chump said:

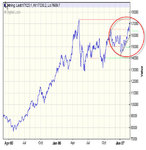

I've been watching the mining sector closely for the last 6 months and I posted these charts earlier on the price patterns thread page 10..technically what can you say about that timing in relation to the range..I think when people say the market is random I can't agree.

Interesting charts and repeat patterns.

I'm trying to think this through and considering I was a bear this is total herd mentality and over reaction.

Speakers were saying the Chineese earnings ratios were too high and had to come down. So why did the US indexes fall so much if our earning ratios were more level. How many times did I hear the likes of shares are fairly valued etc etc.

I know the markets were extended and not much potential for growth but these kinds of moves are exceptional.

I'm beginning to think markets totally over reacted and a pull back is in order. Dying to know how the Asian markets will react in Japan and Hong Kong tonight.

Coming back to gold and applying previous analysis and whats changed...

1. Lack of support for $ = likely to continue

2. Geopolitcal uncertainties = still there

but

3. Inflation and rise in interest rates = can't see interest rises so good for gold

4. Economic crash = this is the only bad signal but good for 1 above.

So kaos is still with us and commodities may sink but I think gold will hold up all things being equal. Interest rate falls now on the cards I'd guess.

Remembering what TWI said before gold went through the 680 barrier, buy when everybody else is selling.

I'll get out if it dips below 655 and not moving this time...