9th Dec GU London Breakout

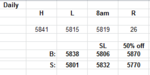

...short breakout filled as per sheet below. I tweak the first scaleout (which isn't necessarily 50% these days) when weekly or monthly pivot values are in the vaccinity of the trades 1:1 level, so todays trade had the 1st scaleout at the monthly pivot, 5780 just 10 pips from the 1:1. I'll move stops to breakeven when a confirmed SbR switch prints and not before. Even if a full on pivot reversal occurs, the loss will at least have been reduced....just need to work on letting the winners run more, as always 🙂

Edit: 9:55 - stops to b/e now...some profit taken and now a free ride to do what it likes.

...short breakout filled as per sheet below. I tweak the first scaleout (which isn't necessarily 50% these days) when weekly or monthly pivot values are in the vaccinity of the trades 1:1 level, so todays trade had the 1st scaleout at the monthly pivot, 5780 just 10 pips from the 1:1. I'll move stops to breakeven when a confirmed SbR switch prints and not before. Even if a full on pivot reversal occurs, the loss will at least have been reduced....just need to work on letting the winners run more, as always 🙂

Edit: 9:55 - stops to b/e now...some profit taken and now a free ride to do what it likes.

Attachments

Last edited: