Hi Tradesmart

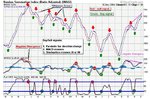

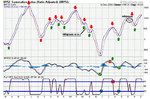

I have just been looking at this on the Nasdaq composite. Have a look at the restance it is bouncing off, It may well be in for a tanking just as you say... maybe.

tradesmart said:However, the Naz, like the other indices, looking ever so slightly overbought just now, and with a divergent RSI ‘top’ on the radar and two unfilled gaps under; will be watching for some sort of retracement very soon…..

I have just been looking at this on the Nasdaq composite. Have a look at the restance it is bouncing off, It may well be in for a tanking just as you say... maybe.

Attachments

Last edited: