You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

donaldduke

Experienced member

- Messages

- 1,665

- Likes

- 260

GotGold said:Yes, surely we need to examine statistically whether trends exist before we commit precious capital in pursuing them ( and making brokers rich in the process).

If you can find tradable trends in FX, anywhere but the LONG term, then post here.

The channel breakout system already mentioned ('Spot on') is way of capturing daily

trends in the FX markets. In backtesting this system has been profitable, although some years

are better than others.

Now you can improve alot on this system, but its a good place to start.

TheBramble

Legendary member

- Messages

- 8,394

- Likes

- 1,171

I have something positive to say GG - read all the FX forum posts - then come back and ask some sensible questions.

Your first post is quite meaningless without any context of timeframe (as alluded to above by Buk).

FX is no different to any other instrument. Use varying timeframes to establish broad agreement - or not - among the timeframes.

When all timeframes are in agreement as to trend you have a far greater probability of success taking a trade with the existing trend direction.

If you can't detect a trend - assume there isn't one.

You refer to trends and reversals as different animals - they're not. The price is either going up, or going down, or going nowhere in particular.

Your rather arbitrary 50-pts at the beginning of a trend and again at the end are just that - arbitrary. If you can't spot a trend/reversal/continuation in fewer pips than that, get a new system, get a new instrument or (as stated by others) get a new timeframe.

Was that positive enough for you?

Your first post is quite meaningless without any context of timeframe (as alluded to above by Buk).

FX is no different to any other instrument. Use varying timeframes to establish broad agreement - or not - among the timeframes.

When all timeframes are in agreement as to trend you have a far greater probability of success taking a trade with the existing trend direction.

If you can't detect a trend - assume there isn't one.

You refer to trends and reversals as different animals - they're not. The price is either going up, or going down, or going nowhere in particular.

Your rather arbitrary 50-pts at the beginning of a trend and again at the end are just that - arbitrary. If you can't spot a trend/reversal/continuation in fewer pips than that, get a new system, get a new instrument or (as stated by others) get a new timeframe.

Was that positive enough for you?

well, for what it's worth I trade the Cable utilising a discretionary strat via intraday, swinging into short term moves off key s&r paying particular att'n to the 50/00 levels. Be they breakouts of ranges/channels/combinations of patterns/Fibs….I don’t stick handles on them, simply trade off the repetative signals.

As has been pointed out above, this year has seen a contraction of the ranges/trends…call em what you will, and much of the action has revolved around shorter target expectations due to the chop around the century levels, thus reducing the trendy runs on the larger (potential) cent moves.

I still find plenty of opportunities on the intraday frames to make it worthwhile, as do many other folk!…..the larger moves require wider trail management, and I guess that comes down to account/time/risk parameters.

As has been pointed out above, this year has seen a contraction of the ranges/trends…call em what you will, and much of the action has revolved around shorter target expectations due to the chop around the century levels, thus reducing the trendy runs on the larger (potential) cent moves.

I still find plenty of opportunities on the intraday frames to make it worthwhile, as do many other folk!…..the larger moves require wider trail management, and I guess that comes down to account/time/risk parameters.

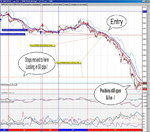

and to further highlight the regular opportunities available on this instrument, (other than the lack of apparent trends?!!)......a couple snapshots of 'tradeable' opps, continually visible EVERY day on this as well as other pairs.......find your timeframe(s), establish a workable strat which fits your psyche/expectations & study the behaviour around key levels........the sheer weight of participation offers you & anyone else plenty of pips up & down the ladder if you're patient & disciplined to take em!..........it aint rocket science.

Attachments

last one, to put fwd (another) case of observing the 00/50 levels as they unfold with increasing regularity on this instrument.....by using Fibs/Pivot & the natural s&r points around these reaction levels, it's possible to catch both quick fire punts as well as maximising the occasional runs away from these common century points.

You've witnessed Newtron Bomb post up examples of these moves time & again....they're regularly punted consistantly by the currency traders.....and when they set up with additional 'pattern' formations (1-2-3/2b's/major line breaks) it further reinforces the strength of the moves 😉

You've witnessed Newtron Bomb post up examples of these moves time & again....they're regularly punted consistantly by the currency traders.....and when they set up with additional 'pattern' formations (1-2-3/2b's/major line breaks) it further reinforces the strength of the moves 😉

Attachments

Gordon Gekko

Member

- Messages

- 69

- Likes

- 5

GotGold said:What i'm saying is that trend following is an illusion (just as 10 tails in a row looks like a trend).

unless the trend following system is heavily optimised, then it won't work.

Love to be proved wrong here!

Is there anybody out there who consistently profits from day trading FX?

If so then what style of trader are you (not asking for your system here). Pattern, momentum, breakout etc?

