in a trend, not a retracement after a breakout as there's nothing to break out of. If you're referring to the range breakout on the hourly, that took place on Thursday, which in any case was inside a short trade on the daily, which would affect the probability of a successful long trade which, so far, has been neutral as we ended yesterday within a few ticks of where we started. Even if one were to ignore the daily, however, the aforementioned "long" trade on the hourly took place Thursday evening. It's gone. Someone trading the hourly without regard for the daily -- which of course violates the protocols -- has to wait for the hinge on the hourly to resolve itself.

Last edited:

You're referring to the Crib Notes for trading via AMT, but the daily chart posted above is plain ol' SLA (p.9), the short op presenting itself in August (the op being there whether one took it or not). If one is trading the daily, the short is still in effect, and even if one wanted to go long for some reason, he would not be able to do so as one can't be long and short in the same instrument at the same time. He'd have to exit the short first, then find some rationale for going long, and, so far, there isn't one.

The "retracement" referred to is a retracement in a trend, not a retracement after a breakout as there's nothing to break out of. If you're referring to the range breakout on the hourly, that took place on Thursday, which in any case was inside a short trade on the daily, which would affect the probability of a successful long trade which, so far, has been neutral as we ended yesterday within a few ticks of where we started. Even if one were to ignore the daily, however, the aforementioned "long" trade on the hourly took place Thursday evening. It's gone. Someone trading the hourly without regard for the daily -- which of course violates the protocols -- has to wait for the hinge on the hourly to resolve itself.

So according to the daily we are in a downtrend and you don't buy the break of a TL when trending(SLA), you wait for a retracement/test after the break which constitutes a trend change. You only buy breakouts when ranging(AMT). But we have identified a hinge on the daily and in the Hinge pdf buying the BO, even though not the best op, is a legitimate entry. Is it because the hinge is within a downtrend? I understand that if one has been in the market for a while that they would still be short so buying the break of the SL is not an option until one exits the short.

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

There is a hinge on the hourly and a hinge on the daily. Given that the hinge on the hourly is nose-in to the supply line on the daily, trading the one is the same as trading the other. What is key here, however, is the downtrend. That is the focus. If price can't break the downtrend, the hourly hinge is irrelevant. The trade is the short off the supply line and the failure to break it if that in fact occurs.

One can of course ignore the daily and trade the hourly alone. If he does so, however, he also ignores those who have the greater power to move price and runs the risk of trading the entire day to end up where he started, as on Friday. At the very least he must develop the mindset of the daily trader and trade the hourly accordingly, patiently, ignoring the moves and countermoves and counter-countermoves of daytraders, such as on Thursday.

One can of course ignore the daily and trade the hourly alone. If he does so, however, he also ignores those who have the greater power to move price and runs the risk of trading the entire day to end up where he started, as on Friday. At the very least he must develop the mindset of the daily trader and trade the hourly accordingly, patiently, ignoring the moves and countermoves and counter-countermoves of daytraders, such as on Thursday.

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

One of the chief reasons for trading S/R that are determined by AMT is to eliminate -- or at least severely curtail -- overtrading. If you know, for example, that you're going to look for shorts at or near R, then you have no reason to jump into what appear to be good shorts (no pun intended) that show up ahead of R (or longs ahead of S).

Similarly, using a tick chart can also help eliminate or curtail overtrading, assuming that you're very clear on what you're looking for and that you have the discipline to wait for it. You don't have to guess as to what traders are doing as you might with, say, a 5m bar. Nor do you have to wait for anything to "close".

Below is a 1m chart of Thursday's PA in the NQ up to 1430 NYT. Ignoring the fact that you're in a range and that the SLA is not designed for ranges, go ahead and apply the SLA rules anyway and see what you end up with.

Then remember suddenly that the SLA is not designed for ranges and refer to the hourly chart in the lower-lefthand corner. Note the upper and lower limits of this range. Wait for price to reach the lower limit of this range and enter a long at this level. How much will you have banked by time price reaches the upper limit of this range shortly after 1430?

Factoring in commissions and other expenses (stopouts, slippage, etc), which is the better course to follow: to "surf" throughout the day, in and out, forward and back, "trend and counter-trend", or employ tactics that incorporate AMT? Which option is less likely to stir up the muddy waters of fear?

Something to think about.

Similarly, using a tick chart can also help eliminate or curtail overtrading, assuming that you're very clear on what you're looking for and that you have the discipline to wait for it. You don't have to guess as to what traders are doing as you might with, say, a 5m bar. Nor do you have to wait for anything to "close".

