I have recently started placing far more bias on trade opportunities with fundamentals than technical analysis but placing trade entry on technical...I'm wondering why I didn't do this before but I think most retail traders are brainwashed into thinking that fundamentals are already reflected in price and technical analysis.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I have recently started placing far more bias on trade opportunities with fundamentals than technical analysis but placing trade entry on technical...I'm wondering why I didn't do this before but I think most retail traders are brainwashed into thinking that fundamentals are already reflected in price and technical analysis.

That is the main feedback i get when challenging others on the subject. How they believe that price reflects future opportunity in my opinion can be explained through coincidence. If a person sees a setup and price pops they automatically believe the setup is the cause of it. When they see price fail on other setups they either put it down to a failed trade or look for ways to tweak their method to prevent it in future (the endless loop of curve fitting).

Good luck with your success with this. I am sure with some practice you will see a remarkable improvement in your ability to filter out the duds.

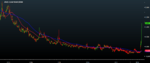

Trade taken this morning on a pair i don't normally trade USDSEK

Yesterdays fomc minutes commentary seemed to focus on a June rate hike. For me however and what seemed to spur dollar selling was the lack of guidance on changes to the number of hikes. I didn't jump into any trade at the time as there was nothing immediately obvious at the time. EU has been facing slower growth and subdued inflation. UK is in no man's land with inflation dropping and putting any hikes on ice for now. Commodity based currencies have their own issues and there was no clear outlier for a trade.

I was thinking last night that I should extend my research into some exotics as there is without doubt dollar softness on the cards especially in the face of it being strong over the past several weeks. I was basically looking for a pair that had been weak against the $ but had not yet reacted sufficiently to the fresh $ softness. This is when i stumbled on USDSEK. The chart showed that the Swedish Krona has been absolutely dicked in the teeth against USD since Feb. I spent some time reading their central bank statements and looking at the economic data. Their economy is strong however they have been struggling with inflation and this has kept their monetary policy very loose with an interest rate of -0.5%. Recent data has shown slight pickups in prices and it was at this point I made the decision to place a trade in the morning when the spread was a bit better and perhaps getting in on a good level which i did.

My reasoning for the trade is:

USD has had a very good run against the Krona with almost no rest or pullback. Sweden can't get much worse in the existing climate and their fundamentals excluding inflation do not appear negative. Fomc have disappointed the market with failing to provide changes to forward guidance showing they are concerned at hiking more than they are planning. There is scope for some correction and with lack of fresh negative news from Sweden there has to be some relief to the existing trend started in Feb.

Here is the trade outlined on the chart. This is an unconventional trade by my books for sure but i do believe the analysis behind it is sound. Profit = 30 pips

Yesterdays fomc minutes commentary seemed to focus on a June rate hike. For me however and what seemed to spur dollar selling was the lack of guidance on changes to the number of hikes. I didn't jump into any trade at the time as there was nothing immediately obvious at the time. EU has been facing slower growth and subdued inflation. UK is in no man's land with inflation dropping and putting any hikes on ice for now. Commodity based currencies have their own issues and there was no clear outlier for a trade.

I was thinking last night that I should extend my research into some exotics as there is without doubt dollar softness on the cards especially in the face of it being strong over the past several weeks. I was basically looking for a pair that had been weak against the $ but had not yet reacted sufficiently to the fresh $ softness. This is when i stumbled on USDSEK. The chart showed that the Swedish Krona has been absolutely dicked in the teeth against USD since Feb. I spent some time reading their central bank statements and looking at the economic data. Their economy is strong however they have been struggling with inflation and this has kept their monetary policy very loose with an interest rate of -0.5%. Recent data has shown slight pickups in prices and it was at this point I made the decision to place a trade in the morning when the spread was a bit better and perhaps getting in on a good level which i did.

My reasoning for the trade is:

USD has had a very good run against the Krona with almost no rest or pullback. Sweden can't get much worse in the existing climate and their fundamentals excluding inflation do not appear negative. Fomc have disappointed the market with failing to provide changes to forward guidance showing they are concerned at hiking more than they are planning. There is scope for some correction and with lack of fresh negative news from Sweden there has to be some relief to the existing trend started in Feb.

Here is the trade outlined on the chart. This is an unconventional trade by my books for sure but i do believe the analysis behind it is sound. Profit = 30 pips

Attachments

Some interesting news out today on the dollar. The feds shiny new chairman said that forward guidance will play a smaller role going forward. So that got me thinking how it might play out. More specifically, given they have to discuss the economy and their decisions, they have to discuss the main issues and\or concerns. The only thing that is most likely going to be excluded will be the number of hikes they forecast. Their language will more or less be the same as they are not In the business of surprising markets (take note SNB).