Yes. Momentum.

roguetrader100

Junior member

- Messages

- 13

- Likes

- 1

roguetrader100

I would agree with some of the replies to your original message. An analysis of one month's data on the EUR/USD is a joke. Take at least 5 major currency pairs and go back at least 10 years. To be honest with you though, you are probably wasting your time trying to find the 'holy grail' through your analysis. Trust me, there are guys out there who have spent their entire lives trying to find it and still can't make a cent in the market. There is no hidden secret to the market which you'll accidentally stumble on through your analysis. The only benefit that you're going to get is probably a better understanding and feeling for the market. Go back to the basics, step back and try to think logically about what you're trying to achieve. Here goes :

Long-term probability theory states that if you flip a coin an infinite number of times you should get exactly 50% heads and 50% tails. Now let's say that every time that you decide to buy or sell you randomly flip a coin (assuming the randon walk theory for price movements) According to LT prob theory you should then be right at least 50% of the time. The question is then : How do I make money in the markets by being right 50% of the time? Simple. You make more on your profits than you lose on your losses. It's that simple (ignoring opinions, greed, fear, stupidity .etc) It's your emotions and opinions (and in many cases pure stupidity) that make you lose money. Don't trade the direction of the market and don't even have an opinion on where it's going. Only trade good risk reward opportunities .ie. risk 20 pips to make 100 (use strong support/resistance levels as well as other factors to do this). If you have capital and be disciplined and stick to this approach, long term probability theory tells you that you should make cash over the long term. Lastly, the random walk theory is a load of rubbish so all of a sudden, if you're a half decent trader you should be able to gain an edge over the 50% strike rate and therefore greatly enhance your potential to make cash. Any opinions?

I would agree with some of the replies to your original message. An analysis of one month's data on the EUR/USD is a joke. Take at least 5 major currency pairs and go back at least 10 years. To be honest with you though, you are probably wasting your time trying to find the 'holy grail' through your analysis. Trust me, there are guys out there who have spent their entire lives trying to find it and still can't make a cent in the market. There is no hidden secret to the market which you'll accidentally stumble on through your analysis. The only benefit that you're going to get is probably a better understanding and feeling for the market. Go back to the basics, step back and try to think logically about what you're trying to achieve. Here goes :

Long-term probability theory states that if you flip a coin an infinite number of times you should get exactly 50% heads and 50% tails. Now let's say that every time that you decide to buy or sell you randomly flip a coin (assuming the randon walk theory for price movements) According to LT prob theory you should then be right at least 50% of the time. The question is then : How do I make money in the markets by being right 50% of the time? Simple. You make more on your profits than you lose on your losses. It's that simple (ignoring opinions, greed, fear, stupidity .etc) It's your emotions and opinions (and in many cases pure stupidity) that make you lose money. Don't trade the direction of the market and don't even have an opinion on where it's going. Only trade good risk reward opportunities .ie. risk 20 pips to make 100 (use strong support/resistance levels as well as other factors to do this). If you have capital and be disciplined and stick to this approach, long term probability theory tells you that you should make cash over the long term. Lastly, the random walk theory is a load of rubbish so all of a sudden, if you're a half decent trader you should be able to gain an edge over the 50% strike rate and therefore greatly enhance your potential to make cash. Any opinions?

The only benefit that you're going to get is probably a better understanding and feeling for the market. Go back to the basics, step back and try to think logically about what you're trying to achieve.

well, thats my take on it anyway 🙂 I guess you play this game according to 'your' rules & observations. I'm not really into all this statistical, what if malarkey......I look at what the picture tells me, pick (my perceived) the least area of pain, set out my stall (next level targets/emergency exit point) & shoot.

at the end of the day, we all have our own structures & strat guidelines to assist in weaving thru the obstacles, and I guess much of that comes with experience of banging up against consistant hurdles etc.....eventually, it comes down to the same old story....you trade what you see, given the current picture in front of your eyes.....you find your own way of getting thru, and imo nothing beats hard, repetative, consistant observation of your chosen instrument(s) & their behaviour patterns in (past) similar situations!

it may well be different in each area of trading, I don't know cos I only punt the currencies, but it works for me, and THAT'S the important thing! 😉

good posts.

This harks back to the old debate regarding mechanical versus discretionary trading approaches. the biggest variable here being the individual.

There certainly seems to be a fine or non existent line between eternal 'holy grail seekers' and those trying to automate there returns. Where is that line?

Conversely there is a fine line between 'tea leaf readers' and effective discretionary techies.

I'm not discrediting antibody's methods here, just looking for new angles to improve my own trading.

This harks back to the old debate regarding mechanical versus discretionary trading approaches. the biggest variable here being the individual.

There certainly seems to be a fine or non existent line between eternal 'holy grail seekers' and those trying to automate there returns. Where is that line?

Conversely there is a fine line between 'tea leaf readers' and effective discretionary techies.

