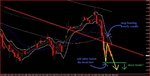

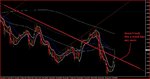

Trading the morning gap

It seems to me that this is a good method. Now we can see the pre-market data on Google- finance. I realize that small-medium stocks that declare earnings, sales and future earnings better than expected usually gap up immediately and the price increases further after 9.30 am. I enter the price at 9.29. The average volume should be more than 500.000, the gap no more than 10%, and the tecnical setup a buy.

Usually it works, but not always. Has anyone obtained these oservations? If yes are there more things to consider in order to reduce the error? Thank you. For an exchange of opinions you can contact me at my mail address:

[email protected]