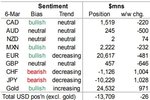

As follows from the latest data of the CFTC, in the week before March 6 in speculative positioning in the foreign exchange market were, in general, barely noticeable. In anticipation of news from Washington about tariffs, traders preferred to close both long and short positions in major currencies, as a result of which the net dollar value for the dollar remained almost unchanged, remaining at $ 13.7 billion.

Speculators slightly reduced the net long position on the CAD, and the threat of US protectionist measures almost did not affect the bulls in CAD and only stimulated the bears to open a small number of new shorts.

The stability of the bullish sentiment of speculators in the Mexican peso in these circumstances is simply astounding given the rather large volume of net long.

The most notable changes in the positioning of the currency "safe haven", such as the yen and the franc, where speculators quite actively closed short positions. Demand for this assets in the face of growing uncertainty did not pass and in the gold.

The volume of net long euros has changed little, remaining at a historically high level of more than $ 20 billion, despite the fact that due to the large profit differential of European and American long-term EURUSD purposes it is quite expensive.

Pound positioning is becoming less bullish and increasingly neutral.

And without that, the small volume of the net long position for the Aussies was reduced by one third, and positioning in the Kiwi was almost complete.