You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Benj1981

Established member

- Messages

- 694

- Likes

- 108

so how is your account looking at the moment benj1981? I hope your doing well and getting some of the USD weakness

Hi HRJ, not a lot of movement since my last update, in a trade - shall update when out.

GTTY.

BBPI_FXTrader

Active member

- Messages

- 146

- Likes

- 10

Benji, don't remember exactly, how much do you risk per trade ?

Benj1981

Established member

- Messages

- 694

- Likes

- 108

Benji, don't remember exactly, how much do you risk per trade ?

Welcome back. You don't remember, because i didn't say...and i'd rather not say the % risked, as it would give the wrong idea to newbies. However, my position sizing is derived using an algorithm for the optimal bet size of the particular concept i'm trading. Therefore, it's very high compared to the numbers you hear bandied about on trading forums.

Last edited:

Shakone

Senior member

- Messages

- 2,460

- Likes

- 665

Welcome back. You don't remember, because i didn't say...and i'd rather not say the % risked, as it would give the wrong idea to newbies. However, my position sizing is derived using an algorithm for the optimal bet size of the particular concept i'm trading. Therefore, it's very high compared to the numbers you hear bandied about on trading forums.

Do you understand the algorithm and are confident that it accurately applies to trading? Or is this just some Kelly Criterion?

Benj1981

Established member

- Messages

- 694

- Likes

- 108

Do you understand the algorithm and are confident that it accurately applies to trading? Or is this just some Kelly Criterion?

Shakone, please say why Kelly doesn't apply to trading? And try not to trot out Ralph Vince passages verbatim as well.

Benj1981

Established member

- Messages

- 694

- Likes

- 108

There are a few reasons i use a derivation of Kelly, compared to other optimal growth algorithms:

The thing to recognise, is that no money management technique is perfect, however most are looking for perfection in trading, which is why they'll be chasing their tails forever.

- Simplicity in trading is rewarded.

- Optimal f "assumes" your worst drawdown is behind you.

- Having extensive backtest results (30 years+) allows one to draw upon the necessary numbers to estimate Kelly.

The thing to recognise, is that no money management technique is perfect, however most are looking for perfection in trading, which is why they'll be chasing their tails forever.

VendorExterminator

Member

- Messages

- 73

- Likes

- 10

LIFFE Open Outcry Trading in '80s in The Royal Exchange, Ruti Ahronee - YouTube

Look hard and u might see me at 1min 22...

Look hard and u might see me at 1min 22...

Benj1981

Established member

- Messages

- 694

- Likes

- 108

LIFFE Open Outcry Trading in '80s in The Royal Exchange, Ruti Ahronee - YouTube

Look hard and u might see me at 1min 22...

Thanks for the vid; which bad haircut are you? 😆

Benj1981

Established member

- Messages

- 694

- Likes

- 108

A tear in the eye for all romantics:

MGEX - The final minute of trading in the pits, forever. - YouTube

MGEX - The final minute of trading in the pits, forever. - YouTube

VendorExterminator

Member

- Messages

- 73

- Likes

- 10

Thanks for the vid; which bad haircut are you? 😆

Centre left, that's all I'm saying benj!

Benj1981

Established member

- Messages

- 694

- Likes

- 108

Centre left, that's all I'm saying benj!

😆😆😆 that haircut realy must be a shocker then

GTTY.

R.Charnock

Well-known member

- Messages

- 400

- Likes

- 124

Welcome back. You don't remember, because i didn't say...and i'd rather not say the % risked, as it would give the wrong idea to newbies. However, my position sizing is derived using an algorithm for the optimal bet size of the particular concept i'm trading. Therefore, it's very high compared to the numbers you hear bandied about on trading forums.

So what you're saying is that you could easily blow your account if you had a bit of 'bad luck'? Anyway, I thought you were a newbie?

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

LIFFE Open Outcry Trading in '80s in The Royal Exchange, Ruti Ahronee - YouTube

Look hard and u might see me at 1min 22...

Ughhh, I remember those old Telerate terminals we used for treasury prices. 😆

Peter

Shakone

Senior member

- Messages

- 2,460

- Likes

- 665

Shakone, please say why Kelly doesn't apply to trading? And try not to trot out Ralph Vince passages verbatim as well.

I haven't read Ralph Vince, is he good? I only know the math.

If you are applying a theory, and any of the assumptions do not hold, then it doesn't technically apply. It may still work reasonably well, that depends.

Kelly typically assumes:

-I can bet any size amount, large or small freely

-That you are playing the same game

-That the win probability is known and fixed

-That the risk:reward ratio is known and fixed

Well the first doesn't apply, there are minimum stakes and for large stakes margin requirements may cause issues or the size may affect the results, the third doesn't apply either, and you could reasonably argue against the second and fourth.

So with perhaps none of its assumptions holding, does it really apply to trading?

If it works for you, no problem. Just be aware is all I'm saying.

Benj1981

Established member

- Messages

- 694

- Likes

- 108

So what you're saying is that you could easily blow your account if you had a bit of 'bad luck'? Anyway, I thought you were a newbie?

Not at all dear boy, but i respect there's always a chance you could lose everything, as should you, whatever % you risk. At my risk level for the concept i'm trading in this journal, deep drawdowns are entirely plausible, and more than expected.

The mantras of; "never bet more than 2% per trade otherwise you'll blow up", is simply nonsense. The amount to risk depends on the robustness of your concept, and the size of it's edge. The only way i know how to gauge both of these is through extensive backtesting. The last "small" caveat is; you also have to be able to handle the trade size and equity swings mentally.

Benj1981

Established member

- Messages

- 694

- Likes

- 108

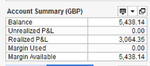

so how is your account looking at the moment benj1981? I hope your doing well and getting some of the USD weakness

Hi HRJ, not a lot of movement since my last update, in a trade - shall update when out.

GTTY.

Small profit booked.

Attachments

Shakone

Senior member

- Messages

- 2,460

- Likes

- 665

Not at all dear boy, but i respect there's always a chance you could lose everything, as should you, whatever % you risk. At my risk level for the concept i'm trading in this journal, deep drawdowns are entirely plausible, and more than expected.

The mantras of; "never bet more than 2% per trade otherwise you'll blow up", is simply nonsense. The amount to risk depends on the robustness of your concept, and the size of it's edge. The only way i know how to gauge both of these is through extensive backtesting. The last "small" caveat is; you also have to be able to handle the trade size and equity swings mentally.

Well I think you're mixing up two different ideas. One idea is about maximising growth, and the other idea is about eliminating risk of ruin. The 2% or less refers to trying to eliminate the risk of ruin.

Similar threads

- Replies

- 37

- Views

- 9K