So if it isn't going to be vastly different then why are they turning off this information. USA business is currently late in the cycle and how long it lasts is really a function of pain due to rates. There have been some heavy hitters mentioned on zerohedge including Ray Dalio who have taken on shorts in the bull market. That was a brave thing to do but hell they are heavy hitters and you don't get there wearing crocodile skin boots and a cowboy hat. They can see it coming in their analysis and if you think about it, what would their payoff targets be given they are stepping in front of a market. What would make you step in front of the market in terms of payoff?

So turning off the rate hike forecasts late in the business cycle to me is starting to build a case for opportunity. Safe haven flows will be the order of the day but this won't be the usual risk off event. This will be large position liquidation and now the question I need to answer is where is the greatest opportunity going to be.

Sent from my SM-G950F using Tapatalk

So if it isn't going to be vastly different then why are they turning off this information. USA business is currently late in the cycle and how long it lasts is really a function of pain due to rates. There have been some heavy hitters mentioned on zerohedge including Ray Dalio who have taken on shorts in the bull market. That was a brave thing to do but hell they are heavy hitters and you don't get there wearing crocodile skin boots and a cowboy hat. They can see it coming in their analysis and if you think about it, what would their payoff targets be given they are stepping in front of a market. What would make you step in front of the market in terms of payoff?

So turning off the rate hike forecasts late in the business cycle to me is starting to build a case for opportunity. Safe haven flows will be the order of the day but this won't be the usual risk off event. This will be large position liquidation and now the question I need to answer is where is the greatest opportunity going to be.

Sent from my SM-G950F using Tapatalk

A caval donato non si guarda in bocca. – Don’t look a gift horse in the mouth (Italian)

As the Italian debacle gains momentum the evacuation to safe havens provides fruits for free. The order of the day of course is EURCHF. An added nugget was the Swissy trade balance surprise to the upside. I am currently up 30 pips and looking to lock in 10 and give it scope to run some more as positions unwind.

Edit: Just noticed this in Ransquawk:

Morgan Stanley short EURCFH @ Market(1.15) Target (1.12)

This image says it all (Italian Bonds)

As the Italian debacle gains momentum the evacuation to safe havens provides fruits for free. The order of the day of course is EURCHF. An added nugget was the Swissy trade balance surprise to the upside. I am currently up 30 pips and looking to lock in 10 and give it scope to run some more as positions unwind.

Edit: Just noticed this in Ransquawk:

Morgan Stanley short EURCFH @ Market(1.15) Target (1.12)

This image says it all (Italian Bonds)

Attachments

Last edited:

Some general thoughts on the Italian crisis and how the ECB will react along with their plans to end QE this year. In short i think the euro project is once again being tested. They are even touting the inevitable snap elections the euro referendum. Lets face it the euro was a nice idea but poorly implemented and the results require no explanation. Added to all of this George Soros popped up again with the following:

"Everything Has Gone Wrong": Soros Warns "Major" Financial Crisis Is Coming

"Until recently, it could have been argued that austerity is working: the European economy is slowly improving, and Europe must simply persevere. But, looking ahead, Europe now faces the collapse of the Iran nuclear deal and the destruction of the transatlantic alliance, which is bound to have a negative effect on its economy and cause other dislocations."

"The EU is in an existential crisis. Everything that could go wrong has gone wrong,” he said.To escape the crisis, “it needs to reinvent itself.”

"since the financial crisis of 2008, the EU seems to have lost its way. It adopted a program of fiscal retrenchment, which led to the euro crisis and transformed the eurozone into a relationship between creditors and debtors. The creditors set the conditions that the debtors had to meet, yet could not meet. This created a relationship that was neither voluntary nor equal – the very opposite of the credo on which the EU was based."

Added to the Europe debacle is Brexit and the budget gap that needs to be filled when we leave. No wonder they have been absolute @r_ses about Brexit since they are rapidly distributing shovels to keep the floating turd afloat.

It is looking like this is going to be a volatile year with at least 1 jumbo trade opportunity ahead as safe haven flows take control.

"Everything Has Gone Wrong": Soros Warns "Major" Financial Crisis Is Coming

"Until recently, it could have been argued that austerity is working: the European economy is slowly improving, and Europe must simply persevere. But, looking ahead, Europe now faces the collapse of the Iran nuclear deal and the destruction of the transatlantic alliance, which is bound to have a negative effect on its economy and cause other dislocations."

