T

t.roland

Hello,

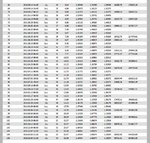

I have a trading method that in 16 years of backtests has only 2 lost trades from a total of 53.

The trades are based on mathematics and the pattern which generates them is rare, but the trades are reliable and guaranteed.

This is the safest method I have and I only trade this one.

I will post here my last such trade and my future trades.

Feel free to test my trades.

I have a trading method that in 16 years of backtests has only 2 lost trades from a total of 53.

The trades are based on mathematics and the pattern which generates them is rare, but the trades are reliable and guaranteed.

This is the safest method I have and I only trade this one.

I will post here my last such trade and my future trades.

Feel free to test my trades.

Attachments

-

^8FA1C8FF57499BBCA94A3099CC90E4BDB8B9D4B8A6FCE97853^pimgpsh_fullsize_distr.jpg60.6 KB · Views: 417

^8FA1C8FF57499BBCA94A3099CC90E4BDB8B9D4B8A6FCE97853^pimgpsh_fullsize_distr.jpg60.6 KB · Views: 417 -

^9D1286832BE796A37382D0ADEF817C1FB79715036697B6BB78^pimgpsh_fullsize_distr.jpg288.6 KB · Views: 494

^9D1286832BE796A37382D0ADEF817C1FB79715036697B6BB78^pimgpsh_fullsize_distr.jpg288.6 KB · Views: 494 -

^B137C7AF5B59CFED0B91841BE295EDED6CF2DAC66FB1C850F7^pimgpsh_fullsize_distr.jpg181.9 KB · Views: 405

^B137C7AF5B59CFED0B91841BE295EDED6CF2DAC66FB1C850F7^pimgpsh_fullsize_distr.jpg181.9 KB · Views: 405

Last edited by a moderator: