Dominic Walsh

Active member

- Messages

- 130

- Likes

- 0

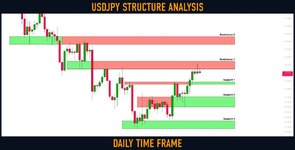

USDJPY: Key Levels to Watch This Week

Here is my fresh structure analysis for ⚠️USDJPY.

Resistance 1: 134.48 - 135.475 area

Resistance 2: 137.6 - 138.6 area

Support 1: 132.6 - 132.9 area

Support 2: 129.7 - 131.05 area

Support 3: 127.2 - 128.2 area

Consider these structures for pullback, breakout trading.

Here is my fresh structure analysis for ⚠️USDJPY.

Resistance 1: 134.48 - 135.475 area

Resistance 2: 137.6 - 138.6 area

Support 1: 132.6 - 132.9 area

Support 2: 129.7 - 131.05 area

Support 3: 127.2 - 128.2 area

Consider these structures for pullback, breakout trading.