I'm not discrediting antibody's methods here, just looking for new angles to improve my own trading.

there's one nail you've smacked firmly on the head - "the biggest variable here being the individual"

to a large degree, that's what it comes down to, regards your chosen destination of style?!

as far as the 'grail seekers/chasers'....can't really comment there (or would rather not 😉 )

but often, folk mosey around aimlessly looking for a "magic" item of software/indicator/system in which to alleviate the pain/hard work/persistance of putting in the hours of study & research??....only to eventually realise (if they're lucky enough) that had they begun their journey at that point in the first place, they'd have saved themselves an awful amount of time & cost!

there aint no 'easy route' is there??...if there was we'd all have taken it & there'd be masses of folks out there stripping bucks willy nilly out of the pot!

the points you make regards the fine lines are correct, but only time & exposure to the markets will judge the oucome of who reads leaves & who doesn't 😉

maybe YOUR answers have to ultimately come from the angle of "what are my objectives"?....what exactly do I want to achieve here?.....and they're judged by a lot of differing considerations? : time alloted to trade/funds/experience/preferred style & disciplines/etc......

there is no right or wrong outlook, some folk prefer automation, others like to sit close to the action & ride the rhythm....only by experimentation will you come down on one side or the other, or maybe a happy marriage of the two?

to a large degree, that's what it comes down to, regards your chosen destination of style?!

as far as the 'grail seekers/chasers'....can't really comment there (or would rather not 😉 )

but often, folk mosey around aimlessly looking for a "magic" item of software/indicator/system in which to alleviate the pain/hard work/persistance of putting in the hours of study & research??....only to eventually realise (if they're lucky enough) that had they begun their journey at that point in the first place, they'd have saved themselves an awful amount of time & cost!

there aint no 'easy route' is there??...if there was we'd all have taken it & there'd be masses of folks out there stripping bucks willy nilly out of the pot!

the points you make regards the fine lines are correct, but only time & exposure to the markets will judge the oucome of who reads leaves & who doesn't 😉

maybe YOUR answers have to ultimately come from the angle of "what are my objectives"?....what exactly do I want to achieve here?.....and they're judged by a lot of differing considerations? : time alloted to trade/funds/experience/preferred style & disciplines/etc......

there is no right or wrong outlook, some folk prefer automation, others like to sit close to the action & ride the rhythm....only by experimentation will you come down on one side or the other, or maybe a happy marriage of the two?

Zenda

Well-known member

- Messages

- 491

- Likes

- 10

Hi Got Gold - Yes !

This is a nice trade - Today 5 minutes ago !! just following the Trend - and Yes It's REAL money =

GotGold said:What i'm saying is that trend following is an illusion (just as 10 tails in a row looks like a trend).

unless the trend following system is heavily optimised, then it won't work.

Love to be proved wrong here!

Is there anybody out there who consistently profits from day trading FX?

If so then what style of trader are you (not asking for your system here). Pattern, momentum, breakout etc?

This is a nice trade - Today 5 minutes ago !! just following the Trend - and Yes It's REAL money =

Attachments

Last edited:

Zenda said:This is a nice trade - Today 5 minutes ago !! just following the Trend - and Yes It's REAL money =

Did say i would love t be proved wrong.

Keep it up

Zenda

Well-known member

- Messages

- 491

- Likes

- 10

just added next chart 15 mins later !

and another 10 mins later - just waiting now for pullback to hit stops!! :cheesy:

I can STRONGLY recommend a new book called "Trend Followimg" by Anthony Covel Its the second best trading book I have read ! - Great value good stories well written great anectdotes - Z

and another 10 mins later - just waiting now for pullback to hit stops!! :cheesy:

I can STRONGLY recommend a new book called "Trend Followimg" by Anthony Covel Its the second best trading book I have read ! - Great value good stories well written great anectdotes - Z

Last edited:

The General

Active member

- Messages

- 199

- Likes

- 16

Zenda,

Firstly nice trade. I am curious, are you using TWS ? If so, what's your opinion of them ?

Firstly nice trade. I am curious, are you using TWS ? If so, what's your opinion of them ?

:cheesy: nice one Zenda!! - had a good nights sleep I see 😉 I'm afraid I sat a little too close to the screens this morning 😱 punted a 'long' earlier off the Asian cross for chicken feed & got me legs tangled up climbing out of it at the round number 😆

eventually caught up with it (breathless) at the 1.80 & plucked more chicken feed 😈

real money??? you mean you've given up on your $$$ forging press out the back shed???? 😎

eventually caught up with it (breathless) at the 1.80 & plucked more chicken feed 😈

real money??? you mean you've given up on your $$$ forging press out the back shed???? 😎

Attachments

Similar threads

- Replies

- 0

- Views

- 2K

- Article

Technical Analysis

The Four Most Commonly Used Indicators In Trend Trading

- Replies

- 6

- Views

- 13K