Options are exciting to trade for many reasons. They offer so many opportunities that the sheer volume of possibilities can be overwhelming. How can we go about finding the good ones?

To answer this, we need to think about what the sources of options profits are. What makes their prices move? The important factors are:

When looking for option opportunities, we can choose to emphasize any of these.

If we look closer, we will see that the last factor, passage of time, is largely a function of the second one – crowd expectations. Here’s how: when expectations for movement are high, people pay more for options. When they pay more, there is more value in the options to start with, and therefore more of it to decay away over time. The higher the expectations were in the first place, the more the option writers will have, gotten paid for selling the options, and therefore the higher their potential profits.

So it actually boils down to two things – stock price movement, on one hand, and crowd expectations (also known as Implied Volatility, or IV) on the other. When we’re looking for profitable opportunities, we can come at the problem from either of those directions. We can either look for stocks whose prices we can predict, with IV a secondary consideration; or look for stocks whose changes in volatility we can predict, with price secondary.

Of the two, changes in IV can be easier to forecast if we look for them in the right way. That is because IV has strong mean-reverting tendencies. It tends to oscillate around an average value, and return to that average quickly when it does stray away from it. This is especially true when it spikes to high values.

Screening for stocks that are at higher-than-average implied volatility levels can be a good source of option trade ideas. What we are looking for are stocks whose IV is high, not on an absolute basis, but relative to their own average IV. Once we have found some candidates in this way, we can then plan trades that take advantage of an expected drop in IV from these extra-high levels back toward average levels. IV will be the primary consideration here so we will be considering strategies where we are short time value. This will be the goal. Once we have a list of candidates that are at relatively high IV, we can then examine them to decide our forecast for the underlying price. If we are decidedly bearish or bullish, we will use bearish or bullish premium-selling strategies (naked short options, or credit spreads). If on the other hand, we believe that price will remain in a range, then we can use strategies that sell premium on both, sides puts and calls. Such strategies include short straddles, short strangles, and iron condors.

I like the approach of looking for stocks with “out-of-the-ordinary levels” of IV first, and then looking at price activity second. Both are equally valuable, and neither is sufficient on its own. But, the number of unusual IV situations is usually fairly small. They are also pretty easily located if you have access to a volatility scanning tool.

Serious trading platforms like Tradestation, Think or Swim, and Options Express, among others, provide volatility screening as part of their software. The website of the Chicago Board Options Exchange, CBOE.com, also has some screening tools.

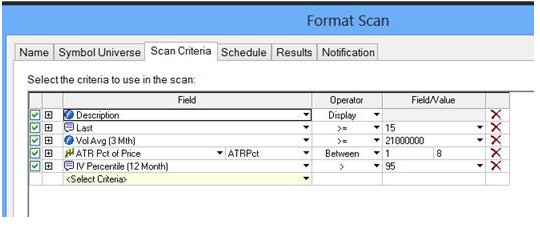

Fig 1 is a screenshot of a scan that I ran on the Tradestation platform recently:

Fig 1

The criteria shown here are:

Description - Just included so that the company name will be shown on the scan results list.

Last >= 15 – To filter out low-priced stocks which probably have wide strike increments.

Vol Avg > 21000000 – Monthly average volume > 21 Mil, means daily average greater than 1M.

ATR Pct of Price between 1 and 8 – Average True Range – from 1 to 8 %, good volatility.

IV Percentile (12 month) – > 95. Stocks in the top 5% of their annual IV range.

This last criterion is the one that pulls in the stocks whose IV is very high, and therefore likely to drop in the near future. The other criteria are just to screen out stocks that do not have the right characteristics in terms of price, volume, and/or volatility. We need plenty of all three to make good options candidates.