"The EU is in an existential crisis. Everything that could go wrong has gone wrong,” he said.To escape the crisis, “it needs to reinvent itself.”

"since the financial crisis of 2008, the EU seems to have lost its way. It adopted a program of fiscal retrenchment, which led to the euro crisis and transformed the eurozone into a relationship between creditors and debtors. The creditors set the conditions that the debtors had to meet, yet could not meet. This created a relationship that was neither voluntary nor equal – the very opposite of the credo on which the EU was based."

Added to the Europe debacle is Brexit and the budget gap that needs to be filled when we leave. No wonder they have been absolute @r_ses about Brexit since they are rapidly distributing shovels to keep the floating turd afloat.

It is looking like this is going to be a volatile year with at least 1 jumbo trade opportunity ahead as safe haven flows take control.

Some general thoughts on the Italian crisis and how the ECB will react along with their plans to end QE this year. In short i think the euro project is once again being tested. They are even touting the inevitable snap elections the euro referendum. Lets face it the euro was a nice idea but poorly implemented and the results require no explanation. Added to all of this George Soros popped up again with the following:

"Everything Has Gone Wrong": Soros Warns "Major" Financial Crisis Is Coming

"Until recently, it could have been argued that austerity is working: the European economy is slowly improving, and Europe must simply persevere. But, looking ahead, Europe now faces the collapse of the Iran nuclear deal and the destruction of the transatlantic alliance, which is bound to have a negative effect on its economy and cause other dislocations."

"The EU is in an existential crisis. Everything that could go wrong has gone wrong,” he said.To escape the crisis, “it needs to reinvent itself.”

"since the financial crisis of 2008, the EU seems to have lost its way. It adopted a program of fiscal retrenchment, which led to the euro crisis and transformed the eurozone into a relationship between creditors and debtors. The creditors set the conditions that the debtors had to meet, yet could not meet. This created a relationship that was neither voluntary nor equal – the very opposite of the credo on which the EU was based."

Added to the Europe debacle is Brexit and the budget gap that needs to be filled when we leave. No wonder they have been absolute @r_ses about Brexit since they are rapidly distributing shovels to keep the floating turd afloat.

It is looking like this is going to be a volatile year with at least 1 jumbo trade opportunity ahead as safe haven flows take control.

I disagree with you with regarding to Brexit. On a personal level I'm scratching my head to see how this will be on benefit to my career. Previously I had to right to live and work in the EU - I could do this for up to 3 months without any worries. So if I wanted to start a business in the France for example, this is an opportunity that was open to me. As a member of a 3rd country this won't be possible. Really struggling to see what upside there is. UK GDP is flat lining, my industry, construction is in recession it really is looking bleak.

I disagree with you with regarding to Brexit. On a personal level I'm scratching my head to see how this will be on benefit to my career. Previously I had to right to live and work in the EU - I could do this for up to 3 months without any worries. So if I wanted to start a business in the France for example, this is an opportunity that was open to me. As a member of a 3rd country this won't be possible. Really struggling to see what upside there is. UK GDP is flat lining, my industry, construction is in recession it really is looking bleak.

The EU have an 11 billion shortfall to cover from net contributors. How do you see them not having a problem with this?

I don't know much about the construction industry. Have you thought about changing careers perhaps?

Sent from my SM-G950F using Tapatalk

The EU have an 11 billion shortfall to cover from net contributors. How do you see them not having a problem with this?

I don't know much about the construction industry. Have you thought about changing careers perhaps?

Sent from my SM-G950F using Tapatalk

No idea of the numbers involved (I don't think anyone does) they seem to change each day according to the paper you read and the person you speak to. All I know is that on a personal level I got value for money from being a member of an organisation we're now leaving. The citizenship, rights and freedoms I had I'm now have to say goodbye to.

Professionally, despite what the experts said, people chose to ignore the warnings but now as a result, it's impacted my job and the most sophisticated advice I'm hearing is to change careers... Presumably you're okay Jack?!

In all seriousness, the consequences of leaving are being felt by me and family so in return I'd like the people who voted for it to happen to stand up and say they caused it... They might as well, whether they like it or not my finger is firmly pointing in their direction.

No idea of the numbers involved (I don't think anyone does) they seem to change each day according to the paper you read and the person you speak to. All I know is that on a personal level I got value for money from being a member of an organisation we're now leaving. The citizenship, rights and freedoms I had I'm now have to say goodbye to.

