You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Killer Spike!! -How good was your system/strategy at prempting this ?

FetteredChinos

Veteren member

- Messages

- 3,897

- Likes

- 40

well there was 3 peak RSI divergance on the 1 min chart which might have given you an entry beforehand.

generally it is better to wait for the dust to settle after the spike and see where it is headed..

currently still going down, so probably wise to sell any bounces..

generally it is better to wait for the dust to settle after the spike and see where it is headed..

currently still going down, so probably wise to sell any bounces..

FetteredChinos said:well there was 3 peak RSI divergance on the 1 min chart which might have given you an entry beforehand.

generally it is better to wait for the dust to settle after the spike and see where it is headed..

currently still going down, so probably wise to sell any bounces..

Interesting. I'm not seeing any tell-tale RSI peaks on my charts.

(that look any more ominous that any other peaks)

but then again, I never really found RSI indicators that useful myself.

Maybe you can see something I can't. I'd be really surprised any indicator could preempt

such a move with an indicator that didn't look the same for more subtle move.

I guess you could never preempt such a move and the best you can do to

protect yourself against these killers is the trail stop losses like your mortgage

depended on it 😉

FetteredChinos

Veteren member

- Messages

- 3,897

- Likes

- 40

exactly...

over time these spikes pretty much go in either direction. you win some, you lose some.

just have to live with it.

i got stopped out for -30 from an earlier long, then banged in a short at 1.8248.

quite happy with things thus far. 🙂

over time these spikes pretty much go in either direction. you win some, you lose some.

just have to live with it.

i got stopped out for -30 from an earlier long, then banged in a short at 1.8248.

quite happy with things thus far. 🙂

alanbeale2001

Junior member

- Messages

- 30

- Likes

- 1

ouch

im currently been eaten by euro/usd went long at 1.2196 resistance break and it went short as the ftse rallied. still in there at 50 pips down. !!!!

im currently been eaten by euro/usd went long at 1.2196 resistance break and it went short as the ftse rallied. still in there at 50 pips down. !!!!

A Dashing Blade

Experienced member

- Messages

- 1,373

- Likes

- 171

Belive it was caused by the BoE minutes being published, these suggested that 2 members voted for a rate cut last month (Sweeden cut yesterday) + Italian retail sales fiugures were very soggy => pressure on ECB to cut rates

Bloomberg Commentary . . .

``It's most likely we will continue in this bullish trend''

n bonds, said Alessandro Tentori, a fixed-income strategist in

ondon at BNP Paribas SA. ``The market will try to corner the ECB

nto a rate cut.''

So . . . bottom line, news related spike, unlikely that any system would have caught it.

Bloomberg Commentary . . .

``It's most likely we will continue in this bullish trend''

n bonds, said Alessandro Tentori, a fixed-income strategist in

ondon at BNP Paribas SA. ``The market will try to corner the ECB

nto a rate cut.''

So . . . bottom line, news related spike, unlikely that any system would have caught it.

I call them 'freak bars'.

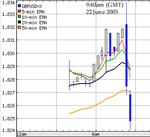

My comments on my log warned of pullback:

Prior bar was a wonder bar sell as seen on the chart.

#35

gus

Member

gus's Avatar

Join Date: Mar 2004

Location: SE Ohio

Posts: 84 gus is an unknown quantity at this point

22/06 Trading thoughts:

EUR/USD - close on or near the high - you get a sell off of some degree, before a continuation pattern.

EUR/JPY - UP which is only an educated guess

GBP/USD - same comment as EUR/USD

USD/JPY - an early buy signal, but I don't expect much outa it.

All of my posts are intended only as instructional & for entertainment. Many times I am wrong.

My comments on my log warned of pullback:

Prior bar was a wonder bar sell as seen on the chart.

#35

gus

Member

gus's Avatar

Join Date: Mar 2004

Location: SE Ohio

Posts: 84 gus is an unknown quantity at this point

22/06 Trading thoughts:

EUR/USD - close on or near the high - you get a sell off of some degree, before a continuation pattern.

EUR/JPY - UP which is only an educated guess

GBP/USD - same comment as EUR/USD

USD/JPY - an early buy signal, but I don't expect much outa it.

All of my posts are intended only as instructional & for entertainment. Many times I am wrong.

Attachments

SOCRATES

Veteren member

- Messages

- 4,966

- Likes

- 136

I disagree with everything expressed so far. This is because all of this is being viewed back to front.

That spike presented a wonderful opportunity for an unopposed short. But there again if it is not viewed as a shorting opportunity and instead it is viewed as a setback, well, there you have it !

It seems obvious to me, if it does not seem obvious to everyone else.

That spike presented a wonderful opportunity for an unopposed short. But there again if it is not viewed as a shorting opportunity and instead it is viewed as a setback, well, there you have it !

It seems obvious to me, if it does not seem obvious to everyone else.

SOCRATES

Veteren member

- Messages

- 4,966

- Likes

- 136

Exactually ! Very well put, Jonny T.JonnyT said:What is obvious to me is that you cannot antiscipate a spike, but you can react to it.

JonnyT

SOCRATES said:I disagree with everything expressed so far. This is because all of this is being viewed back to front.

That spike presented a wonderful opportunity for an unopposed short. But there again if it is not viewed as a shorting opportunity and instead it is viewed as a setback, well, there you have it !

It seems obvious to me, if it does not seem obvious to everyone else.

You're right, it is a great opportunity to go short.

I used the term 'killer' in respect to people who were long at the time, expecting to

ride the trend a little higher.

http://www.trade2win.com/boards/images/icons/icon6.gif

Ash.

Out of interest,..GammaJammer said:Correct - which is why imho you should always pay attention to the fundamentals and news, however much in love you are with your preferred technical methods. And all those people still looking purely at 5 min charts probably got battered after the initial move higher.

GJ

..does the GBPUSD always make such a drastic move down after a significant rally in the FTSE (as demonstrated today at the same time as the spike) or is that just coincidence?

I've never really compared the two.

Ash.

expecation of lower interest rate sends GBP lower against USD as yield differential reducesasht2w said:Out of interest,..

..does the GBPUSD always make such a drastic move down after a significant rally in the FTSE (as demonstrated today at the same time as the spike) or is that just coincidence?

I've never really compared the two.

Ash.

but lowe interest rates send FTSE higher in expectation of higher growth.

v01101999 said:expecation of lower interest rate sends GBP lower against USD as yield differential reduces

but lowe interest rates send FTSE higher in expectation of higher growth.

Aaaahhh ..makes sense!

Given that, what (if any) is the equivalent announcement in the US

that (if unfavourable) typically weakens the dollar, thus raising the GBP against USD?

Unfortunately, no matter how good your TIs' (Technical Indicators)are, there is no way around Newton's Third Law, ("For every action there is a reaction"). The TIs' are all reactors to events and so of course often provide very accurate indications - retrospectively!

Similar threads

- Replies

- 40

- Views

- 12K

- Replies

- 43

- Views

- 11K