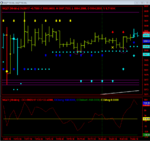

I am a breakout trader counting on high volume breakups to provide quick profits.

I am looking to add another advantage to my trading if it's possible by knowing

somehow where there are more stops.

I'm trading breakouts that are well consolidated and mostly on round and semi

round number but many times even those two don't provide a high volume breakout.

It feels that it will breakout fast but sometimes it goes like 2-3c up and then

breaks the stop.

I know that there are algorithms that see the stops that people have

and take advantage of it to grab them on stocks that are not liquid.

Is there a way i can get that access without being inside the exchange?

How do those algorithms have that access?

I am looking to add another advantage to my trading if it's possible by knowing

somehow where there are more stops.

I'm trading breakouts that are well consolidated and mostly on round and semi

round number but many times even those two don't provide a high volume breakout.

It feels that it will breakout fast but sometimes it goes like 2-3c up and then

breaks the stop.

I know that there are algorithms that see the stops that people have

and take advantage of it to grab them on stocks that are not liquid.

Is there a way i can get that access without being inside the exchange?

How do those algorithms have that access?