Time will tell, but that's the important question every trader must have the answer to if they actually plan to avoid that unpleasant fate. So with that, let's begin ...

I make no recommendations, just some notes to self and some performance numbers over the next few days based on early walk-forward tests, good, bad & ugly.

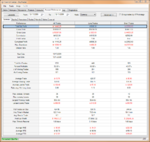

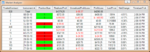

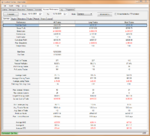

Here's what I trade: Yen, Pound, Euro, E-minis, Bond, Note, Oil, Gold futures. Acct size is 500K nominal.

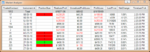

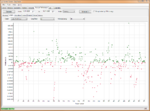

Used market maker algos (basically just dumb autofaders, currently configured to make on the order of 100-500 trades/day) on ZB (30 Yr Bond Future) and ES overnight and during day session. Only serious drawdown came during the common overnight 1-way move. But an early morning recovery and trendless day session gave a positive net for the day. Market maker algos do well on these types of days, hence the positive results for the day.

That made up the bulk of the positive p&l for today, with a couple of discretionary trades in 6E (Euro Currency Future) and CL (Oil Future). Good trading day for the bots, boring trading day for the humans.

The discretionary trades were the standard 1:3+ Risk/Reward ratio type trades. for the bot trades I'm still trying to quantify appropriate risk/reward ratios. Suffice it to say the risk/reward ratios and winning percentages for the bot trades are very different than for my discretionary trades.

Here's my rule of thumb for winning percentages and corresponding reward (in units of risk R) required in order to be long-term profitable.

Winning pct :

10% : 15R

20% : 10R

30% : 4-5R

40% : 3-4R

50% : 2-3R

60% : 1.5-2R

70% : 1-1.5R

In other words if my profit target is ALWAYS at least 15 times my stop loss for all trades, then I will be long-term profitable if my winning trade percentage is 10% or better, etc.

In order to succeed as a trader, at the very least I must:

Ensure the odds are in my favour over the long term.

Ensure I am intellectually & psychologically prepared to cope with trading over the long term.

Ensure my account is appropriately capitalized to survive until the long term ...

imho.

I make no recommendations, just some notes to self and some performance numbers over the next few days based on early walk-forward tests, good, bad & ugly.

Here's what I trade: Yen, Pound, Euro, E-minis, Bond, Note, Oil, Gold futures. Acct size is 500K nominal.

Used market maker algos (basically just dumb autofaders, currently configured to make on the order of 100-500 trades/day) on ZB (30 Yr Bond Future) and ES overnight and during day session. Only serious drawdown came during the common overnight 1-way move. But an early morning recovery and trendless day session gave a positive net for the day. Market maker algos do well on these types of days, hence the positive results for the day.

That made up the bulk of the positive p&l for today, with a couple of discretionary trades in 6E (Euro Currency Future) and CL (Oil Future). Good trading day for the bots, boring trading day for the humans.

The discretionary trades were the standard 1:3+ Risk/Reward ratio type trades. for the bot trades I'm still trying to quantify appropriate risk/reward ratios. Suffice it to say the risk/reward ratios and winning percentages for the bot trades are very different than for my discretionary trades.

Here's my rule of thumb for winning percentages and corresponding reward (in units of risk R) required in order to be long-term profitable.

Winning pct :

10% : 15R

20% : 10R

30% : 4-5R

40% : 3-4R

50% : 2-3R

60% : 1.5-2R

70% : 1-1.5R

In other words if my profit target is ALWAYS at least 15 times my stop loss for all trades, then I will be long-term profitable if my winning trade percentage is 10% or better, etc.

In order to succeed as a trader, at the very least I must:

Ensure the odds are in my favour over the long term.

Ensure I am intellectually & psychologically prepared to cope with trading over the long term.

Ensure my account is appropriately capitalized to survive until the long term ...

imho.