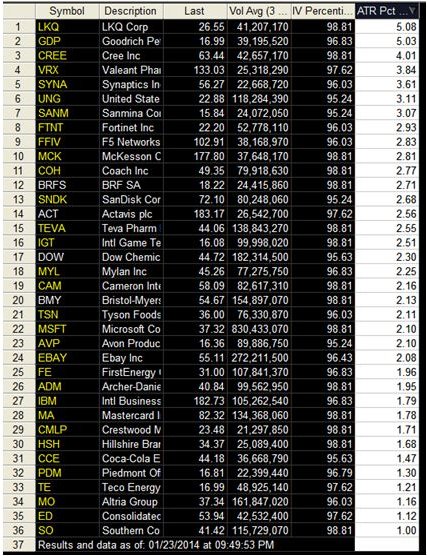

Running that scan on January 24, I got the list shown in Fig 2

Fig 2

This gave 36 possibilities. I should mention here that the general environment for IV was very low at the time. The VIX (IV of the S&P 500 index) was at a low level not seen in years. Any stocks that were at high IV were definitely rowing upstream, which made them even better bets for a volatility drop in the near future, all else being equal.

The next step was to check the price charts for these stocks. Any that were at solid demand (support) levels were candidates for short puts or bull put spreads. Any that were at strong supply (resistance) levels would be possibilities for short calls or bear call spreads and those that seemed range-bound would be candidates for iron condors.

As each chart was checked out, each one had to be checked for its earnings announcement date since we are in earnings season. Most stocks will build up to high IV just before earnings. After the earnings announcement, the IV will collapse, regardless of what does or does not happen to the stock price. If earnings were imminent, it would not be a smart idea to do any of these premium-selling strategies. We also needed to check for news stories, to try to find out why IV was high.

The first stock on the list, LKQ, had recently fallen from $34 to $25 and was in a solid demand zone. It was an auto parts manufacturer being sued by Chrysler for patent infringement. The company contended that the parts would represent an immaterial part of their revenue if they lost the suit. This is the kind of drop that could well be an overreaction that provided an opportunity.

We looked at doing a bull put spread on LKQ, using February puts at the 25 and 20 strikes, for a net credit of $.50 per share.

Russ Allen can be contacted by email on this link Russ Allen

To answer this, we need to think about what the sources of options profits are. What makes their prices move? The important factors are:

- Stock price movement

- Changing crowd expectations

- The passage of time

When looking for option opportunities, we can choose to emphasize any of these.

If we look closer, we will see that the last factor, passage of time, is largely a function of the second one – crowd expectations. Here’s how: when expectations for movement are high, people pay more for options. When they pay more, there is more value in the options to start with, and therefore more of it to decay away over time. The higher the expectations were in the first place, the more the option writers will have, gotten paid for selling the options, and therefore the higher their potential profits.

So it actually boils down to two things – stock price movement, on one hand, and crowd expectations (also known as Implied Volatility, or IV) on the other. When we’re looking for profitable opportunities, we can come at the problem from either of those directions. We can either look for stocks whose prices we can predict, with IV a secondary consideration; or look for stocks whose changes in volatility we can predict, with price secondary.

Of the two, changes in IV can be easier to forecast if we look for them in the right way. That is because IV has strong mean-reverting tendencies. It tends to oscillate around an average value, and return to that average quickly when it does stray away from it. This is especially true when it spikes to high values.

Screening for stocks that are at higher-than-average implied volatility levels can be a good source of option trade ideas. What we are looking for are stocks whose IV is high, not on an absolute basis, but relative to their own average IV. Once we have found some candidates in this way, we can then plan trades that take advantage of an expected drop in IV from these extra-high levels back toward average levels. IV will be the primary consideration here so we will be considering strategies where we are short time value. This will be the goal. Once we have a list of candidates that are at relatively high IV, we can then examine them to decide our forecast for the underlying price. If we are decidedly bearish or bullish, we will use bearish or bullish premium-selling strategies (naked short options, or credit spreads). If on the other hand, we believe that price will remain in a range, then we can use strategies that sell premium on both, sides puts and calls. Such strategies include short straddles, short strangles, and iron condors.