Below is a 1m chart of Thursday's PA in the NQ up to 1430 NYT. Ignoring the fact that you're in a range and that the SLA is not designed for ranges, go ahead and apply the SLA rules anyway and see what you end up with.

Then remember suddenly that the SLA is not designed for ranges and refer to the hourly chart in the lower-lefthand corner. Note the upper and lower limits of this range. Wait for price to reach the lower limit of this range and enter a long at this level. How much will you have banked by time price reaches the upper limit of this range shortly after 1430?

Factoring in commissions and other expenses (stopouts, slippage, etc), which is the better course to follow: to "surf" throughout the day, in and out, forward and back, "trend and counter-trend", or employ tactics that incorporate AMT? Which option is less likely to stir up the muddy waters of fear?

Something to think about.

Attachments

... Factoring in commissions and other expenses (stopouts, slippage, etc), which is the better course to follow: to "surf" throughout the day, in and out, forward and back, "trend and counter-trend", or employ tactics that incorporate AMT? Which option is less likely to stir up the muddy waters of fear?

Something to think about.

Db, since reading your post, I've started watching the hourly chart with AMT in mind. Today I saw these three possible trade opportunities and I’m wondering if you think they would have been worthwhile. I’ve also attached a daily chart showing the hinge, though I’m not clear on how it would impact the decision on whether to take these trades. Thanks.

Attachments

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Db, since reading your post, I've started watching the hourly chart with AMT in mind. Today I saw these three possible trade opportunities and I’m wondering if you think they would have been worthwhile. I’ve also attached a daily chart showing the hinge, though I’m not clear on how it would impact the decision on whether to take these trades. Thanks.

The trade takes its cue from the daily; the daily determines whether or not a trade should be taken at all. In this case, a hinge practically defines chop, and as it narrows, the chop generally gets worse. Therefore, the trader can assume the risk of entering a reversal off the limit of the hinge or he can wait for some sort of confirmation that a reversal has actually taken place.

In this case, if one were to enter a reversal off the upper limit of the hinge, he'd be in below Monday's low. However, as price shot up to a higher high after triggering such a trade, the loss would be considerable. Given the tendency toward chop in hinges, this sort of movement is not unusual. Waiting for minimal confirmation, such as the break of a demand line, is prudent. If price plunges immediately after testing the upper limit of the hinge, the trade misses out on part of his potential profits. But then he also protects himself from the sort of loss illustrated above.

In this case, the trader has the option of waiting for the break of a demand line, which he now has, then a retracement, perhaps a test of the upper limit of the hinge. This would provide a safer entry. If one were to trade the hourly, he could short a break below the range formed today. This option was not available before today because the range didn't exist.

Trading opportunities present themselves whether the trader is available to take them or not, such as those that occur in the middle of the night. But the counsel to "watch price move" doesn't apply to daily and hourly charts. That's one of the more important points regarding trading daily and hourly charts: one doesn't have to watch them (if one were actually in a position to watch his charts, he could trade a smaller interval). So if one judges that an opportunity might come up when he isn't around to see it in real time, such as a long above today's high (the 14th), he can enter a buystop at that level. If it triggers while he's sleeping, fine. If it doesn't, he cancels it the next morning.

Ordinarily, a drop back into the hinge, such as happened today, would suggest more to the downside. But price rallied nicely at the end of the day. It only rallied halfway, which complicates matters further, but the trader has the option of bracketing his trades. He also has the option of choosing not to trade this chop at all and wait for a clearer signal.

Given that price thrice tested the top of the range it broke out of last week and held above it, I'll guess that the line of least resistance is up. But never lose sight of the fact that this is chop. There is however nothing to be afraid of if one has planned for every contingency and knows exactly what he's going to do in the event of each of them. The degree to which one experiences fear either before or during a trade is in direct inverse proportion to the amount of preparation he has done.

http://www.sierrachart.com/image.php?l=1444879562639.png

10000 contract perspective

10000 contract perspective

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Given that price spent four hours testing yesterday's high, one can assume that it is of some importance. The task now is to decide whether one is going to go long or short and where and how. If one has no idea, then the his job is to do nothing other than observe the action.

Db

Db

dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Given that price thrice tested the top of the range it broke out of last week and held above it, I'll guess that the line of least resistance is up.

Given that the long has probably been triggered by now, the task becomes management. One has of course already determined the danger point as well as the criterion for the confirmation of the ret.

What now?

Given that the long has probably been triggered by now, the task becomes management. One has of course already determined the danger point as well as the criterion for the confirmation of the ret.

What now?

Draw a demand line (valid once we reach a higher high), then manage with SLA?

Which of my preliminary DL lines, if either, would be right?

Thanks.

Attachments

- Status

- Not open for further replies.