You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

"Can Mario Draghi QE push Euro to 1.10, What if he disappoints where are we heading ?

If Draghi disappoints the financial markets tomorrow in ECB Press Conference by going on a lower base than where EURO would be heading is a question to be discussed. Majority of the Financial Analysts are expecting ECB President will announce a bond-purchase program on Jan 22. Forecasted target is of 550 billion-euro. ECB conference on 22nd Jan would confirm that whether Draghi meets the expectation or fall short on that.

If Draghi disappoints the financial markets tomorrow in ECB Press Conference by going on a lower base than where EURO would be heading is a question to be discussed. Majority of the Financial Analysts are expecting ECB President will announce a bond-purchase program on Jan 22. Forecasted target is of 550 billion-euro. ECB conference on 22nd Jan would confirm that whether Draghi meets the expectation or fall short on that.

Attachments

How much will ECB induce ?

Here's what some other major forecasters are expecting:

Barclays: The ECB is likely to indicate a €500-750 billion programme tomorrow

Morgan Stanley: €500 billion of government bonds and €100 billion of corporate bonds will be purchased

Bank of America: €500 billion to €700 billion over 18 months

Oxford Economics: A larger programme of more like €800 billion

Societe Generale: €500 billion to €600 billion of sovereign bonds will be purchased

Capital Economics: A €500 billion bond purchase programme

Deutsche Bank: DB don't give a clear forecast of what they think the programme will look like, but there are hints that it could be larger. Most importantly, Deutsche's economists believe full QE will have to wait until the March meeting in six weeks.

Here's what some other major forecasters are expecting:

Barclays: The ECB is likely to indicate a €500-750 billion programme tomorrow

Morgan Stanley: €500 billion of government bonds and €100 billion of corporate bonds will be purchased

Bank of America: €500 billion to €700 billion over 18 months

Oxford Economics: A larger programme of more like €800 billion

Societe Generale: €500 billion to €600 billion of sovereign bonds will be purchased

Capital Economics: A €500 billion bond purchase programme

Deutsche Bank: DB don't give a clear forecast of what they think the programme will look like, but there are hints that it could be larger. Most importantly, Deutsche's economists believe full QE will have to wait until the March meeting in six weeks.

D-Day for the Euro, Great Expectations Over Mario Draghi

Today is the day for the Euro. Mario Draghi’s monetary announcement is highly anticipated with most market participants expecting a 550 billion Euro bond buying program to be announced. Although, today there has been some speculation for an up to 1 trillion Euros QE program establishment. If the ECB decides to go that high then the EURUSD could go much lower than its current level at 1.1582. The EURUSD has been in sideways between top barrier at 1.1639 and floor at 1.1541 in the recent term as we can see at the chart. We expect ECB interest rate announcement at 12:45 GMT and then most importantly is the ECB Press conference at 13:30 GMT.

The US dollar against the Canadian jumped higher than its previous major cap at 1.2115 and went as high as 1.2390. The Bank of Canada unexpectedly lowered its key rate to 0.75% from 1% and that weighed on an already weak Canadian dollar, pushing it to more than 5 ½ year lows. Main reason for its rate cut was the falling Oil prices.

Elsewhere, the British pound following the better than expected employment data did not react at all. The GBPUSD remained in the consolidation trading style around 1.5136. Perhaps that was due to the two members who voted previously for a rate increase are now voting for steady rate policy. Nevertheless, the employment improvement passed like nothing happened and that suggests the GBPUSD is more US dollar dependent. We expect the US Jobless Claims would have an impact on the currency pair today at 13:30 GMT.

The Aussie and the Kiwi responded negatively yesterday to the decision of the Bank of Canada to reduce key rates because these three currencies are the commodity currencies. Investors would expect that the same policy could follow the RBA and RBNZ. The AUDUSD dropped from 0.8229 to 0.8058 and the NZDUSD declined from 0.7682 to 0.7516. The NZDUSD breached a previous key support at 0.7623 and confirmed its previous long term down trend and taking into account lower than expected inflation for December, should we see falling US Jobless Claims today this currency pair could go continue lower.

Today is the day for the Euro. Mario Draghi’s monetary announcement is highly anticipated with most market participants expecting a 550 billion Euro bond buying program to be announced. Although, today there has been some speculation for an up to 1 trillion Euros QE program establishment. If the ECB decides to go that high then the EURUSD could go much lower than its current level at 1.1582. The EURUSD has been in sideways between top barrier at 1.1639 and floor at 1.1541 in the recent term as we can see at the chart. We expect ECB interest rate announcement at 12:45 GMT and then most importantly is the ECB Press conference at 13:30 GMT.

