LivePropFirmTrading

Newbie

- Messages

- 1

- Likes

- 1

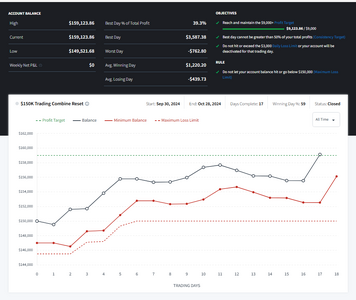

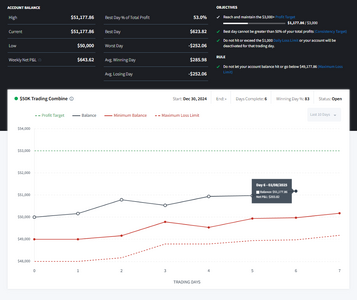

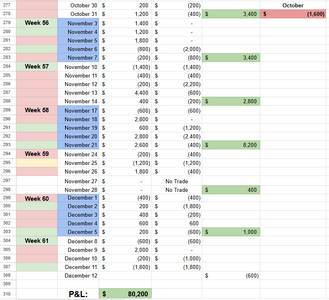

Developing a profitable trading bot has been a long and challenging journey for me, but after 9+ months of trial and error (and creating over 10 bots), I’m ready to share the results of my custom NQ trading bot.

How The Bot Runs?:

P.S. I document my live trading journey daily on YouTube if you’d like to see the bot in action: Live Prop Firm Trading.

How It Works:

This bot trade with 1 NQ contract with a prop firm account ($50k-$150k funded account) and uses price action and volume analysis to identify high-probability setups, entering trades only when the market aligns with specific criteria. To maximize its effectiveness:- Time-Based Execution: It operates during 10:30 AM–2:30 PM EST, avoiding volatile periods like news events or high-volume spikes.

- ADX-Driven Control: It’s only activated when the ADX is below 23, ensuring it performs best in slow-trending or consolidating markets - along with the highest probability to profit.

- Trailing Stop Mechanics: The bot trails stop losses dynamically and sets take-profit levels based on Renko box mechanics, ensuring calculated risk management.

- Renko Chart: Although Renko chart type is not a favorite of most of you - I found that the profitability and consistency is there. It goes based on price action, not time increments.

- Order type: Limit sell or limit buy orders 10 points (1 Renko box) above or below the pivot lines respectively)

How The Bot Runs?:

- TradingView premium + live market data subscription - only premium subscription has Renko chart type with a 1 second time frame

- Prop firm account (With Tradovate) OR Tradovate as a broker

- Automation software - Send webhooks and execute orders

P.S. I document my live trading journey daily on YouTube if you’d like to see the bot in action: Live Prop Firm Trading.