You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

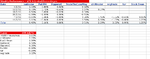

Week 6 Results

Well done to TradeTheEasyWay whose EURJPY short took the win this week with an excellent 1.5% ATR Adjusted gain. This just piped Black Swan at the post late in the week.

It was a positive week for the group as a whole with 5 wins and only 3 loses, giving us an excellent 3.05% ATR Adjusted profit this week. This takes our cumulative return back up to +3.28% ATR Adjusted.

Relative Performance

The S&P 500 and FTSE 100 both were negative again this week. So we are now outperforming the indexes on a cumulative basis since we started as well. Below is the breakdown and the league tables:

One trade a week group

Week: +3.05% (ATR Adjusted)

Cumulative: +3.28% (ATR Adjusted)

S&P 500

Week: -1.39%

Cumulative: +2.24%

FTSE 100

Week: -2.70%

Cumulative: -0.83%

League Table

Name_________ATR Adjusted Percentage

TradeTheEasyWay____3.51%

chilltrader__________2.29%

Black Swan_________1.26%

isatrader___________0.43%

SlipperyC___________-0.06%

Pat494_____________-0.16%

tar________________-0.99%

wigtrade___________-3.02%

Name_________Points

TradeTheEasyWay____5

chilltrader__________4

Pat494____________3

isatrader___________3

Black Swan_________2

SlipperyC__________1

tar_______________-2

wigtrade__________-2

So TradeTheEasyWay leads on both a percentage and points basis now with 4 profitable trades, 1 scratched trade and 1 loss. Giving him a 3.51% ATR Adjusted profit and 5 points.

Keep it up everyone and I look forward to seeing your trades for next week 👍

Well done to TradeTheEasyWay whose EURJPY short took the win this week with an excellent 1.5% ATR Adjusted gain. This just piped Black Swan at the post late in the week.

It was a positive week for the group as a whole with 5 wins and only 3 loses, giving us an excellent 3.05% ATR Adjusted profit this week. This takes our cumulative return back up to +3.28% ATR Adjusted.

Relative Performance

The S&P 500 and FTSE 100 both were negative again this week. So we are now outperforming the indexes on a cumulative basis since we started as well. Below is the breakdown and the league tables:

One trade a week group

Week: +3.05% (ATR Adjusted)

Cumulative: +3.28% (ATR Adjusted)

S&P 500

Week: -1.39%

Cumulative: +2.24%

FTSE 100

Week: -2.70%

Cumulative: -0.83%

League Table

Name_________ATR Adjusted Percentage

TradeTheEasyWay____3.51%

chilltrader__________2.29%

Black Swan_________1.26%

isatrader___________0.43%

SlipperyC___________-0.06%

Pat494_____________-0.16%

tar________________-0.99%

wigtrade___________-3.02%

Name_________Points

TradeTheEasyWay____5

chilltrader__________4

Pat494____________3

isatrader___________3

Black Swan_________2

SlipperyC__________1

tar_______________-2

wigtrade__________-2

So TradeTheEasyWay leads on both a percentage and points basis now with 4 profitable trades, 1 scratched trade and 1 loss. Giving him a 3.51% ATR Adjusted profit and 5 points.

Keep it up everyone and I look forward to seeing your trades for next week 👍

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Next trade: GBPUSD Long

ENTRY: Break of bar = 1.6086

Stop: below fibs = 1.5965

Target: 1.6498

Hi Mike, here's your initial ATR Targets for GBPUSD based on the 1.6086 entry point

ATR Targets

Daily ATR(200) = 0.0114 (0.71%)

Weekly ATR(52) = 0.0342 (2.13%)

1x ATR: 1.6200

1.5x ATR: 1.6257

2x ATR: 1.6314

Good luck

Total gamble this weekend on the DAX for obvious reasons.

It seemed to get support around the 6970 area so ordinarily I'd go long from Monday for a bounce ... BUT ... in the current climate I would have thought risk would be right off.

So, what to do.

With my live accounts I've a small long (6972) from Friday with a guaranteed stop at 6960. Looking for a bounce to 7150-200. Otherwise I'd wait until the market opens on Monday!

So, my trade will be ...

DAX LONG

limit BUY from 6880, stop: 6790, target: 7000.

in case the DAX gaps down on Monday and bounces. Although depending on the overnight situation on Sunday I might enter immediately on Monday morning.

Wishing all the best to those in Japan right now.

It seemed to get support around the 6970 area so ordinarily I'd go long from Monday for a bounce ... BUT ... in the current climate I would have thought risk would be right off.

So, what to do.

With my live accounts I've a small long (6972) from Friday with a guaranteed stop at 6960. Looking for a bounce to 7150-200. Otherwise I'd wait until the market opens on Monday!

So, my trade will be ...

DAX LONG

limit BUY from 6880, stop: 6790, target: 7000.

in case the DAX gaps down on Monday and bounces. Although depending on the overnight situation on Sunday I might enter immediately on Monday morning.

Wishing all the best to those in Japan right now.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

warehoused

Long/Nymex crude oil April11

reason: geopolitical .

500 cents limit .

500 cents stop loss .

Thanks tar, here are the ATR limits based on Fridays close of 101.16

ATR Targets

Daily ATR(200) = 1.6946 (1.68%)

Weekly ATR(52) = 4.2394 (4.19%)

1x ATR: 102.85

1.5x ATR: 103.70

2x ATR: 104.55

Good luck

chilltrader

Experienced member

- Messages

- 1,296

- Likes

- 115

Long Limit EUR-USD

Entry @ 13860

Stop @ 13780

Target @ 14020

Entry @ 13860

Stop @ 13780

Target @ 14020

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

I am going to have a punt on a Oxford start up called Physiomics (PYC). They have invented a way of showing up tumours. Could fly

Thanks Pat. At the close Friday PYC.L was at 0.415, so here are the targets based on that level. I've included the ATR stop loss level for a -1ATR move so you can decide what to risk on this very volatile stock.

ATR Targets

Daily ATR(200) = 0.055 (13.25%)

Weekly ATR(52) = 0.1249 (30.10%)

-1x ATR: 0.3600

1x ATR: 0.4700

1.5x ATR: 0.4975

2x ATR: 0.5250

Good luck Pat.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Long Limit EUR-USD

Entry @ 13860

Stop @ 13780

Target @ 14020

Thanks chilltrader, here are your ATR targets based on Fridays closing price

ATR Targets

Daily ATR(200) = 0.0121 (0.87%)

Weekly ATR(52) = 0.0372 (2.68%)

1x ATR: 1.3981

1.5x ATR: 1.4042

2x ATR: 1.4102

Good luck

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

i want to change my trade can i ?

Yep sure, you can change at anytime up until midnight (GMT) on Sunday

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Pat I forgot to ask, do you want a market order for the opening price Monday like you normally do or a warehoused order?

sorry I forgot the order

make that a double ripple at market with cream

thanks

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

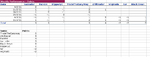

Week 7 Pick - BG.L

Order Type: Warehoused

Ticker: BG.L

Direction: Long

Warehoused Entry: Will enter manually during the week, but 1450 is my initial target entry point

Stop loss: 1394

Target: 1531

Percentage Risk: 4.02%

Potential Reward: 5.59%

Risk Ratio: 1.39

ATR (200 Day): 31.01 (2.14%)

ATR (52 Week): 69.40 (4.79%)

ATR Targets:

-1x ATR: 1418.99

1x ATR: 1481.01

1.5x ATR: 1496.52

2x ATR: 1512.02

Entry Reason

I played the breakout in BG.L in January on 28/1/11 and sold out of my position on 18/2/11 after the weekly candle spiked above the weekly 3ATR level and closed down for the week, signaling a reversal for me. Since that reversal I've been watching BG.L to see whether it would hold the breakout level of 1415. It's tried for 3 weeks to get back down through it and finally touched it last week but was rejected quite strongly on Friday and the last two candlesticks formed a Bullish Engulfing Pattern at the 50 EMA. It's sector, the NMX6530 (FTSE 350 Sector Oil & Gas Producers) also formed a reversal pattern on Friday so I'm looking for a higher close on Monday to confirm the short term reversal in both. The sector made a weekly sell pattern however so this could turn down quickly after a bounce, so I'll need to watch this closely. I think if it struggles at the 1ATR level at 1500 then I'll get out.

Below are the charts

Order Type: Warehoused

Ticker: BG.L

Direction: Long

Warehoused Entry: Will enter manually during the week, but 1450 is my initial target entry point

Stop loss: 1394

Target: 1531

Percentage Risk: 4.02%

Potential Reward: 5.59%

Risk Ratio: 1.39

ATR (200 Day): 31.01 (2.14%)

ATR (52 Week): 69.40 (4.79%)

ATR Targets:

-1x ATR: 1418.99

1x ATR: 1481.01

1.5x ATR: 1496.52

2x ATR: 1512.02

Entry Reason

I played the breakout in BG.L in January on 28/1/11 and sold out of my position on 18/2/11 after the weekly candle spiked above the weekly 3ATR level and closed down for the week, signaling a reversal for me. Since that reversal I've been watching BG.L to see whether it would hold the breakout level of 1415. It's tried for 3 weeks to get back down through it and finally touched it last week but was rejected quite strongly on Friday and the last two candlesticks formed a Bullish Engulfing Pattern at the 50 EMA. It's sector, the NMX6530 (FTSE 350 Sector Oil & Gas Producers) also formed a reversal pattern on Friday so I'm looking for a higher close on Monday to confirm the short term reversal in both. The sector made a weekly sell pattern however so this could turn down quickly after a bounce, so I'll need to watch this closely. I think if it struggles at the 1ATR level at 1500 then I'll get out.

Below are the charts

Attachments

Last edited:

tar

Legendary member

- Messages

- 10,443

- Likes

- 1,314

Thanks tar, here are the ATR limits based on Fridays close of 101.16

ATR Targets

Daily ATR(200) = 1.6946 (1.68%)

Weekly ATR(52) = 4.2394 (4.19%)

1x ATR: 102.85

1.5x ATR: 103.70

2x ATR: 104.55

Good luck

Warehoused

Short Nymex Crude futures May11

ISA i see the 200D ATR is around 2.2 not 1.6 ?

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Warehoused

Short Nymex Crude futures May11

ISA i see the 200D ATR is around 2.2 not 1.6 ?

I downloaded the prices from ADVFN and put them in my chart program. The ATR(200) for NYMEX:CL\K11 (Light Sweet Crude Oil Futures) is 1.5579

I've attached the prices csv file so you can compare, but it might be that your software is not using all the prices as I noticed the other week on your XTA pick that the ATR chart didn't start at the left of the chart, so it wasn't using figures from before the chart edge to calculate the figure only what you could see, so it will give you a different figure.

It doesn't matter though, as I set the ATR figure for you from my software prices so that it is consistent for everyone.

Cheers

Attachments

Similar threads

- Replies

- 3

- Views

- 3K

- Replies

- 44

- Views

- 13K

- Replies

- 3

- Views

- 2K