robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

Folks,

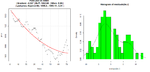

I have been messing around during the quiet periods with a mean reverting strategy which is showing some interesting results.

The question I have is whether you take trades in both directions, particularly if there is good evidence of a trend on a higher timeframe.

Answers on a postcard.

Love

robster

I have been messing around during the quiet periods with a mean reverting strategy which is showing some interesting results.

The question I have is whether you take trades in both directions, particularly if there is good evidence of a trend on a higher timeframe.

Answers on a postcard.

Love

robster