oops...

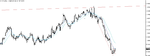

this is a classic example you cannot get in all the move, first of all I was not around at the reversal, secondly as already mentioned despite I was overall bearish I was starting to get hesitant, I would have gone short if I was around but I would have wait for some of break out build up pressure or a double failure of the bull which did not happen, she went fast down.

We cannot get in all the moves but we can specialize and trade only when our condition are met, if we try to trade all the moves we will fail because the moves are too many.

When you are wrong it will burn and that is ok, we are gladly humans, what is not ok is when that burn will make us react in a unprofessional way.

When it burns be aware and stay with it, let it be, give it some space and you will start to learn a great deal.