You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Basically this screen uses proprietary rules to expose equity to multiple derivatives once they meet certain criteria, then whether price keeps trending in multiple price levels or range bound, the screen removes itself or keeps adding to existing positions.

Given a series of 50 sets of numbers, some in the series will trend up and some in the series will trend down, and some will be unchanged given a multiyear span.

If you couldn't predict which ones will trend and which ones will consolidate, how would you go about designing a system to take advantage of the 50 sets of numbers.

What kind of risk management would you use?, what kind of pyramiding techniques would you use?

If you couldn't predict which ones will trend and which ones will consolidate, how would you go about designing a system to take advantage of the 50 sets of numbers.

What kind of risk management would you use?, what kind of pyramiding techniques would you use?

Muchas Gracias

I probably speak for many when I say the effort you are putting in to update us on the various markets is much appreciated 😀

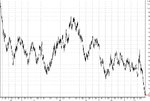

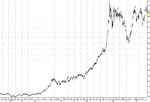

lean hogs, canadian dollar, swiss franc, old positions behaving well, no sign of turn yet. New Eurodollar position still too early, but bonds breaking higher implies well for it.

I probably speak for many when I say the effort you are putting in to update us on the various markets is much appreciated 😀

Similar threads

- Replies

- 0

- Views

- 2K