You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

SlipperyC the DAX hit your stop loss at 7400 @ 13.30

So therefore:

Closing Trade

DAX

Entry: 7436.77

Exit: 7400

Percentage Gain: -0.49%

ATR Adjusted Percentage Gain: -0.37%

All the open trades have been closed now. So only pingvin is yet to take his trade this week. Pat494 is currently winning for the week.

So therefore:

Closing Trade

DAX

Entry: 7436.77

Exit: 7400

Percentage Gain: -0.49%

ATR Adjusted Percentage Gain: -0.37%

All the open trades have been closed now. So only pingvin is yet to take his trade this week. Pat494 is currently winning for the week.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Thought I'd bought it at top-tick!

What an incredibly bad trade!!

I think you can console yourself in that you've had a very profitable week in your intra day trades that you post on my other thread. You can't win them all.

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Annoyingly MLC.L has just made a solid move up a triggered the alert on my target price at 603 which would have won it for me this week. I've got to stop watching the intraday swings so much.

Just one of those things imho

Barclays is well up too on my exit price.

Usually I used to let it ride until it was a loss but no more

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Just one of those things imho

Barclays is well up too on my exit price.

Usually I used to let it ride until it was a loss but no more

Yep, I did that with TALV.L from last week. I let it ride in my actual account and was stopped out today for a loss. Although Barclays like you say is trucking along nicely and I bought in on Monday morning following your trade so I've made 9% on that so far, but could easily give it all back. Taking profits is one of the hardest things I find to get right.

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

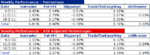

Week 3 Results

It was a quieter week for the group as two peoples orders didn't get filled, so there was only three trades this week. Pat494 took the win with an excellent trade in Barclays making a solid 3.17% or 0.85% ATR adjusted.

The group average this week was another solid 1.38%, so the group cumulative total is now at +4.35% after 3 weeks of trading.

Relative Performance

One trade a week group

Week: +1.38%

Cumulative: +4.35%

S&P 500

Week: +1.07%

Cumulative: +5.09%

FTSE 100

Week: +0.33%

Cumulative: +3.40%

League Table

Name_________Points

Pat494_____________4

isatrader___________4

TradeTheEasyWay____3

chilltrader__________1

SlipperyC___________-1

Well done again everyone, it was another good week. Keep it up 👍

Attached below is the trades spreadsheet and the percentage tables for week 3.

It was a quieter week for the group as two peoples orders didn't get filled, so there was only three trades this week. Pat494 took the win with an excellent trade in Barclays making a solid 3.17% or 0.85% ATR adjusted.

The group average this week was another solid 1.38%, so the group cumulative total is now at +4.35% after 3 weeks of trading.

Relative Performance

One trade a week group

Week: +1.38%

Cumulative: +4.35%

S&P 500

Week: +1.07%

Cumulative: +5.09%

FTSE 100

Week: +0.33%

Cumulative: +3.40%

League Table

Name_________Points

Pat494_____________4

isatrader___________4

TradeTheEasyWay____3

chilltrader__________1

SlipperyC___________-1

Well done again everyone, it was another good week. Keep it up 👍

Attached below is the trades spreadsheet and the percentage tables for week 3.

Attachments

TradeTheEasyWay

Well-known member

- Messages

- 478

- Likes

- 4

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

GKN.L Week 4 Pick

Order Type: Limit

Ticker: GKN.L

Direction: Long

Planned Entry: 212

Stop loss: 205.9

Target: 226.75

Percentage Risk: 2.96%

Potential Reward: 6.96%

Risk Ratio: 2.35

ATR (200 Day): 5.83 (2.75%)

ATR (52 Week): 13.7 (6.46%)

Average point and figure pullback (2 box chart) in the last 6 months excluding the 3 most extreme readings = 5 boxes. And the most common pullback length is 4 boxes. The current pullback has filled 4 boxes and is close to reversing back to Xs. The point and figure ATR is currently 13.68 which is around 7 boxes.

Entry Reason

GKN made a high in early January and pulled back for 4 weeks to it's 22 week EMA. On the daily chart this was the -2ATR level and it made a low and reversed back to the upside. It broke through it's moving averages and managed to reach it's +1ATR level, it then pulled back to the moving averages, but there was no selling pressure so it broke higher through the down trend line to make a new short term high around the +1ATR level. On Thursday last week it pulled back again it's average length, but on Friday it formed a bullish hammer and now looks poised for another move higher IMO.

I bought this in my personal account last Thursday, but think it will reach my target of 226.75

Order Type: Limit

Ticker: GKN.L

Direction: Long

Planned Entry: 212

Stop loss: 205.9

Target: 226.75

Percentage Risk: 2.96%

Potential Reward: 6.96%

Risk Ratio: 2.35

ATR (200 Day): 5.83 (2.75%)

ATR (52 Week): 13.7 (6.46%)

Average point and figure pullback (2 box chart) in the last 6 months excluding the 3 most extreme readings = 5 boxes. And the most common pullback length is 4 boxes. The current pullback has filled 4 boxes and is close to reversing back to Xs. The point and figure ATR is currently 13.68 which is around 7 boxes.

Entry Reason

GKN made a high in early January and pulled back for 4 weeks to it's 22 week EMA. On the daily chart this was the -2ATR level and it made a low and reversed back to the upside. It broke through it's moving averages and managed to reach it's +1ATR level, it then pulled back to the moving averages, but there was no selling pressure so it broke higher through the down trend line to make a new short term high around the +1ATR level. On Thursday last week it pulled back again it's average length, but on Friday it formed a bullish hammer and now looks poised for another move higher IMO.

I bought this in my personal account last Thursday, but think it will reach my target of 226.75

Attachments

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

I'm going for the GBPUSD this week. Going back to what I know best - forex

GBP weekly has broken trend line resistance.

Entry: 1.6175

Stop: 1.6040

Target: 1.6500

Thanks Mike, I'll put it in the spreadsheet and set up the alerts. Good luck.

Thanks

David

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

GBPUSD Targets

Ok Mike, here's the ATR targets for the GBPUSD to help in terms of the competition.

GBPUSD

Daily ATR(200) = 0.0116 (0.72%)

Weekly ATR(200) = 0.0349 (2.16%)

ATR Targets

1 ATR: 1.6291

1.5 ATR: 1.6349

2 ATR: 1.6407

These are the targets if you get the entry you've specified, but will obviously change depending on the entry point.

Ok Mike, here's the ATR targets for the GBPUSD to help in terms of the competition.

GBPUSD

Daily ATR(200) = 0.0116 (0.72%)

Weekly ATR(200) = 0.0349 (2.16%)

ATR Targets

1 ATR: 1.6291

1.5 ATR: 1.6349

2 ATR: 1.6407

These are the targets if you get the entry you've specified, but will obviously change depending on the entry point.

Not sure at all about this one now!! My head says; the trend is up and strong so go long, my 'gut' says; its been hitting resistance at 7440 area for a few days, lots of geopolitical worries, internal (USA) worries, sovereign debt issues etc etc - so go short!

You could argue that it has either been consolidating from the 7380-7400 area and testing support, or banging against strong resistance at the 7440 area.

Hmmm. In 'real life' I'll probably place a short from the 7430 area with a very tight stop UNLESS it gaps up strongly on Sunday night for some reason.

So ... [drum roll]

Market; DAX index

Type: Short

Entry: 7430

Stop: 7480

Targets: (1) 7340, (2) 7300, (3) 7220

You could argue that it has either been consolidating from the 7380-7400 area and testing support, or banging against strong resistance at the 7440 area.

Hmmm. In 'real life' I'll probably place a short from the 7430 area with a very tight stop UNLESS it gaps up strongly on Sunday night for some reason.

So ... [drum roll]

Market; DAX index

Type: Short

Entry: 7430

Stop: 7480

Targets: (1) 7340, (2) 7300, (3) 7220

Last edited:

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Week 4 Trades and Spreadsheet

It is week 4 of the group thread and things are going well so far. We've made 12 trades with 10 winners and 2 losers. The cumulative total of all the individual trades equals 17.33% from the first 3 weeks, which is very good, but it is a skewed result as it doesn't account for the different amounts of risk depending on the product traded. So using the ATR(200) adjusted percentage to give every trade an equal weight, we've made a very respectable 5.46%. So well done everyone.

We have four players this week and below are the initial trades.

Pat494

Vodafone (LSE:VOD)

Direction: Long

Market order (will be filled at the open price on Monday)

Stop: 171

Target: 191

isatrader

GKN (LSE:GKN)

Direction: Long

Limit order: 212

Stop: 205.9

Target: 226.75

TradeTheEasyWay

GBPUSD (FX:GBPUSD)

Direction: Long

Limit order: 1.6175

Stop: 1.6040

Target: 1.6500

SlipperyC

Dax Index (DBI DAX)

Direction: Short

Limit order: 7430

Stop: 7480

Target: 7340

Attached is the spreadsheet with the trades in more detail. As always let me know if there's any changes.

Good luck everyone

It is week 4 of the group thread and things are going well so far. We've made 12 trades with 10 winners and 2 losers. The cumulative total of all the individual trades equals 17.33% from the first 3 weeks, which is very good, but it is a skewed result as it doesn't account for the different amounts of risk depending on the product traded. So using the ATR(200) adjusted percentage to give every trade an equal weight, we've made a very respectable 5.46%. So well done everyone.

We have four players this week and below are the initial trades.

Pat494

Vodafone (LSE:VOD)

Direction: Long

Market order (will be filled at the open price on Monday)

Stop: 171

Target: 191

isatrader

GKN (LSE:GKN)

Direction: Long

Limit order: 212

Stop: 205.9

Target: 226.75

TradeTheEasyWay

GBPUSD (FX:GBPUSD)

Direction: Long

Limit order: 1.6175

Stop: 1.6040

Target: 1.6500

SlipperyC

Dax Index (DBI DAX)

Direction: Short

Limit order: 7430

Stop: 7480

Target: 7340

Attached is the spreadsheet with the trades in more detail. As always let me know if there's any changes.

Good luck everyone

Attachments

Last edited:

isatrader

Senior member

- Messages

- 2,964

- Likes

- 135

Vodafone Entry

Pat494 you are in VOD.L at the open price of 180.8

Trade Details:

Vodafone (LSE:VOD)

Direction: Long

Entry Price: 180.8

Stop: 171

Target: 191

Percentage Risk: 5.73%

Target Gain: 5.64%

Risk Ratio: 0.98

Daily ATR(200): 3.16 (1.75%)

Weekly ATR(52): 6.80 (3.76%)

Good luck Pat

Pat494 you are in VOD.L at the open price of 180.8

Trade Details:

Vodafone (LSE:VOD)

Direction: Long

Entry Price: 180.8

Stop: 171

Target: 191

Percentage Risk: 5.73%

Target Gain: 5.64%

Risk Ratio: 0.98

Daily ATR(200): 3.16 (1.75%)

Weekly ATR(52): 6.80 (3.76%)

Good luck Pat

Similar threads

- Replies

- 3

- Views

- 3K

- Replies

- 44

- Views

- 13K

- Replies

- 3

- Views

- 2K