I like the approach of looking for stocks with “out-of-the-ordinary levels” of IV first, and then looking at price activity second. Both are equally valuable, and neither is sufficient on its own. But, the number of unusual IV situations is usually fairly small. They are also pretty easily located if you have access to a volatility scanning tool.

Serious trading platforms like Tradestation, Think or Swim, and Options Express, among others, provide volatility screening as part of their software. The website of the Chicago Board Options Exchange, CBOE.com, also has some screening tools.

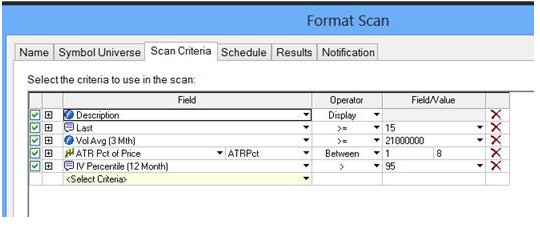

Fig 1 is a screenshot of a scan that I ran on the Tradestation platform recently:

Fig 1

The criteria shown here are:

Description - Just included so that the company name will be shown on the scan results list.

Last >= 15 – To filter out low-priced stocks which probably have wide strike increments.

Vol Avg > 21000000 – Monthly average volume > 21 Mil, means daily average greater than 1M.

ATR Pct of Price between 1 and 8 – Average True Range – from 1 to 8 %, good volatility.

IV Percentile (12 month) – > 95. Stocks in the top 5% of their annual IV range.

This last criterion is the one that pulls in the stocks whose IV is very high, and therefore likely to drop in the near future. The other criteria are just to screen out stocks that do not have the right characteristics in terms of price, volume, and/or volatility. We need plenty of all three to make good options candidates.

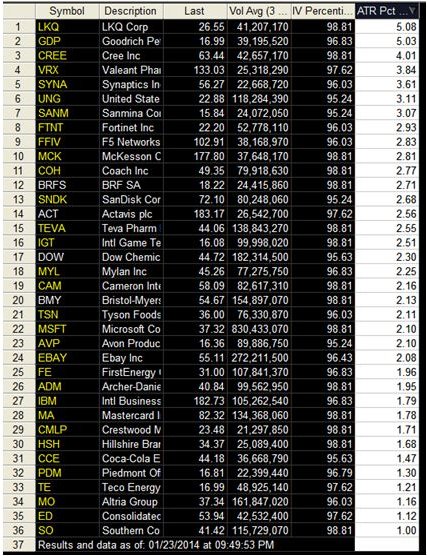

Running that scan on January 24, I got the list shown in Fig 2

Fig 2

This gave 36 possibilities. I should mention here that the general environment for IV was very low at the time. The VIX (IV of the S&P 500 index) was at a low level not seen in years. Any stocks that were at high IV were definitely rowing upstream, which made them even better bets for a volatility drop in the near future, all else being equal.

The next step was to check the price charts for these stocks. Any that were at solid demand (support) levels were candidates for short puts or bull put spreads. Any that were at strong supply (resistance) levels would be possibilities for short calls or bear call spreads and those that seemed range-bound would be candidates for iron condors.

As each chart was checked out, each one had to be checked for its earnings announcement date since we are in earnings season. Most stocks will build up to high IV just before earnings. After the earnings announcement, the IV will collapse, regardless of what does or does not happen to the stock price. If earnings were imminent, it would not be a smart idea to do any of these premium-selling strategies. We also needed to check for news stories, to try to find out why IV was high.

The first stock on the list, LKQ, had recently fallen from $34 to $25 and was in a solid demand zone. It was an auto parts manufacturer being sued by Chrysler for patent infringement. The company contended that the parts would represent an immaterial part of their revenue if they lost the suit. This is the kind of drop that could well be an overreaction that provided an opportunity.

We looked at doing a bull put spread on LKQ, using February puts at the 25 and 20 strikes, for a net credit of $.50 per share.

Russ Allen can be contacted by email on this link Russ Allen

Last edited by a moderator: