Krzysiaczek99

Well-known member

- Messages

- 430

- Likes

- 1

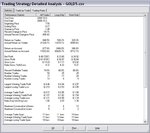

noise formula

screenshot, chart and formula is in post 137......posted already a few times

Krzysztof

screenshot, chart and formula is in post 137......posted already a few times

Krzysztof