The US dollar against the Canadian jumped higher than its previous major cap at 1.2115 and went as high as 1.2390. The Bank of Canada unexpectedly lowered its key rate to 0.75% from 1% and that weighed on an already weak Canadian dollar, pushing it to more than 5 ½ year lows. Main reason for its rate cut was the falling Oil prices.

Elsewhere, the British pound following the better than expected employment data did not react at all. The GBPUSD remained in the consolidation trading style around 1.5136. Perhaps that was due to the two members who voted previously for a rate increase are now voting for steady rate policy. Nevertheless, the employment improvement passed like nothing happened and that suggests the GBPUSD is more US dollar dependent. We expect the US Jobless Claims would have an impact on the currency pair today at 13:30 GMT.

The Aussie and the Kiwi responded negatively yesterday to the decision of the Bank of Canada to reduce key rates because these three currencies are the commodity currencies. Investors would expect that the same policy could follow the RBA and RBNZ. The AUDUSD dropped from 0.8229 to 0.8058 and the NZDUSD declined from 0.7682 to 0.7516. The NZDUSD breached a previous key support at 0.7623 and confirmed its previous long term down trend and taking into account lower than expected inflation for December, should we see falling US Jobless Claims today this currency pair could go continue lower.

Attachments

ECB Live Press Conference - 15:30 [GMT+2:00]

Press conference following the meeting of the Governing Council of the European Central Bank on 22 January 2015 at its premises in Frankfurt am Main, Germany

Introductory statement by Mario Draghi, President of the ECB.

Question and answer session. Registered journalists pose questions to Mario Draghi, President of the ECB, and to Vítor Constâncio, Vice-President of the ECB.

http://www.ecb.europa.eu/press/tvservices/webcast/html/webcast_150122.en.html

Press conference following the meeting of the Governing Council of the European Central Bank on 22 January 2015 at its premises in Frankfurt am Main, Germany

Introductory statement by Mario Draghi, President of the ECB.

Question and answer session. Registered journalists pose questions to Mario Draghi, President of the ECB, and to Vítor Constâncio, Vice-President of the ECB.

http://www.ecb.europa.eu/press/tvservices/webcast/html/webcast_150122.en.html

ECB Press Conference Summary

Mario Draghi led the European Central Bank into a new era with an historic pledge to buy government bonds as part of an asset-purchase program worth about 1.1 trillion euros. The central bank will buy 60 billion euros per month of securities until September 2016. The ECB also reduced the cost of its long-term loans to banks.

The euro fell 0.5 percent to $1.1550 at 2:01 p.m. in London, after sliding as much as 0.8 percent to $1.1513. It slid to $1.1460 on Jan. 16, the weakest level since November 2003. The shared currency fell 0.7 percent to 135.94 yen. The dollar was little changed at 117.80 yen.

Mario Draghi led the European Central Bank into a new era with an historic pledge to buy government bonds as part of an asset-purchase program worth about 1.1 trillion euros. The central bank will buy 60 billion euros per month of securities until September 2016. The ECB also reduced the cost of its long-term loans to banks.

The euro fell 0.5 percent to $1.1550 at 2:01 p.m. in London, after sliding as much as 0.8 percent to $1.1513. It slid to $1.1460 on Jan. 16, the weakest level since November 2003. The shared currency fell 0.7 percent to 135.94 yen. The dollar was little changed at 117.80 yen.

Draghi Proposes 1 Trillion rescue plan for Euro zone

The European Central Bank took the ultimate policy leap on Thursday, launching a government bond-buying program which will pump hundreds of billions in new money into a sagging euro zone economy. By September next year, more than 1 trillion euros will have been created under quantitative easing, the ECB's last remaining major policy option for reviving economic growth and warding off deflation. The next hurdle for European Union is election in Greece.

The European Central Bank took the ultimate policy leap on Thursday, launching a government bond-buying program which will pump hundreds of billions in new money into a sagging euro zone economy. By September next year, more than 1 trillion euros will have been created under quantitative easing, the ECB's last remaining major policy option for reviving economic growth and warding off deflation. The next hurdle for European Union is election in Greece.

AUDUSD trades below 0.80 mark, near 4-1/2 yr low

Aussie pair extends its losing streak on the back of continued decline in bullion and industrial metals. Moreover, increased bets on a rate cut by RBA following Canada's central bank unexpectedly rate cut earlier this week, may also weigh on AUDUSD.

For now AUDUSD hits the Daily low of 0.7964.

S1 : 0.7951

S2 : 0.7931

S3 : 0.7911

R1 : 0.8079

R2 : 0.8099

R3 : 0.8199

Aussie pair extends its losing streak on the back of continued decline in bullion and industrial metals. Moreover, increased bets on a rate cut by RBA following Canada's central bank unexpectedly rate cut earlier this week, may also weigh on AUDUSD.

For now AUDUSD hits the Daily low of 0.7964.

S1 : 0.7951

S2 : 0.7931

S3 : 0.7911

R1 : 0.8079

R2 : 0.8099

R3 : 0.8199

Can the AUDJPY push lower then 92.02 ?

The Australian dollar against the Japanese Yen found a key support level at 92.02. As we can see at the chart the currency pair entered a downtrend phase indicated by the falling trend line. Moving Averages are above prices adding weight on the currency pair and the last candles are below the lower Bollinger band increasing bearish expectations.

In the inter-market analysis we are concerned that what is going on is mostly due to greenback’s movement. The AUDUSD is on falling spiral while the USDJPY is in a range. Should the Yen strengthen against the US dollar we could see a stronger selling pressure on AUDJPY. We remind that tonight we are expecting inflation and employment data for Japan’s economy.

Oscillators such as the Stochastic are around the lower boundary before the oversold territory. The RSI (14) is down trending confirming the price pattern and the Average Directional Movement suggests that the bears have the edge on the prevailing trend. Should the prices bid below the support at 92.02 then falling potential would revive exposing potential next support at 90.29.

The Australian dollar against the Japanese Yen found a key support level at 92.02. As we can see at the chart the currency pair entered a downtrend phase indicated by the falling trend line. Moving Averages are above prices adding weight on the currency pair and the last candles are below the lower Bollinger band increasing bearish expectations.

In the inter-market analysis we are concerned that what is going on is mostly due to greenback’s movement. The AUDUSD is on falling spiral while the USDJPY is in a range. Should the Yen strengthen against the US dollar we could see a stronger selling pressure on AUDJPY. We remind that tonight we are expecting inflation and employment data for Japan’s economy.

Oscillators such as the Stochastic are around the lower boundary before the oversold territory. The RSI (14) is down trending confirming the price pattern and the Average Directional Movement suggests that the bears have the edge on the prevailing trend. Should the prices bid below the support at 92.02 then falling potential would revive exposing potential next support at 90.29.

Busy week Ahead, Investors' Eyes Look at Non Farm Payrolls

Early today the Chinese Manufacturing PMI released lower than projected adding pressure on the investors risk appetite. That pushed Asian indices lower with NIKKEI 225 falling by 0.66% and the Shanghai composite declining by 2.56%. The US dollar against the Japanese Yen dropped suddenly at the open of the FX market to support at 116.87 but quickly recovered losses back to 117.86. Sluggish manufacturing for China is weighing on global economic recovery and there are some expectations the People’s Bank of China may go for a more relaxed monetary policy.

The Euro against the greenback jumped moments ago from 1.2958 to 1.1343 after better than expected Spanish Manufacturing PMI. The most of the focus during the weekend has been on Greek Prime Minister, Alexis Tsipras, and Finance Minister, Varoufakis who are trying to start negotiations for to change the austerity plan. Today the main focus concerning the Euro would be on the manufacturing PMI reports as well as for the British pound. The EURUSD in general remains in consolidation zone between upper boundary at 1.1419 and lower border at 1.1262.

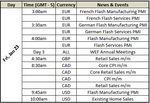

Looking ahead for today we focus on the US Personal Spending figures and ISM Manufacturing PMI. Moreover, this week is full of events. On Tuesday morning we are going to monitor the RBA decision on Cash Rate, expected to maintain the 2.5% key rate unchanged. Then on Wednesday we have the ADP Non-Farm Employment change and on Friday the Non-Farm Payrolls.

Early today the Chinese Manufacturing PMI released lower than projected adding pressure on the investors risk appetite. That pushed Asian indices lower with NIKKEI 225 falling by 0.66% and the Shanghai composite declining by 2.56%. The US dollar against the Japanese Yen dropped suddenly at the open of the FX market to support at 116.87 but quickly recovered losses back to 117.86. Sluggish manufacturing for China is weighing on global economic recovery and there are some expectations the People’s Bank of China may go for a more relaxed monetary policy.

The Euro against the greenback jumped moments ago from 1.2958 to 1.1343 after better than expected Spanish Manufacturing PMI. The most of the focus during the weekend has been on Greek Prime Minister, Alexis Tsipras, and Finance Minister, Varoufakis who are trying to start negotiations for to change the austerity plan. Today the main focus concerning the Euro would be on the manufacturing PMI reports as well as for the British pound. The EURUSD in general remains in consolidation zone between upper boundary at 1.1419 and lower border at 1.1262.

Looking ahead for today we focus on the US Personal Spending figures and ISM Manufacturing PMI. Moreover, this week is full of events. On Tuesday morning we are going to monitor the RBA decision on Cash Rate, expected to maintain the 2.5% key rate unchanged. Then on Wednesday we have the ADP Non-Farm Employment change and on Friday the Non-Farm Payrolls.

Similar threads

- Replies

- 77

- Views

- 45K