Professionally, despite what the experts said, people chose to ignore the warnings but now as a result, it's impacted my job and the most sophisticated advice I'm hearing is to change careers... Presumably you're okay Jack?!

In all seriousness, the consequences of leaving are being felt by me and family so in return I'd like the people who voted for it to happen to stand up and say they caused it... They might as well, whether they like it or not my finger is firmly pointing in their direction.

It's advice from someone who has gone through worse than what you're going through. Fleeing for my safety I left my country and came to the UK alone. I had 700 pounds in my pocket, no job, no place to live (I had to organise that when I arrived), no bank account, no NI number, and no friends or family to lean on. I had to shovel 5h!t while getting on my feet which included farming, bar work, building security, labour work on construction sites, selling vouchers on the street, and even a medical trial. It took me over 2 years to get on my feet. So yes I am okay jack but the 5h!t I had to go through and do to survive wouldn't be acceptable by many. I was earning 50 to 100 pounds a week which had to cover rent, food, and transport. I lived in a caravan and house shares where there was up to 20 of us in a 5 bed house. That experience I can honestly say changed me forever. I am always planning for bad outcomes and if required, would up shift and do it all again to keep my family safe and not without what they need.

I am sorry to hear you are going through a tough time but through my own experiences, suggest you do something about it. I chose to move into a career that offers a solid future that can handle recessions and the likes of brexit even though I didn't know it was coming. I don't have a degree (all my colleagues have) and I have a suboptimal education when contrasted with what is offered in this country. Today I am earning in the top 5 % and this is is not me bragging, if I was like that I would have said it before and I haven't, this is my first time stating my earnings publicly. My point is you can fall on hard times and pull through it but you have to be prepared to shovel 5h!t to get there. Moaning about it isn't going to change anything and praying for change is even worse. I hope this isn't going to be understood as offensive or condescending because that is not my intention.

Sent from my SM-G950F using Tapatalk

Last edited:

Back to the thread

Yesterday's German and Spanish CPI printed surprise upside numbers and its expected that today's EU numbers are going to do the same. Given risk off has diminished this should prove to be an opportunity for the euro. This is one of those times when a trade could be entered leading into the release so long as risk is managed. I am in eurjpy at the moment long from 126.70 with a 10 pop stop

Sent from my SM-G950F using Tapatalk

Yesterday's German and Spanish CPI printed surprise upside numbers and its expected that today's EU numbers are going to do the same. Given risk off has diminished this should prove to be an opportunity for the euro. This is one of those times when a trade could be entered leading into the release so long as risk is managed. I am in eurjpy at the moment long from 126.70 with a 10 pop stop

Sent from my SM-G950F using Tapatalk

So wanted to outline my routine each day to provide some clarity how I trade while in full time employment. Going to run over the tools I use and the general process.

Tools

Metastock Xenith (eikon). News research and data releases

Ransquawk headlines only. Real-time news commentary

Forexlive.com. Analyst commentary

Zerohedge.com. Analyst commentary

Tradingeconomics.com. News releases and historical data

Process

Weekly research happens over the weekend either Saturday or Sunday. I spend time reviewing the upcoming weeks data releases. I also make notes of major themes from the previous week that might affect the upcoming week. Additional notes are scoped at central banks where I summarise their policy and concerns.

All my trading takes place on my mobile because I can't access from work. I do however have sessions to forexlive and ransquawk on my desktop. I note down the daily release schedule and set alarms for anything that's worthy of focusing on. As the day proceeds I keep track of sentiment alongside news while waiting for releases. This aids my process of noting strongest against weakest which is what I call the strength spread. First think in the morning on the way to work I catchup on the Asia session which where I start managing my strength spread list.

5 minutes prior to a release I spend a few minutes scanning news for anything that might be of assistance. I don't really focus on here say by analysts but rather sentiment and other data releases that might have altered it. I go into news knowing exactly what pairs to trade either way and usually have some conviction as to which one is the most likely. If the release comes out with a deviation or confirms a building case for sentiment change I will enter a trade at market. Sometimes I miss a release due to meetings but can sometimes get in on a pullback after the fact.

I target technical levels that are within the daily range of the pair which I get from the Web from sites like https://www.mataf.net/en/forex/tools/volatility

My stops are set to logical zones where price structure is. You will note that I refer to technical levels such as Round numbers or price structure but I never actually plot anything technical on a chart. It is purely used for trade management.

I also have a checklist that I refer to before each release that has some basic rules in to keep me out of trouble. The checklist is as follows:

1) is there a fundamental reason to trade and not just assumption

2) are the pairs being traded based on analysis of strong vs weak

3) are you tired or distracted in any way

The answers have to be yes, yes, no before I am allowed to place a trade.

That's it for my process. Next content will be focusing on how I interpret data and what I look out for.

Sent from my SM-G950F using Tapatalk

Tools

Metastock Xenith (eikon). News research and data releases

Ransquawk headlines only. Real-time news commentary

Forexlive.com. Analyst commentary

Zerohedge.com. Analyst commentary

Tradingeconomics.com. News releases and historical data

Process

Weekly research happens over the weekend either Saturday or Sunday. I spend time reviewing the upcoming weeks data releases. I also make notes of major themes from the previous week that might affect the upcoming week. Additional notes are scoped at central banks where I summarise their policy and concerns.

All my trading takes place on my mobile because I can't access from work. I do however have sessions to forexlive and ransquawk on my desktop. I note down the daily release schedule and set alarms for anything that's worthy of focusing on. As the day proceeds I keep track of sentiment alongside news while waiting for releases. This aids my process of noting strongest against weakest which is what I call the strength spread. First think in the morning on the way to work I catchup on the Asia session which where I start managing my strength spread list.

5 minutes prior to a release I spend a few minutes scanning news for anything that might be of assistance. I don't really focus on here say by analysts but rather sentiment and other data releases that might have altered it. I go into news knowing exactly what pairs to trade either way and usually have some conviction as to which one is the most likely. If the release comes out with a deviation or confirms a building case for sentiment change I will enter a trade at market. Sometimes I miss a release due to meetings but can sometimes get in on a pullback after the fact.

I target technical levels that are within the daily range of the pair which I get from the Web from sites like https://www.mataf.net/en/forex/tools/volatility

My stops are set to logical zones where price structure is. You will note that I refer to technical levels such as Round numbers or price structure but I never actually plot anything technical on a chart. It is purely used for trade management.

I also have a checklist that I refer to before each release that has some basic rules in to keep me out of trouble. The checklist is as follows:

1) is there a fundamental reason to trade and not just assumption

2) are the pairs being traded based on analysis of strong vs weak

3) are you tired or distracted in any way

The answers have to be yes, yes, no before I am allowed to place a trade.

That's it for my process. Next content will be focusing on how I interpret data and what I look out for.

Sent from my SM-G950F using Tapatalk

Last edited:

Back to the thread

Yesterday's German and Spanish CPI printed surprise upside numbers and its expected that today's EU numbers are going to do the same. Given risk off has diminished this should prove to be an opportunity for the euro. This is one of those times when a trade could be entered leading into the release so long as risk is managed. I am in eurjpy at the moment long from 126.70 with a 10 pop stop

Sent from my SM-G950F using Tapatalk

Closed for 60 pips. While inflation was starkly higher when food and energy was excluded it was as expected. Given the volatility in energy prices and its relationship with food prices the numbers are not a major game changer. If Opec were not manipulating supply to increase prices these numbers wouldn't reflect a stark increase.

Last edited:

Just wanted to highlight something that might not be obvious to anyone reading this that comes from a technical trading background. The ej chart this morning prior to the cpi news was showing bullish tones. It broke out of a range and was testing resistance. This has from reading other threads, sucked some traders into the trap of a technical setup that ultimately failed. The bullish tone up to the release was anticipation of a deviation to the upside and traders, like myself, positioning leading into the news. This was put into play by the deviations yesterday in Germany and Spain and there was market analyst chatter about expectations of a surprise to the upside.Closed for 60 pips. While inflation was starkly higher when food and energy was excluded it was as expected. Given the volatility in energy prices and its relationship with food prices the numbers are not a major game changer. If Opec were not manipulating supply to increase prices these numbers wouldn't reflect a stark increase.

Anyway, my point is the fundamentals led to an early entry and the core cpi disappointment today led to a profitable exit while technical traders, void of this info, assumed losses or break even trades.

The fundamentals provide a filtering mechanism that is not possible with technical trading and today is an excellent example of this.

Sent from my SM-G950F using Tapatalk

2 potentials today on the cards

UK manufacturing - although not as important as services because we have about 80% of GDP coming from the services sector. Nonetheless it can offer opportunity in situations where it is already losing ground and the deviation is sufficient. I am looking at EURGBP for this because the $ is on a softer footing due to several factors including trade wars, pending NFP, and the fact that it has more or less already priced in information.

NFP could prove to be a sell today if we have softer numbers. I am not inclined to be buying $ even if the numbers are better than expected. This is due to the ongoing trade war and lack of new sentiment changing news. I will be looking to sell today and it is looking like euro as the counterpart at the moment but sentiment can change and therefore the counterpart might be different at the time of the data release. I might sell on both expected numbers or better, a deviation to the downside. The former depends on overall sentiment but if you look at the $ run over the last several weeks it has a good chance to be a "buy the rumour sell the news" day. If the deviation is to the upside and is good, just be careful as this data point isn't introducing new data to the market and will likely have a spike up and sell. These can be difficult to trade but the key is to align your expectations with what the central bank is watching - and it isn't employment.

UK manufacturing - although not as important as services because we have about 80% of GDP coming from the services sector. Nonetheless it can offer opportunity in situations where it is already losing ground and the deviation is sufficient. I am looking at EURGBP for this because the $ is on a softer footing due to several factors including trade wars, pending NFP, and the fact that it has more or less already priced in information.

NFP could prove to be a sell today if we have softer numbers. I am not inclined to be buying $ even if the numbers are better than expected. This is due to the ongoing trade war and lack of new sentiment changing news. I will be looking to sell today and it is looking like euro as the counterpart at the moment but sentiment can change and therefore the counterpart might be different at the time of the data release. I might sell on both expected numbers or better, a deviation to the downside. The former depends on overall sentiment but if you look at the $ run over the last several weeks it has a good chance to be a "buy the rumour sell the news" day. If the deviation is to the upside and is good, just be careful as this data point isn't introducing new data to the market and will likely have a spike up and sell. These can be difficult to trade but the key is to align your expectations with what the central bank is watching - and it isn't employment.

Last edited:

currently researching Turkey since they have mentioned changes to their central bank policy framework

https://www.bloomberg.com/news/arti...fied-its-tangled-interest-rates-quicktake-q-a

Looking at the economy as it is showing signs of overheating with a 10.75% inflation rate, 8% interest rate, an improving trade balance, and low debt to gdp (28%).

Today is their PMI and on the 4th is their cpi data.

I am wondering if the risks are now skewed to the downside (Lira appreciation) as there can't be much more room to price in uncertainty. I think i recall reading 18% slide this year to date. Given they have simplified their policy it should bode well for investor confidence in their policy direction. Also noted that Morgan Stanley are recommending a sell - not that i take any institution advice to heart but they have clearly looked at this and seen what seems to be potential for a relief rally.

https://www.bloomberg.com/news/arti...fied-its-tangled-interest-rates-quicktake-q-a

Looking at the economy as it is showing signs of overheating with a 10.75% inflation rate, 8% interest rate, an improving trade balance, and low debt to gdp (28%).

Today is their PMI and on the 4th is their cpi data.

I am wondering if the risks are now skewed to the downside (Lira appreciation) as there can't be much more room to price in uncertainty. I think i recall reading 18% slide this year to date. Given they have simplified their policy it should bode well for investor confidence in their policy direction. Also noted that Morgan Stanley are recommending a sell - not that i take any institution advice to heart but they have clearly looked at this and seen what seems to be potential for a relief rally.

going to risk it, shorted usdtry @ 4.60957

Trade reasoning:

1) Risks to the downside after very little relief this year so far.

2) central bank policy framework simplification - a positive thing

3) inflation + economy isn't looking as bad as price suggests

Note: the rollover is in my favour (6.25%) happy days

Trade reasoning:

1) Risks to the downside after very little relief this year so far.

2) central bank policy framework simplification - a positive thing

3) inflation + economy isn't looking as bad as price suggests

Note: the rollover is in my favour (6.25%) happy days

Attachments

Last edited:

Update - bought EURUSD into the spike of the NFP\Wages news. Price hovered around for some time and was looking lacklustre so closed for 10 pips profit. Waited until 10AM NY time for the large options to expire and shortly after that price in EURUSD spiked down which i thought was odd but gave another entry for me so took it and just closed for 32 pips profit- i believe price will range here until close. I also closed the USDTRY trade for 30 pips profit. I didn't fancy holding it over the weekend with the current price action. Overall I am pleased with the outcome albeit not as smooth as i liked. It has also been a good week overall. Have a good weekend, time for a few beers.

Similar threads

- Replies

- 6

- Views

- 3K

D

- Replies

- 39

- Views

- 7K

D