The Aim

OK I've now forward tested my semi-automated trading strategy on a demo account for a few weeks and I think it's ready to be moved on to a live trading account! I'm writing this journal to keep myself on track, because I know from past experience that I tend to tinker with things a bit too much and end up not sticking with a good strategy when I should. So this time I'm not going to change a thing until; either I empty my account or I double my money. I'll increase my account size when I think the time is right. I've got an account with Gain Captial/forex.com and the current balance is about $2,000.

The Strategy

I've been trading forex for over a year now and before that I used to spreadbet the FTSE & DOW with some success, but ended up giving most of it back by being stupid. Now I've found that I enjoy trying different automated strategies mostly of my own creation. The strategy that I'm now using is a variation of a strategy that I was manually trading for a little while. The strategy is based on Trendlines and S/R and 3 Moving Averages. The strategy makes trades on MA crossovers and trendlines and S/R level breaches. There is a hard stoploss of 150pips for each trade, but trades should be closed long before that stoploss is reached.

Automation

This is semi-automated strategy because once a month the strategy has to be supplied with trendlines and S/R co-ordinates, which are manually worked out using standard charts. I use Metatrader4 for charting because it's free and it does what I need it to do i.e. the ability to easily switch timeframes while keeping all objects on the chart and the ability to manipulate objects in different timeframes, but I'm sure there are lots of other charting packages out there that are just as good. For automation I'm using Ninjatrader. I like Ninjatrader, the C# language it uses is very easy to pick up (but I'm a Java programmer and there's not much difference in syntax). I created my own Trendline and S/R indicator so that all I have to do is plug in the coordinates of the lines drawn in Metatrader4. Once a month I refresh my trendlines and S/R co-ordinates and restart the strategies. As far as money management goes I'll be trading 7 pairs @ 1 mini lot each.

This Journal

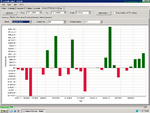

I'll be posting here mainly for my own benefit. It might keep me occupied so I won't be tempted to tinker with the strategy. I'm not posting any signals or anything like that, nor am I the right person to ask for advice (I'm still learning myself), but I'm willing to pass on little nuggets of information that I've learned over the years. I think this journal will make interesting reading, so if you'd like to follow my progress that's fine. I'll probably be posting on a weekly basis and I'll be showing trading statistics and performance graphs. Let's see how it goes!

OK I've now forward tested my semi-automated trading strategy on a demo account for a few weeks and I think it's ready to be moved on to a live trading account! I'm writing this journal to keep myself on track, because I know from past experience that I tend to tinker with things a bit too much and end up not sticking with a good strategy when I should. So this time I'm not going to change a thing until; either I empty my account or I double my money. I'll increase my account size when I think the time is right. I've got an account with Gain Captial/forex.com and the current balance is about $2,000.

The Strategy

I've been trading forex for over a year now and before that I used to spreadbet the FTSE & DOW with some success, but ended up giving most of it back by being stupid. Now I've found that I enjoy trying different automated strategies mostly of my own creation. The strategy that I'm now using is a variation of a strategy that I was manually trading for a little while. The strategy is based on Trendlines and S/R and 3 Moving Averages. The strategy makes trades on MA crossovers and trendlines and S/R level breaches. There is a hard stoploss of 150pips for each trade, but trades should be closed long before that stoploss is reached.

Automation

This is semi-automated strategy because once a month the strategy has to be supplied with trendlines and S/R co-ordinates, which are manually worked out using standard charts. I use Metatrader4 for charting because it's free and it does what I need it to do i.e. the ability to easily switch timeframes while keeping all objects on the chart and the ability to manipulate objects in different timeframes, but I'm sure there are lots of other charting packages out there that are just as good. For automation I'm using Ninjatrader. I like Ninjatrader, the C# language it uses is very easy to pick up (but I'm a Java programmer and there's not much difference in syntax). I created my own Trendline and S/R indicator so that all I have to do is plug in the coordinates of the lines drawn in Metatrader4. Once a month I refresh my trendlines and S/R co-ordinates and restart the strategies. As far as money management goes I'll be trading 7 pairs @ 1 mini lot each.

This Journal

I'll be posting here mainly for my own benefit. It might keep me occupied so I won't be tempted to tinker with the strategy. I'm not posting any signals or anything like that, nor am I the right person to ask for advice (I'm still learning myself), but I'm willing to pass on little nuggets of information that I've learned over the years. I think this journal will make interesting reading, so if you'd like to follow my progress that's fine. I'll probably be posting on a weekly basis and I'll be showing trading statistics and performance graphs. Let's see how it goes!