pennycapitalist

Junior member

- Messages

- 39

- Likes

- 15

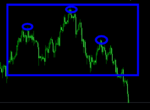

Hi traders, I was wondering if anyone else is seeing what I'm seeing in the major indices. I'm seeing a fully formed head and shoulders reversal pattern with an upwardly sloping neckline. If I'm not wrong, everything is there except a substantial dip below the neckline to confirm the pattern. The head is not as pronounced as some other head and shoulders formations, but it is higher than the peak of the first shoulder. Many of the head and shoulder's formations from the history books that marked major market turns had less defined heads than this one.

There are other signs as well, like the transportation stocks not doing as well as they should, even though tonnage is up. There is labor trouble on the west coast docks. Service industries are not doing great, and commodity prices are low in many cases.

There were nine distribution days until a couple dropped off. Six distribution days is a bad sign! There are, of course, conflicting signs, but aren't there always conflicting signs?

None of the talking heads are talking about this. There are always the bears predicting the sky is going to fall, but wouldn't those guys be shinning a light on a head and shoulders to prove their point?

Maybe I'm seeing things that aren't there. It is said that once you've seen a head and shoulders, that's all you see. Still, distribution days are real and if they are my imagination, I share the illusion with Investor's Business Daily.

Could some more experienced than me take a look and show me where I'm wrong, if I am.

Thank you,

Randy Cox

Pennycapitalist

There are other signs as well, like the transportation stocks not doing as well as they should, even though tonnage is up. There is labor trouble on the west coast docks. Service industries are not doing great, and commodity prices are low in many cases.

There were nine distribution days until a couple dropped off. Six distribution days is a bad sign! There are, of course, conflicting signs, but aren't there always conflicting signs?

None of the talking heads are talking about this. There are always the bears predicting the sky is going to fall, but wouldn't those guys be shinning a light on a head and shoulders to prove their point?

Maybe I'm seeing things that aren't there. It is said that once you've seen a head and shoulders, that's all you see. Still, distribution days are real and if they are my imagination, I share the illusion with Investor's Business Daily.

Could some more experienced than me take a look and show me where I'm wrong, if I am.

Thank you,

Randy Cox

Pennycapitalist